Informes

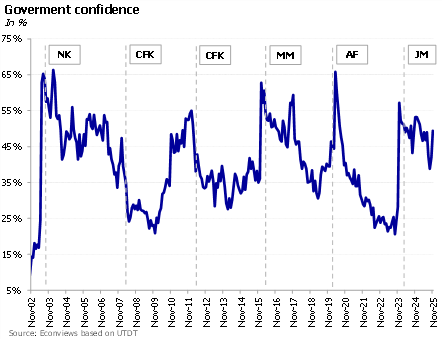

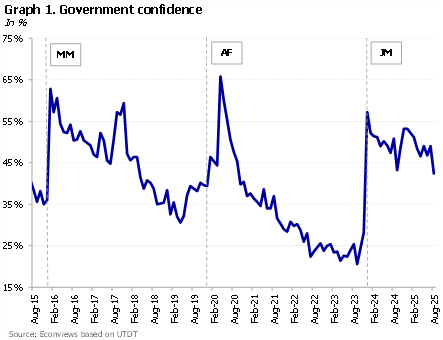

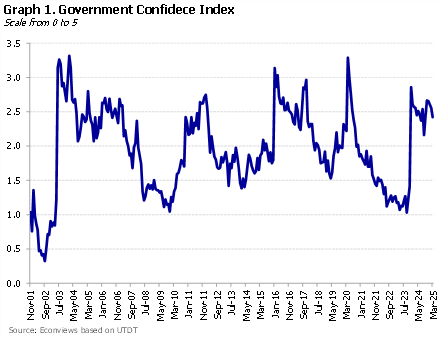

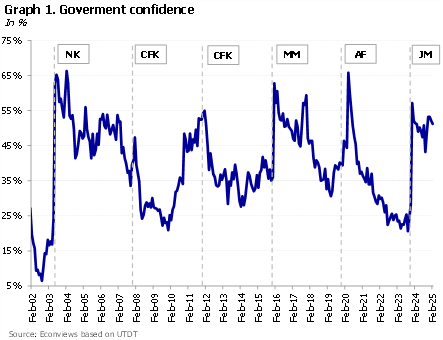

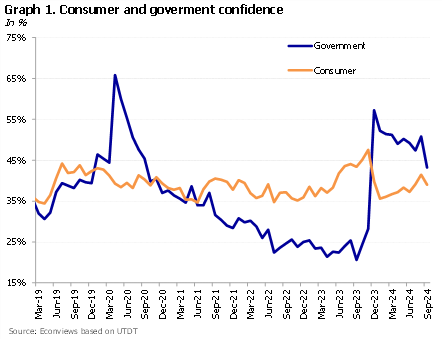

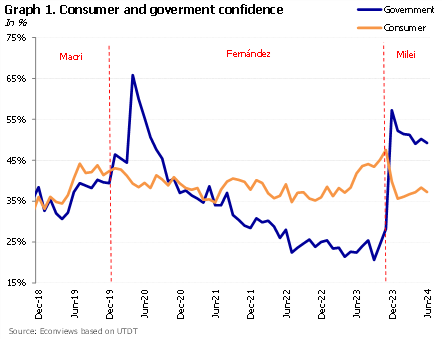

A turning point? After a year characterized by high economic volatility and political uncertainty, the government has strengthened its political position, supported by greater representation in Congress and continued popular backing. Confidence in the administration has recovered to high levels after suffering a significant decline prior to the October elections. This political consolidation has improved governance conditions and enhanced the government’s capacity to advance its policy agenda.

The October elections marked a turning point .

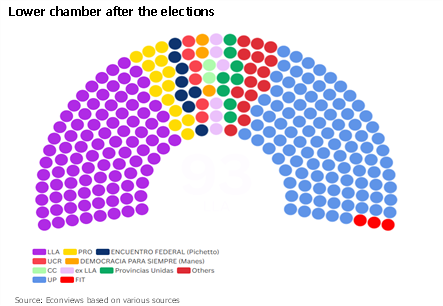

In 2025, the government consolidated its power after achieving a convincing victory in the midterm elections. LLA, President Milei’s party, now holds the largest minority in the lower house, while the Peronists lost their majority in the Senate for the first time since the return of democracy in 1983. This places LLA in a strong position. Although it does not command a majority in either chamber, it can negotiate with provincial parties and the more “reasonable” opposition—including Macri’s PRO—to pass the budget and advance structural reforms. The government does not have a blank check, but it does have enough political leverage to negotiate effectively with Congress.

