Reports

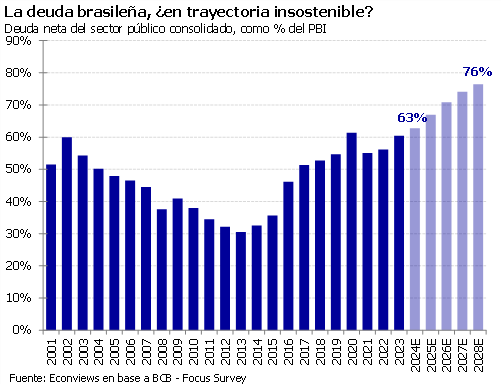

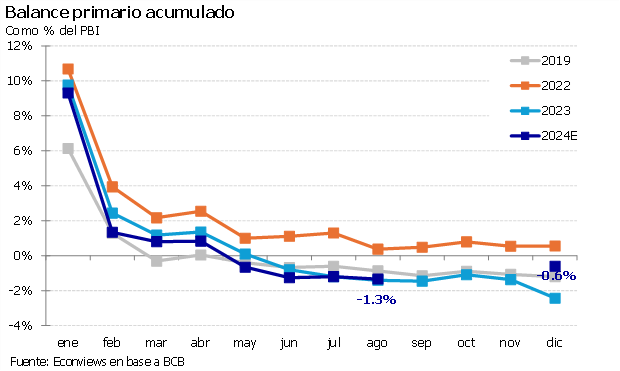

La crisis fiscal sigue sin solución. El Congreso licuó el paquete de ajuste propuesto por el gobierno de BRL 70 MM a 44 MM, o de 1.2% a 0.7% del PBI por año en 2025 y 2026. Y todavía no consiguió pasar la reglamentación de la reforma tributaria ni del presupuesto 2025. El ministro de Hacienda, Fernando Haddad, que representa la línea más pro-mercado dentro del gobierno del PT, está desgastado por las críticas externas e internas.

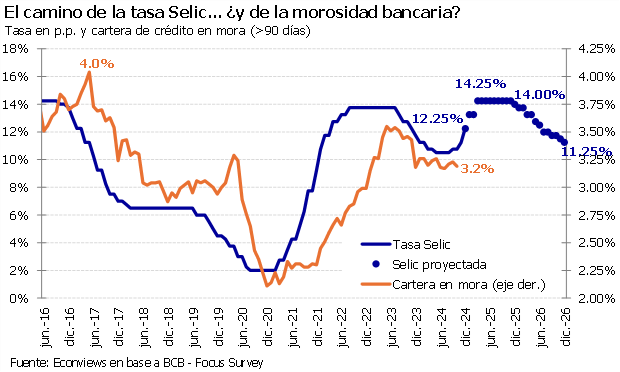

Luego de semanas de inestabilidad, el miércoles 11 el Banco Central subió 100 bps la tasa Selic a 12.25%, sorprendiendo al mercado que esperaba 75. El comunicado dio a entender que volverá a subir de a 100 en las próximas dos reuniones, dejando la tasa en 14.25% para marzo. No llegaba tan alto desde 2016. El anuncio no alcanzó para tranquilizar al Real, que sigue cotizando en 6.06 por dólar, depreciándose 4.4% en el último mes. La Bolsa de São Paulo perdió 2.4% en ese lapso, arrastrada por los bancos. El jueves el Banco Central volvió a intervenir en el mercado cambiario, con ventas por USD 4 MM como en noviembre.

El Banco Central subió la tasa Selic de 10.50 a 10.75% en la reunión de septiembre. Cortó con el ciclo de bajas empezado en 2023. El mercado espera dos alzas de 50 bps de acá a fin de año y otra de 25 bps en enero, dejando la tasa a 12% en el primer semestre de 2025. Lo que preocupa al BC no es la inflación en sí, sino la volatilidad externa y el deterioro fiscal. El real se devaluó 3% en el último mes a 5.68 BRL/USD y perdió 15% en lo que va del año. El déficit primario a agosto es mayor que en años previos, aunque la recaudación fiscal mejoró. La Bolsa de São Paulo cayó 2.9% en el último mes. Las elecciones municipales no dejaron un ganador claro, con balotaje en SP y victoria del centro en RJ. En diciembre el ex viceministro de economía de Lula, Gabriel Galípolo, asumirá la presidencia del BC: habría continuidad en la política.

