Our View of Last Week

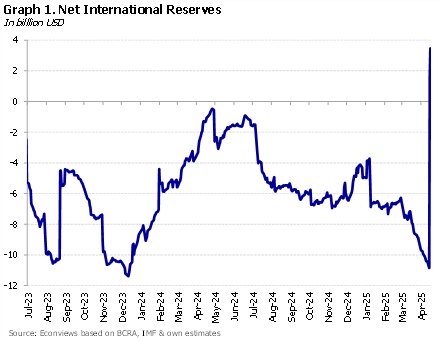

Seeking the waiver. The government has been “passing the hat” in recent days with new debt issuances. Bonte (hard peso) bonds have already contributed around USD 1.5 billion, to which USD 2 billion from the repo were added, bringing gross reserves above USD 40 billion and liquid reserves above USD 20 billion. To meet the […]

The Evolution of the Economic Program: From Unconventional to More Orthodox

Monetary and exchange rate policy has been evolving since Milei took office. Initially, the program included several unconventional elements aimed at rapidly reducing inflation and providing an anchor for inflation. During that phase, interest rates were negative in real terms, the official exchange rate was quasi-fixed, capital controls remained in place, and there were multiple […]

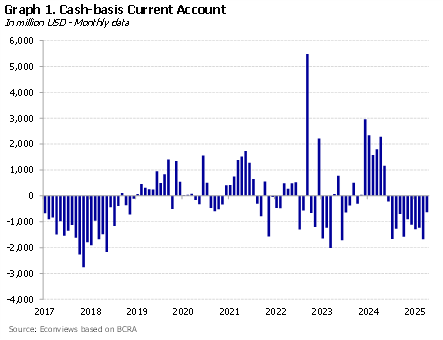

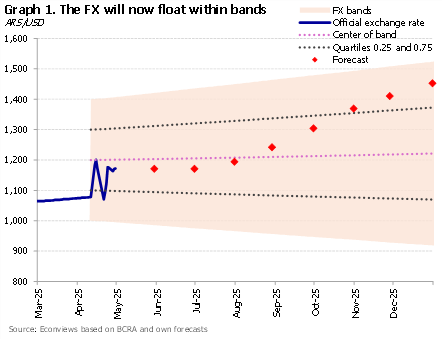

Exchange Rate and Reserves: Two Sides of the Same Debate

The debate on the exchange rate has calmed down now that the dollar floats within the band and its value is determined by the market. It’s true that it’s still not a clean float because there are many exchange controls in place for companies, but the spread with parallel dollar rates has disappeared and the […]

The Alchemy of Issuing Peso Bonds and Raising Dollars

Finally, the Treasury raised dollars by issuing a peso bond to international investors, who purchased it in dollars. Thus, the Treasury received fresh dollars, although the principal and interest payments will be paid in pesos. The move was a good one: it allowed the government to approach its reserve target with the IMF (which we […]

What Will Happen With the Dollars Stashed Under the Mattress?

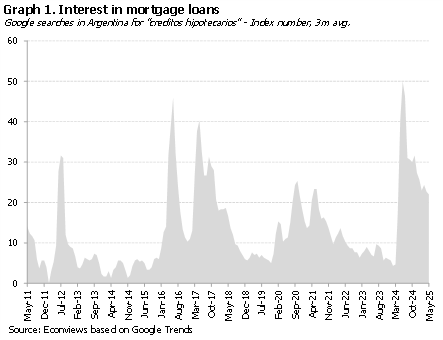

The government’s plan for getting Argentines to use their stashed dollars has finally been revealed, and everything indicates that the measures are less revolutionary than many expected. Even so, they represent an important step forward: by raising the minimum amounts for transactions that must be reported to the tax agency, people’s lives are simplified and […]

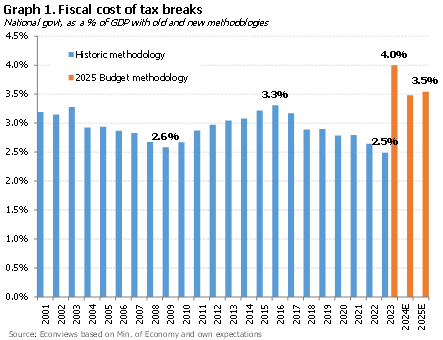

Tierra del Fuego: A Regime Under Scrutiny

The deregulation and trade opening agenda continues at full speed. This is probably one of the areas where the government has made the most progress. Untangling the knot of regulations and opening the economy often involves confronting deeply entrenched business interests. However, the executive branch decided to take a further step on the eve of […]