To begin with, La Libertad Avanza increased its representation in both chambers of Congress. In the Lower House it is now the largest bloc, with roughly 90 seats—plus additional support from PRO and other parties aligned with the government. In the Senate its representation also grew, and, most importantly, Peronism will not hold a majority in that chamber for the first time since the return of democracy. These numbers pave the way for the approval of the budget and put the government in a stronger negotiating position to advance labor and tax reforms.

The government’s victory in the mid-term election was a game changer. The LLA got 40% of the national vote and achieved its goal of reaching one-third of Congress in both chambers (enough to sustain possible vetoes to opposition populist initiatives). With its alliance with PRO, it now has 104 Congressmen in the lower House, more than the Peronists, thus becoming the largest minority.

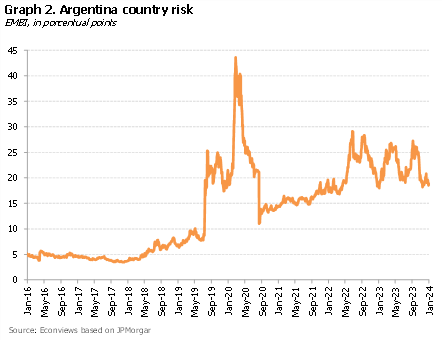

We are now in election mode, and the campaign is heating up. The government is under scrutiny about a corruption scandal that involves close advisors to Karina Milei (namely “Lule” Menem). It is also under pressure in Congress as it lost crucial votes that reversed executive orders while Milei’s veto to stop increases in expenditures for persons with disabilities was turned down. To make things worse, there has been more pressure on the exchange rate despite a drastic increase in interest rates and a deterioration in the country risk that complicates access to external financing.

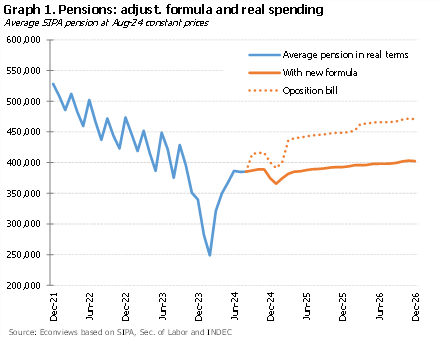

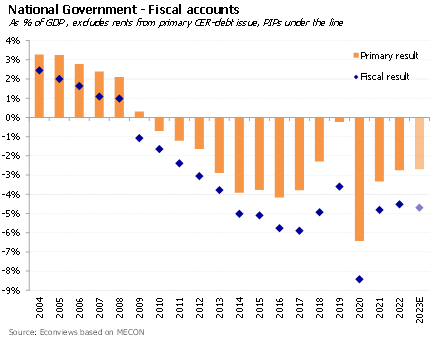

The electoral process is starting to affect the overall political and economic climate. Nothing major yet just some mild turbulence, as the opposition begins to take advantage of the situation to negotiate financial resources for the provinces. Congress has been the sounding board for this new dynamic, passing a law to increase pensions and other expenditures, while it is still discussing another law that would boost transfers to the provinces. The total cost of these measures is estimated to be around 1.3% of GDP.

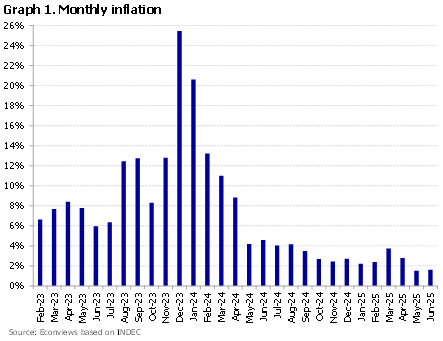

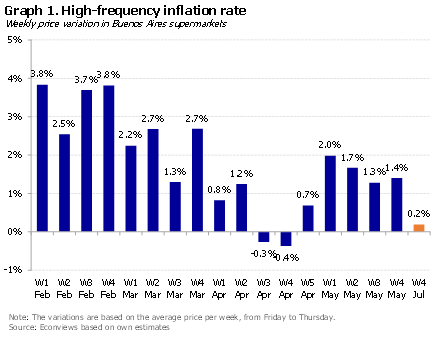

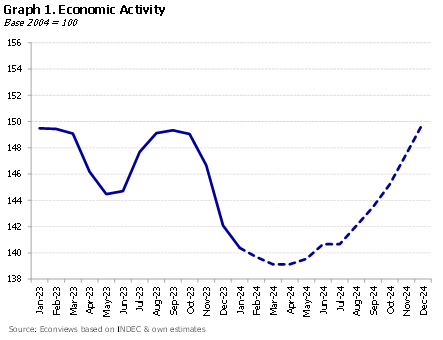

There is increasing evidence that after an initial period in which the government was very successful in getting the economy out of intensive care, the program is now entering a new phase, which involves trade-offs, more fine tuning in the design of policy, and in which it will be more difficult to show impressive results.