Por la combinación de economía caliente, cuentas fiscales en rojo y presión externa, el Banco Central dio un giro de 180º y volverá a subir la tasa Selic, que había bajado de 13.75 a 10.50% en el último año. Ahora, la encuesta FOCUS la ve en 11.25% para diciembre, tres alzas de 25 bps. La primera, el 18 de septiembre. El traspaso de Roberto Campos Neto a Gabriel Galípolo no debería afectar la política monetaria: también subió la tasa prevista para fines de 2025 y 2026. Ve un alza más a 11.50% a principios del año que viene, y luego un recorte gradual hacia 10.25%. Si bien la inflación en 4.2% sigue dentro del rango meta, el Banco Central está preocupado por la volatilidad del real, que se devaluó 2% en el último mes y cotiza en 5.56 por dólar. La Bolsa de São Paulo avanzó 1.9% en ese período, pero perdió 0.8% en lo que va de septiembre.

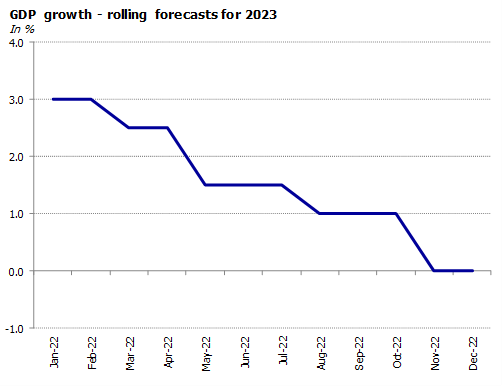

The economy grew 5.2% in 2022, mostly driven by 2021s statistical carryover. Investment displayed the highest growth rate (10.9% y/y), followed by private consumption (9.4%). Exports increased by 5.8% and public consumption by 1.8%. From the supply side, Hotels and restaurants had the best performance growing 35% while Agriculture and livestock appears at the bottom of the list with a fall of 4.1%. Economic activity rebounded 0.3% m/m in January, cutting a streak of 4 monthly drops. But due to the worsening of the drought and all the spillovers of that on sectors such as transport, fuel, and consumption, we reduced our GDP growth forecast to -4.5% for 2023.

GDP grew 1.7% in the third quarter s.a. related to Q2 and 5.9% year-on-year. From the demand side, investment showed an increase of 14% (Q3 2022 vs Q3 2021), followed by private consumption with 10.2%. Exports contracted by 4.6%. Considering the supply side, Hotels and restaurants (+37.3%) and Mining (+14.4%) were the sectors with higher increases. However, for their share, the most relevant sectors were Industry (+6.4%) and Commerce (+7.3%). In the last quarter of the year, economic activity has cooled down and we think that 2022 will end with a GDP growth of 5.5%, most of it explained by the statistical carryover. For 2023 we expect that economic activity will stay stagnant.

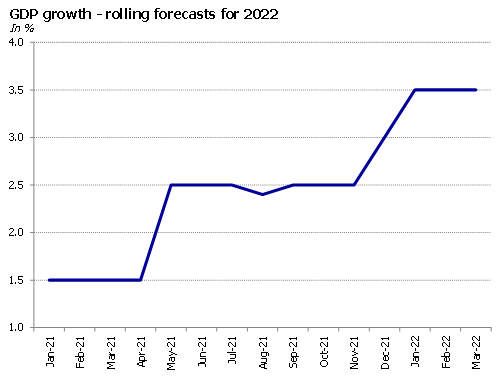

Economic activity grew 1.0% in the second quarter, above expectations, but it stagnated in July (-0.04% in July m/m, seasonally adjusted). Year-on-year the economy grew 5.6%, below the 6.9% in June and the 7.9% in May. We expect the decelerate during Q3 and contract in Q4 due to import controls that affect production and the impact of inflation on household incomes. In July, the most dynamic sectors were Hotels & Restaurants (45.7% y/y) and Mining (13.6%). On the other hand, fishing (-4.1%) and Agriculture & Livestock (-2.7) had the worst performances. Mostly explained by the statistical carryover, we forecast that the GDP will grow at least 4% this year.

