A Temporary Relief for Agriculture

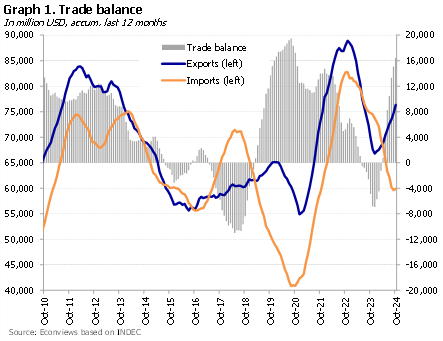

The government surprised everyone by announcing a temporary reduction in export taxes for the agricultural sector and their elimination for regional economies, leveraging the excellent fiscal results achieved in 2024. The measure comes ahead of a scheduled meeting between Caputo and the agricultural sector representatives, where producers were expected to demand lower export taxes. The […]

An Oxymoron: Currency Competition with FX Controls

Argentinians have a tendency to think in dollars, a result of the inflation that has tormented us for so many years. It feels almost natural to convert prices into dollars when dining at a restaurant or buying a t-shirt to assess whether it is expensive or not. There is no doubt that we also consider […]

Country Risk Fell Sharply, but There Is Still Ground to Cover

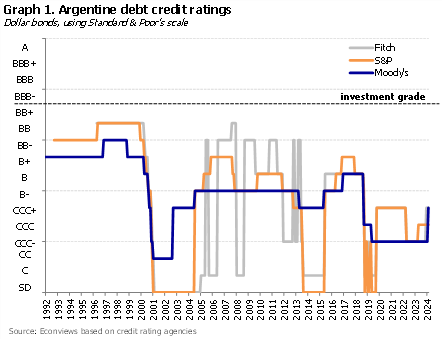

One of the economic program’s great victories has been the phenomenal reduction in country risk. It fell from around 2,000 when Milei took office to 580 basis points last week. This improvement has not been accompanied in the same dimension by improvements in credit ratings, which remain at CCC for the three major agencies, but […]

In a Year of Consolidation, Lifting FX Controls Can Wait

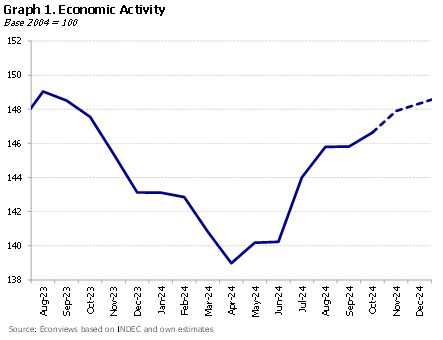

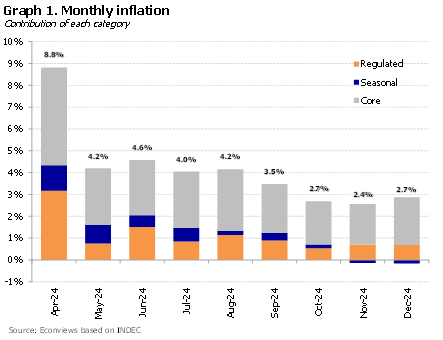

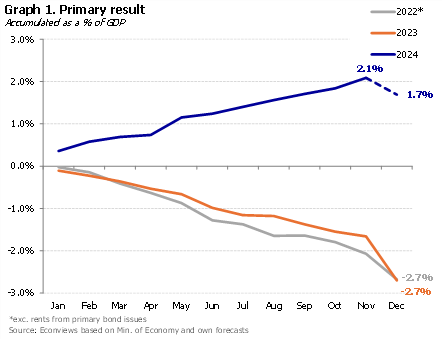

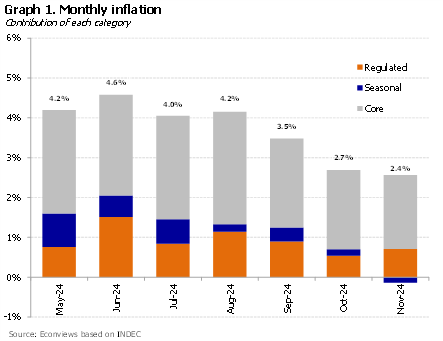

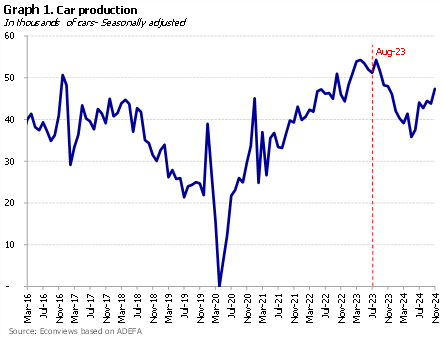

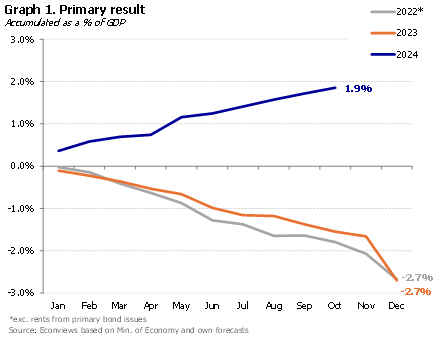

The year begins with lots of hope and some challenges. 2024 left important achievements, such as the impressive improvement in fiscal accounts, or the decrease in inflation and the exchange rate spread. At the same time, the economy is beginning to show a path of recovery, and after an initial deterioration, real wages and poverty […]

The Best and Worst of 2024

2024 is coming to an end and at Econviews we wanted to finish by summarizing the best and worst of the year. It was undoubtedly a year that we will remember and with the pass of time we will be able to put it in historical context. For now, this list is a contribution so […]

The Keys to Move From Stabilization to Growth

In his speech to evaluate his first year in office, Milei showed satisfaction with the achievements obtained, and it was made in a calmer tone than we are used to, which is comforting. It was clear that 2024 was the year of stabilization and of surfing the crisis left by the previous government, and 2025 […]

A Year of the “Plan Peluca”

A year ago, Argentina was gripped by uncertainty and fears of a massive crisis. Milei’s first goal was to avoid the country falling in a major disaster, but there were widespread concerns. His government lacked executive experience, held a marked minority in Congress, had no governors or mayors from his party, and faced a fragile […]

A Challenging but Achievable Financial Program

As the year comes to an end, questions arise about whether Argentina has the funds to meet its 2025 debt obligations. The financial needs seem daunting—around $17 billion in dollar-denominated requirements and 11% of GDP in peso debt. However, upon closer inspection, the outlook appears more manageable, and unless a “black swan” event occurs, there […]

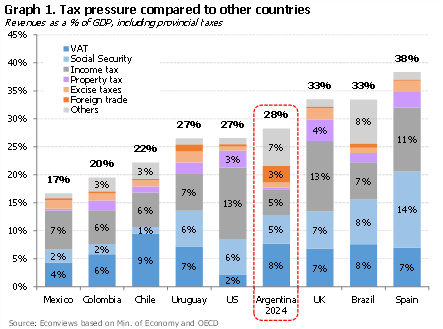

Opening Up the Economy… to Lower Inflation or to Be More Efficient?

There is no doubt that Argentina is a very closed economy. Imports represent only 14% of GDP, when the regional average is 25% of GDP.

It’s MAGA: Make Argentina Great Again

The meeting between Milei and Trump had an impact because it took place just a week after the elections, and because Milei was the first president to meet with the president-elect since then. The meeting was framed in a context where the government has been doing well. The fiscal balance is consolidated as non-negotiable, inflation […]