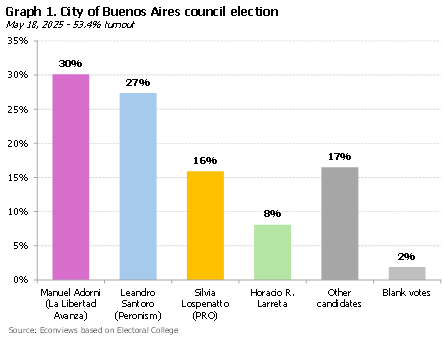

The political and economic climate has markedly improved since Argentina signed the new agreement with the IMF. On the political front, the government scored a key victory in the legislative elections of the City of Buenos Aires, which was a local election with strong implications at the national level. What would normally have been a minor election became a critical test of strength between Milei’s La Libertad Avanza (LLA) and Macri’s PRO. In the end, LLA secured nearly twice as many votes as PRO (30% vs. 16%), marking a major win for Milei and a serious setback for Macri, who lost a district that had been his stronghold in the last two decades.

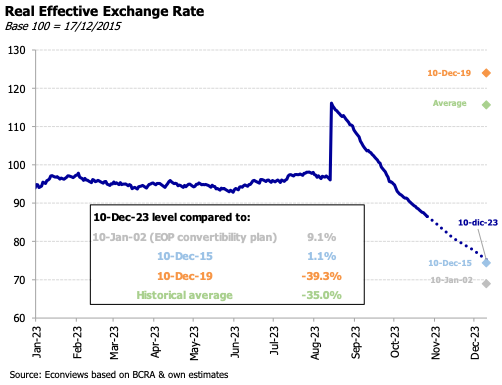

The negotiations with the IMF took longer than most people anticipated. Argentina wanted a USD 25 billion program while the IMF probably had in mind half of that amount. There were also discussions about the size of the upfront disbursement, as Argentina was requesting more dollars than the IMF was willing to provide. At the same time, the IMF was asking for more flexibility in the exchange rate regime, an issue that was raised in previous reviews, while Argentina wanted to avoid a step devaluation because it could put pressure on prices. One could summarize the discussions as more money in exchange for more flexibility in the exchange rate regime.

The government is losing momentum, and it now appears unlikely to have a smooth path to the October elections. After a first year in which everything went according to plan on the economic and political fronts, the outlook is gloomier due to some unforced errors and deteriorating financial conditions.

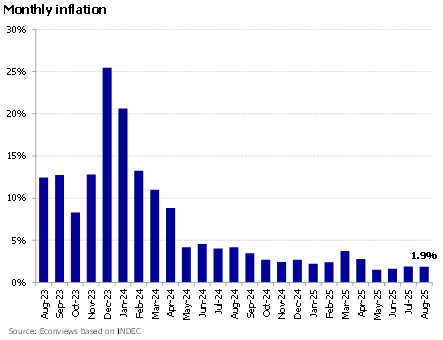

- mensual

Some hurdles on the way to the election: From Libra to higher country risk

Until now Milei’s image appeared to be bulletproof. Though recently, some of his statements generated criticisms that affected his image. It all started with an unfortunate dissertation in Davos, where he was aggressive with minorities. However, the biggest controversy came from a tweet in which he promoted the token Libra. The price of Libra skyrocketed almost immediately following his tweet, only to collapse a few hours later. In the process, the creators of Libra and some of the early buyers made around 100 million dollars. Although there is no evidence yet that Milei benefited from this maneuver, the fact that he publicized or supported the crypto generated noise around the world and has tainted his image.

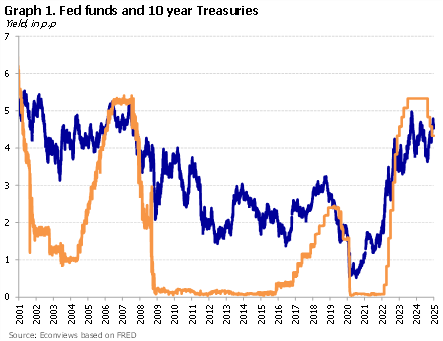

The international environment is changing rapidly and does not seem to bring the tail wind that Argentina needs. At first glance Trump appears to be good news. This is clearly the case when it comes to providing support in the negotiations with the IMF, as he did with Macri. A call from the White House can help at critical times to unlock the negotiations. However, the impact of his policies on other grounds is not so clear. His policy against immigrants and the idea to increase protectionism may result in higher prices and lead the FED to stop the reduction in interest rates to avoid the resurgence of inflation. There are also concerns that Trump might not address the large fiscal deficit and therefore maintain high borrowing needs which put pressure on long-term interest rates (that have been hovering above 4.5%). This dynamic may trigger a strong dollar, which doesn’t help Argentina. Finally, the new policy of encouraging production of fossil fuels could generate downward pressure on oil prices, which would affect Argentina´s increasing exports of energy.