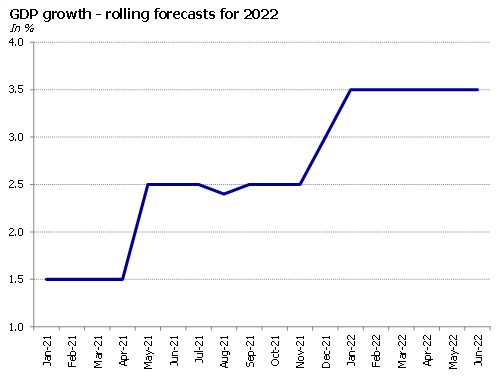

Economic activity is evolving with ups and downs since the beginning of the year. In February it grew 1.1%, in March it fell again 0.8% and in April it recovered 0.6%. Year-on-year positive rates are observed but it is mainly because of the low comparison base. In the accumulated of the year the economy grew by 5.7% y/y but we must remember that in this period of 2021 there were sanitary restrictions. The most dynamic sectors were Hotels and Restaurants (35% y/y), Fishing (15.9%), and Mining (14.3%). Manufacturing and Construction, two of the most important activities grew 4.8% and 3.8% respectively. With a statistical carryover of more than 4%, we expect that real growth will be 3.5% in 2022.

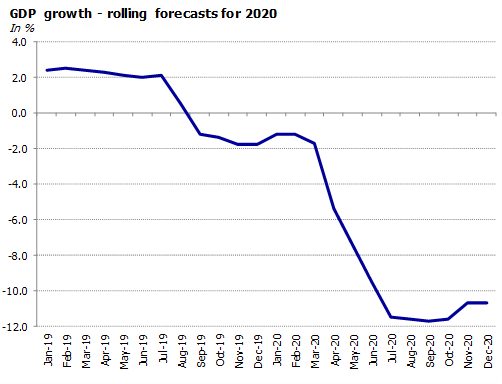

The economy rebounded 10.3% in 2021 after the collapse of 9.9% in 2020. In the fourth quarter, activity grew 1.5% compared to the third quarter s.a. and 8.6% y/y. Investment and private consumption were the components of aggregate demand with the best performance. On the supply side, the largest year-on-year increases were in sectors that had been the most affected by the lockdown measures and, therefore, in 2021 benefited from the reopening, such as theaters, hotels, and restaurants. In January, activity fell 0.5% monthly due to a COVID outbreak and restrictions on imports. For 2022 we expect 3.5% growth, below the statistical carryover left by Dec-21 of 4.1%.

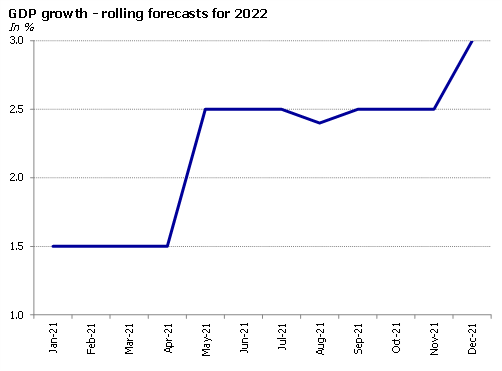

In the third quarter of the year, GDP grew 11.9% y/y and 4.1% compared with the previous quarter. The most dynamic sectors during that period were social services (cinemas, theatres, cultural and sport venues) and hotels and restaurants, both highly affected by the lockdowns. Construction and Industry also had good performances. A slight recovery of real wages combined with the reopening were key factors of the activity rebound. For 2021 we expect a GDP growth of 10%. Next year the economy will moderate its path expanding 3% despite the strong statistical carryover, as there will likely be some adjustments under the program with the IMF.

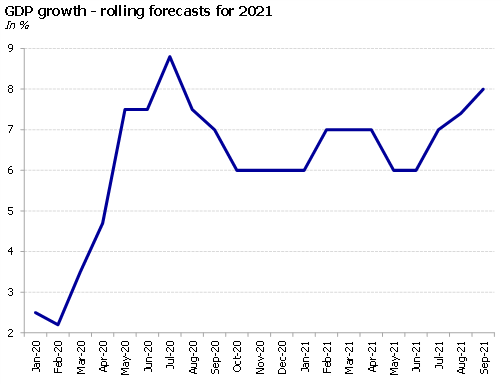

Economic activity grew 0.8% in July and 11.7% in the year-on-year comparison. This recovery is being led by Manufacturing, Commerce and Real Estate activities. Additionally, as the vaccination process continues and the pandemic seems to be giving in, consumption-related sectors will take the lead. That is the case of Cinemas, Theaters, Restaurants or Tourism. Electoral measures will be another factor that could contribute to boost economic growth. In part due to the statistical carryover that left last year, we expect the economy to grow 8% this year and 2.5% next.

