Services

Reports

We offer reports on the Argentine economic and financial situation, focused on key aspects such as the level of activity, fiscal accounts, inflation, interest rates and exchange rates.

Presentations

We make in-company presentations on the Argentine and international economic situation, adjusting to the client's needs.

Consultations

We are available for specific queries from our clients on current issues via phone or email.

Forecasting

We prepare detailed long-term economic forecasts and alternative scenarios for budgeting and decision making.

Contact Us

Last Reports

The closure of the Fate tire plant and the debate over labor reform have placed growing concerns about jobs and wages at the center of the stage. The latest survey from the University of San Andrés confirms this shift: according to public opinion, low wages are now the main problem affecting the country, followed closely by corruption and unemployment. Inflation only appears in tenth place—a drastic change from November 2023, when price hikes led the rankings by a wide margin.

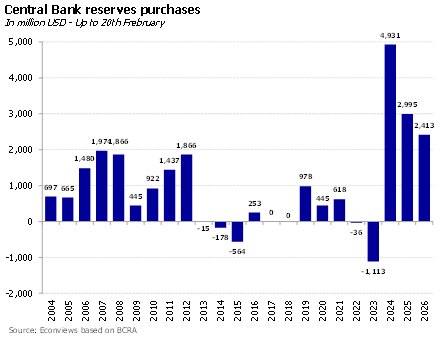

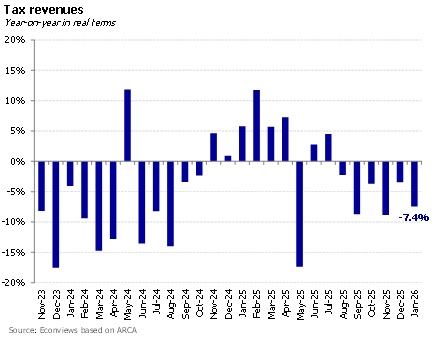

The week in the Argentine economy left a bittersweet taste. On one hand, the good news was that the Senate passed the labor reform bill and the Central Bank (BCRA) continued to buy dollars at a steady pace. However, at the same time, inflation served as a reminder that the game was far from over and the opponent was tough to beat, compounded by employment data that were far from encouraging.

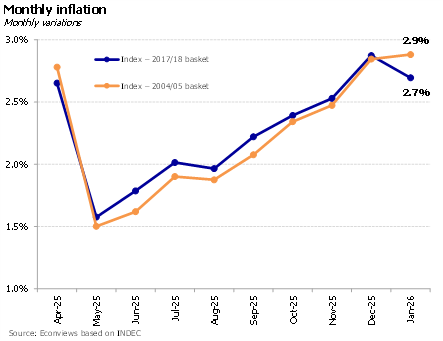

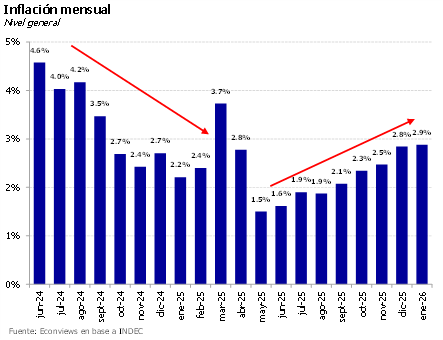

La inflación está difícil de domar. El 2.9% de enero sorprendió negativamente, ubicándose por encima de lo esperado por el mercado y marcando el octavo mes consecutivo de aceleración mensual. La nota positiva es que la inflación núcleo se desaceleró del 3% al 2.6%, y en febrero los aumentos en alimentos vienen siendo más moderados. Con el nuevo índice, la medición habría rondado el 2.7%. Sin embargo, la postergación de la nueva canasta (que otorga mayor peso a los servicios) parece responder más a los ajustes tarifarios pendientes para el resto del año que al dato puntual de enero. Como señalamos habitualmente, la desinflación es un proceso largo y no lineal, pero preocupa la ausencia de un ancla clara. El último REM ya mostraba un repunte en las expectativas. Prevemos que la inercia seguirá pesando y que la inflación cerrará 2026 cerca del 27%.

January closed with a highly positive balance for the Argentine economy. After moving past the electoral noise and with a macroeconomy showing signs of stabilization, the Government managed to make significant progress in reserve accumulation, brought country risk down to the 500-point range, and kept the exchange rate under control. However, February has begun with a slightly more complex scenario, as clouds gather on both the external and domestic fronts.

Inflación, INDEC y polémica. Después de un enero tranquilo, el gobierno se autoinfligió ruido innecesario con la decisión de postergar la implementación del nuevo índice de inflación, causando la renuncia del titular del INDEC. No son buenas señales. En un país con una historia de manipulación de estadísticas todavía fresca, la credibilidad cuesta mucho construirla y muy poco dañarla. La decisión también es difícil de entender: si bien en 2024 la diferencia entre ambos índices fue de 16.5 p.p., en 2025 fue de apenas 1 p.p. Con tarifas bastante más alineadas, estimamos que la diferencia tampoco iba a ser significativa en 2026. Yendo al corto plazo, enero pinta para cerrar con una inflación cercana al 2.5%. Nuestro relevamiento de alimentos y bebidas se mantuvo en el 2.8% mensual, y los regulados aumentaron nuevamente cerca de 3.4%. La buena noticia es que registramos una desaceleración importante en alimentos para la última semana del mes.

Articles

Más rápido de lo que muchos economistas esperaban, el Gobierno va consolidando su objetivo de cerrar el año con déficit fiscal cero, mejora de las cuentas del Banco Central, y camino a la tasa de inflación de un dígito porcentual….

About Us

Graduate in Economics from the University of Buenos Aires and Ph.D. in Economics from Columbia University. Professor and researcher at the Di Tella University and academic advisor at FIEL

With vast experience as an advisor to multilateral organizations such as the IMF, the World Bank and the Inter-American Development Bank, as well as several Latin American countries, he held prominent roles in the financial sector, including the presidency of Banco Hipotecario S.A. and functions in the Ministry of Economy and the Central Bank of the Argentine Republic.

He was an Assistant Professor at the University of Maryland, and taught at institutions such as CEMA, Georgetown University, and Columbia University.

He is a columnist and author of numerous articles in international publications. Author of the book “The Argentine economic crisis, a history of adjustments and imbalances” with Sebastián Kiguel.

Graduate in Economics from the University of Buenos Aires and MSc in Economics from the University of Warwick (UK).

He was an economic consultant at the Inter-American Development Bank (IDB) and at Econviews. He also served as an advisor at the Ministry of Economy and the Ministry of Transport of Argentina.

Alejandro Giacoia

Economist

Bachelor of Economics (UBA).

Pursuing a Master’s Degree in Finance (Di Tella)

Pamela Morales

Economist

Bachelor of Economics (UCEMA).

Associate Professor of Macroeconomics UCEMA

Rafael Aguilar

Economist

Bachelor of Economics (UBA).

He was an assistant in the UBA National Accounts chair

Leila García

Economist

Bachelor of Economics (UBA).

Assistant in the UBA Argentine Economic History