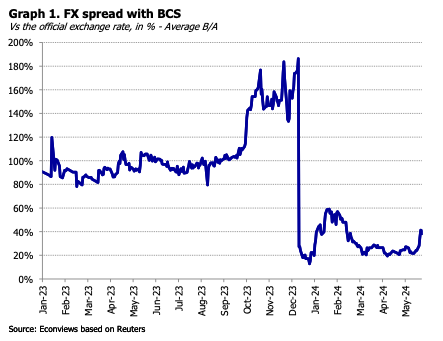

Just a few months ago the concern was that the parallel exchange rates were again skyrocketing and that the country risk was returning to astronomical levels. Something happened along the way and in the last weeks we have seen a tremendous rally in stocks and bonds, the exchange rate has stabilized, and the spread dropped recently to less than 20%, while the country risk fell to the lowest level in five years.

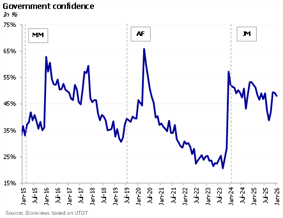

The government confronts a more difficult political climate. However, it benefits from the fact that no one in the opposition is able to capitalize the moment yet. The index of confidence in the government dropped 15% in the September measure, while the index of consumer confidence fell 5.9%. Another bad news is that 52.9% of the population in now below the poverty line, and more worrisome is that those suffering extreme poverty almost doubled to 18.1% relative to the last measurement.

President Milei has had a terrible political couple of weeks in Congress. The Senate voted with an overwhelming majority to change the formula to adjust pensions. This would cost money this year and next, although through a good ruling it may not be too bad. Milei promised a veto but given that the bill passes with over two-thirds of the votes in both houses, the risk is that Congress insists. Even when PRO senators also voted against Milei, the impression is that Macri may end up helping the president.

With the approval of the Ley de Bases and the signing of the Pacto de Mayo in Tucumán on 9 July the government seems to have completed the first stage of the program. The main objectives were to achieve fiscal balance, to bring down inflation, to liberalize most prices, to eliminate the import permits, to deal with the overhang of debt due to the unpaid imports and to create a business friendly environment with policies like the RIGI, which provides incentives for large investments.

Finally, Milei is getting the approval of the first laws: the “Ley Bases” reform bill, and the fiscal package. This is an important political victory, and it indicates that when push comes to shove, he is willing to compromise. Much of the merit goes to his new Chief of Cabinet, Guillermo Francos, who proved to be a shrewd and tireless negotiator, though it is clear that Milei supported him throughout this process.

The government is approaching critical times as Congress is starting to debate the “Ley de Bases”. The bill includes a fiscal package as well as some structural reforms that should help to improve productivity and increase investment and growth. This is a tone down version from the law that was sent to Congress in February and then withdrawn because the government considered that Congress was softening it too much.

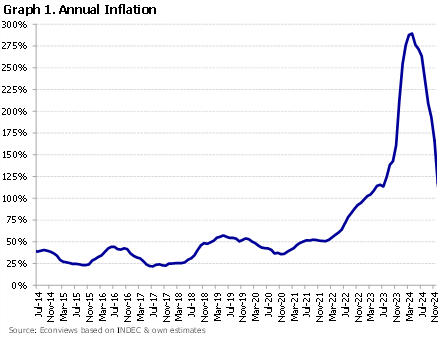

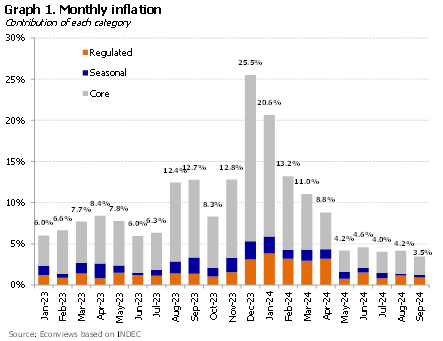

1) How would the economy look at the end of 2024 to be considered a success? A successful adjustment would mean most of the following features. Firstly, the inflation rate has to be comfortably in one digit. We think that unless there is a conventional stabilization plan (i.e. a regime change) inflation will hover around 6-7%. That fits the criteria of one digit, but it is probably higher than what the government is hoping for.