Economic activity fell 1.2% m/m in April. This is the third consecutive fall since February. Year to date the economy has grown by 8.2% against the same period in 2020, but this is mostly explained by the low comparison base. Compared to April 2019, only four out of 15 sectors are above 2019s level, among which are Industry and Commerce. Among the hardest hit sectors we can mention Hotels and Restaurants (-52.6%) and Social and Healthcare services (-33.4%). The recovery will depend on the evolution of the pandemic and the arrival of new variants that could force even more mobility restrictions. For 2021 we expect a rebound of 6%.

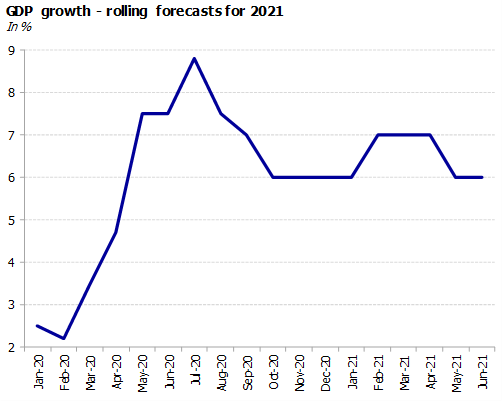

In 2020 the GDP fell 9.9% recording one of the highest contractions in history. Both private consumption and investment plummeted 13.1% and 13% respectively. According to January data, the recovery is being led by Manufacturing (+4.6% y/y, Construction (+10.2% y/y), and Commercial activity (2.6%). Another sector with a good performance is the one related to exports, boosted by high international prices. For 2021 we have raised our forecast of GDP growth to 7%, but most of this figure will be a statistical effect. FX calm and a controlled number of COVID contagions will be critical to keep the economy on this path.

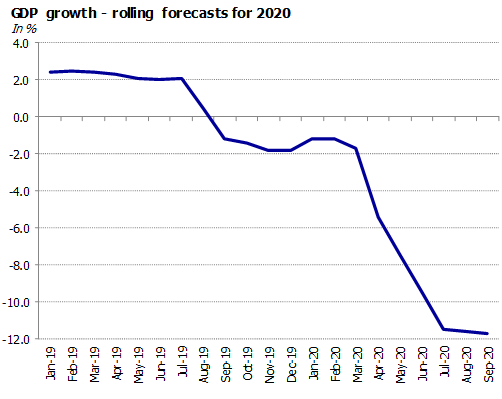

On Q3 the GDP rebounded 12.8% q/q s.a. after the record contraction in Q2 of 16.0% q/q (and -19.0% y/y), leading to a reduction of the y/y fall to 10.2%. As isolation measures eased, private consumption rebounded 10.2% q/q and investment jumped 42.9% -driven by the construction sector- but will end the year with the smallest ratio to GDP since the start of the new series in 2004. Economic activity grew 1.9% m/m s.a. in October and is expected to keep on recovering in the last two months of the year. We expect the year to end with a contraction of activity of 10.7% and a rebound of 6.0% in 2021.

Economic activity recovered from the trough of April in May and June and to a lesser extent in July, but it seems to have stopped there. The lack of an exit plan for the lockdowns coupled with severe injuries to government credibility have implied a strong hit on investment. The interior of the country that was almost Covid-free in Q2 is now starting to see a rise in cases, hence closing some activities previously allowed.

The economy seems to have touched bottom in April, but the recovery is not looking like a V-shaped one. Firstly, the lockdown continues in the Buenos Aires area and is likely to do so through July. Secondly, the government is limiting in the second half the size of the stimulus programs. Thirdly, the payment chain faces a very difficult situation with a huge stock of bounced cheques and part of the middle class finances severely wounded. By June still one third of the workers cannot work at national level, but that number goes to almost 50% in the Buenos Aires area, according to an official report.

Alberto Fernández assumed the presidency on December 10th with Cristina Fernández de Kirchner as his vice-president. The key positions at the Central Bank (Miguel Ángel Pesce), the Ministry of Foreign Affairs (Felipe Solá) and the Ministry of Economy (Martín Guzmán) carry Albertos seal rather than Cristinas. The first package of economic measures from the new Administration was sent to the Congress this week. It includes a freeze in utilities rates, an increase in wealth and export taxes, a new 30% tax on dollar purchases and a freeze in the mobility pension’s law, among other measures.

Macri lost the primaries against Alberto Fernández by an unexpected difference of 15 points. The market reaction was very negative, with a significant depreciation of the peso and significant losses across all asset classes. Hernán Lacunza became the new Minister of Finance. General elections will take place on October 27th. If main trends are repeated as expected, the Fernández-Fernández partnership will win in the first round and there will be no need for runoff voting.