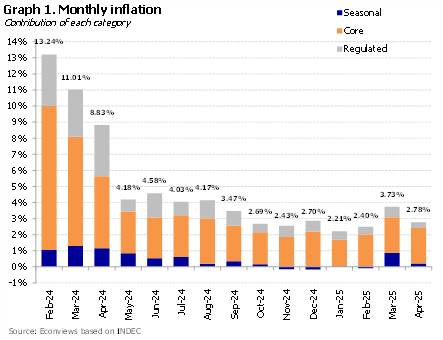

What Really Hurts Is Inflation — We Can Live with Less Growth

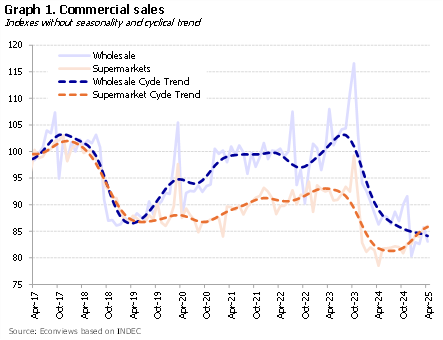

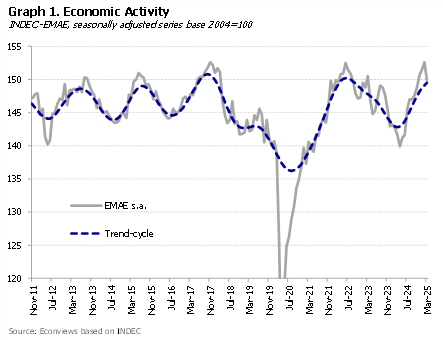

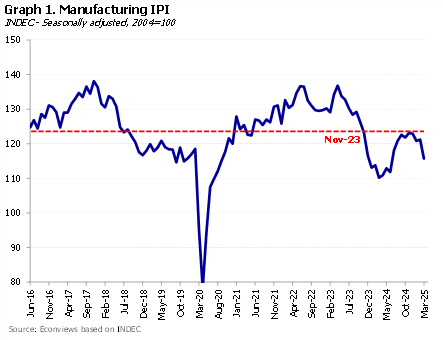

Following the new agreement with the IMF, the government announced the beginning of a new phase in its economic program — a turning point meant to mark the transition from stabilization to sustained growth. However, as the days went by, it became clear that this outlook was perhaps premature, and that we are actually heading […]

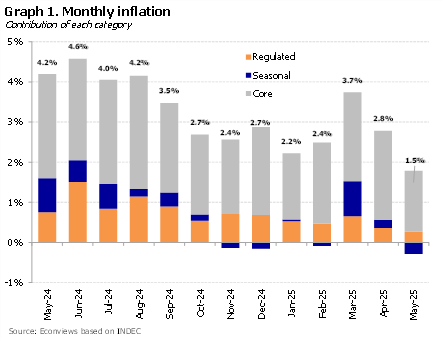

The Government Is Still Focused On Inflation

There is no second chance to make a good first impression. After implementing the new floating-withing-bands scheme, the government’s main objective was to avoid an overshooting of the exchange rate and, thereby, fuel the narrative that there was no step devaluation and that prices should not be adjusted.

The IMF Program and Monetary Policy

The monetary policy outlined in the new program shows a shift toward a more conventional framework. Targets are now set for traditional monetary aggregates, such as the traditional monetary base or M2, instead of capping the broad monetary base — another Argentine invention that does not appear in any textbook. The rigid 1% monthly crawling […]

A Strong Start. What Comes Next?

The first few days without capital controls were, without a doubt, a success for the government. The market reacted very positively to the announcements: far from testing the upper bound, the exchange rate settled closer to the lower band. The Merval index started off strong, later gave up some ground, but bonds remained firm and […]