Javier Milei has had a good beginning on the economic front. Investors like what they see, the IMF supports his policies, and the US has been sending top government officials to visit Buenos Aires, a gesture that is welcome by the government. Despite the tough policy measures that have been implemented Milei´s popular support remains high with a positive image of around 50%.

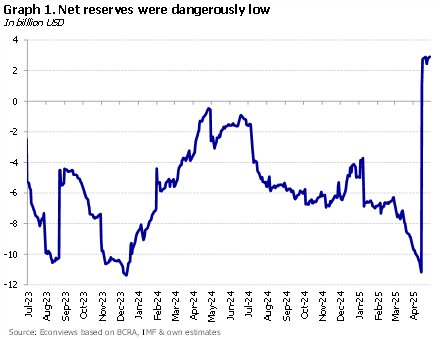

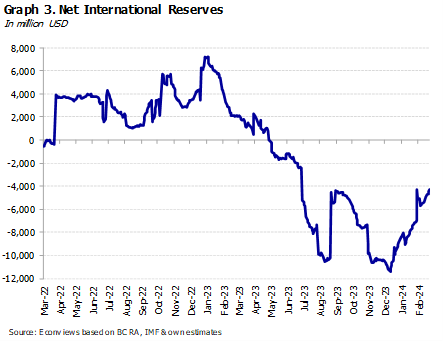

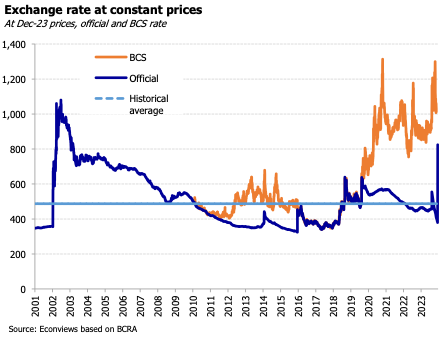

The Milei administration has generated high hopes in the market, mainly because of its decision to eliminate the fiscal deficit and undertake structural reforms. In addition to those objectives, it stated clearly that he wants to unify the foreign exchange market this year, eliminate the FX spread, and replenish international reserves.

The Milei administration has generated high hopes in the market, mainly because of its decision to eliminate the fiscal deficit and undertake structural reforms. In addition to those objectives, it stated clearly that he wants to unify the foreign exchange market this year, eliminate the FX spread, and replenish international reserves.

Milei has started his presidential mandate with policy measures that generate some hope. True, he confronts huge challenges, as he received an economy in intensive care with negative international reserves, a grossly overvalued currency, rampant inflation, a large fiscal deficit, and no access to international credit. He is taking steps to correct it.

Milei has been elected with roughly 56% of the popular vote, which means that he has a strong mandate to go ahead with his plan for stabilization and structural reforms. On the other hand, he has a small representation in Congress, including only seven senators out of a total of 72, and hence he will have to work with the opposition to get the approval of most laws. None of the 24 governors belong to his party and is thin on the ground in terms of union support and more importantly an army of public managers to implement the reforms.

Massa was the big winner in the general election and appears to be the front runner in a runoff that is likely to be very tight. The fact that he came in the first position with 37% of the votes was a surprise, as most pollsters were expecting Milei to lead, but he ended in the second place and only managed to maintain 30% of the votes. Patricia Bullrich came in third, well behind gathering only 24% of the votes, a big loss for Juntos por el Cambio, whose future is uncertain.

The economic situation continues to deteriorate, and it is now clear that whoever wins the general elections will have a colossal challenge in December. He or she will have to deal with an extremely fragile situation including a high and probably rising rate of inflation, the need to devalue to reduce the FX spread, reduce the fiscal deficit, increase utility rates, remove the FX controls, and design a strategy to quickly increase reserves to avoid a new default on external debt.

The primary elections came with many surprises. The big winner was Javier Milei, who was in the radar and was thought to be competitive, though nobody expected that he would end in first place and obtain 30% of the votes. Rodriguez Larreta was the big loser, as he lost badly the primary to Patricia Bullrich, who is now the candidate of Juntos por el Cambio (JxC). The Peronists had a poor election and finished in third place, but they still have a good chance of winning the province of Buenos Aires, where Axel Kicillof won, and they are likely to have a close race with JxC for the governorship. In Buenos Aires there is no second round.