Macri shocked the political space by choosing Miguel Pichetto as his vice president candidate. Hes a veteran Peronist, a pro market defender and one of the leaders of Alternativa Federal. The decision was celebrated by the market, with a nominal FX appreciation of the Peso to 42.50, and a slump in country risk to 845 bps. Some weeks before, Cristina Kirchner surprised the market when she announced she was running as vice president, with Alberto Fernandez as presidential candidate.

The IMF staff and local authorities reached an agreement on the 3rd review of the program. Still subject to the approval of the Executive Board, Argentina will access to US$10.87 billion in the coming weeks. The image of the Government is 23% lower than a year ago and close to the lowest since Macri took office. First polls show a close tie between Macri and CFK each with around 30% of vote intention, while former Minister of Economy Lavagna appears with serious chances in case CFK decides not to run.

The IMF closed a new deal with Argentina, adding USD 6.0 billion to the existing stand-by credit, now totaling USD 56.3 billion. While the government took several months to find a response to the crisis, it now seems to finally managed, with the support of the IMF, to put together a policy package that can succeed in stabilizing the Peso and pave the way for an improvement in the external and fiscal deficits. The image of the Government is 38% lower than year ago, at the lowest level since Macri took office.

Macri announced negotiations to improve the IMF program, but there were no details and the IMF remained silent. This created confusion in the market followed by rumors of possible changes in cabinet. This weakened Macri´s image, already in lows by the currency crisis, and raised questions about his chances for re-election in 2019. Central Bank President Luis Caputo resigned, and was replaced by Guido Sandleris. Cristina Kirchner was accused of corruption and her future depends on Peronists senators.

The currency run that depreciated the peso 30% so far this year is having an impact. The governments image dropped to the lowest levels since Macri took office in late 2015, as its positive image is now below 40%. While it still has over a year to make a comeback, the perception that many political analysts had that his re-election was almost ensured is now questioned. Macri is still the frontrunner, but he may lose in a second round if the economy does not recover by the middle of the next year.

The last few months were difficult for Macri administration. Its popularity dropped to the pre-October election levels of around 46% after surging in late Oct-Nov, consumer confidence suffered the overall mood among investors and the business community clearly took a bearish turn. The government still has the advantage that the Peronist party is divided between Kirchneristas and orthodox and there is little chance they can get together and unified to the presidential elections.

The year ended with bells and whistles, as the Congress had a heated debate due to the pension and tax reforms, while the government in a controversial move changed the inflation targets. The Government succeeded in passing the 2018 Budget, the tax reform and the pension reform. Although the approval of reforms was key to improve the fiscal consolidation, the confidence in the Government recorded its largest fall (-20.3%) during Macris Administration, doubling the drop of April 2016 (10%).

The official party received a strong support on the general elections. Cambiemos candidates not only prevailed over CFK in the province of Buenos Aires by 4 points, but they also won in 13 other provinces and scored the five most populated districts. At a national level it received 41.9% of the total votes and it expanded its electoral base by almost five points compared to the primaries. The Government announced a tax reform, a labor reform and wants to change the adjustment formula for pensions.

The first half of August was marked by the primary elections, which resulted in a clear victory of the official party Cambiemos at national level. In the Province of Buenos Aires, the final scrutiny threw Cristina Kirchner as the winner by a very small margin (34.27% vs. 34.06%), but polls indicate that Esteban Bullrich, the official candidate, is likely to win in the general elections of October. The business climate and the mood of investors has improved rapidly in response to the results of the primaries.

Despite no major change in Congress is expected as a result of the coming elections, the results will condition the next 2 years of Macris administration. Cristina Kirchner will run for a Senate seat in the Province of BA, and a good electoral performance is the only way to guarantee her political survival. Polls suggest she is likely to become a Senator, although the electoral map appears to be favorable for Cambiemos, as the opposition is fragmented with the three main candidates dividing the Peronist vote.

Macri’s administration got an unexpected political boost in April, as the approval rating recovered 6%. This positive news for Macri came after a 10% slippage in February. His positive image now reaches 53% and returned to similar levels than before the unforced errors of February that cost 10 points by the social conflicts and the confrontation with the unions. Now the focus is on the mid-term elections, where the Government is likely to have a good performance at the national level.

Confidence in the government (UTDT) deteriorated in Feb-17 to 47% and hit the lowest record since Macri took office. However, the indicator is still higher than the one printed by the end of CFK administration. Tough negotiations between the government and the teacher’s union ignited a conflict and strike that has reached important political dimensions and is testing the strength of both contenders. The government views this negotiation as critical to meet its 17% inflation target.