Markets Remain on Edge Ahead of Elections

Argentina has fully entered election mode and, as usual, politics is shaping the economy. But it’s not just about politics: President Milei’s government is dealing with a broader mix that includes a corruption scandal within his inner circle, defeats in Congress, and unforced errors in economic policy. All this is unfolding in a context of […]

The Long and Winding Road to the Elections

Another turbulent week has passed in Argentina. There are two months left until the general elections, and just two weeks until the Buenos Aires provincial elections. Until then, noise and volatility will likely remain the main characters. Politics is playing its game, but on the economic front the field has also been muddied.

Disinflation, but at What Cost

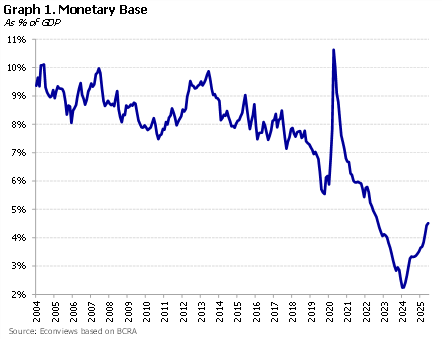

Argentina is managing to bring inflation down, but only through a monetary squeeze whose sustainability is highly uncertain. Last week once again highlighted the erratic and opaque management of monetary policy. In theory, the Central Bank follows a quarterly target for monetary aggregates (transactional private M2). In practice, however, policy has been discretionary, with the […]

What Exactly Are the “Structural Reforms”?

Everyone says that after the elections, “structural reforms” will arrive. The government repeats it, the market expects it, and the IMF demands it. But if you ask what concrete measures are actually being considered, the answers are vague and generic. It seems there has been more progress on tax reform, some ideas on pension reform, […]

When the Market Speaks Louder Than the Plan

Last week was likely one of the most difficult ones for the government. The exchange rate took the spotlight again with a sharp jump, showing that the idea of the dollar slowly moving to the lower end of the band was just an illusion. The new level isn’t alarming, but the sudden move created concern, […]

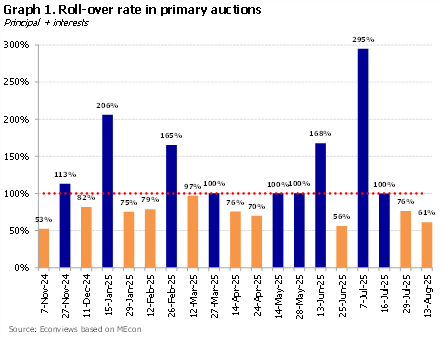

Peso-Denominated Debt Returns to the spotlight

In recent days, short-term interest rate volatility has surged. Market rates swung between 18% and 70% in a short period, surprising markets and generating noise in the financial system. This was largely due to changes in monetary policy by the Central Bank, which removed key mechanisms for managing liquidity—tools that most central banks routinely use.

The Frustrated Search for a Consistent Monetary Framework

Monetary policy has been the weakest link in an otherwise orthodox and solid economic program. Over the past twenty months, there have been many back-and-forths. One clear example was when authorities claimed that there was no more money printing because the broad monetary base wasn’t growing. In reality, the traditional monetary base—the one that actually […]

The Opposition Isn’t Helping Either

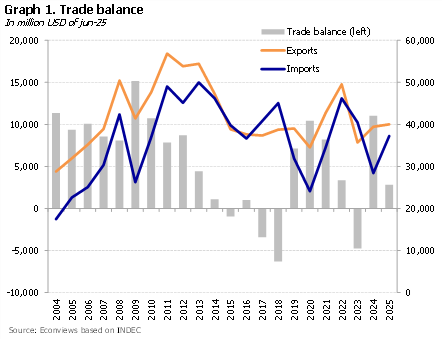

The second half of the year kicked off with tension for the government. On the economic front, it’s a time filled with challenges. First, the exchange rate is back in the spotlight, adjusting to higher levels as the soy harvest winds down and the incentive to export driven by lower export taxes fades, and the […]

Who Pays for the Current Account?

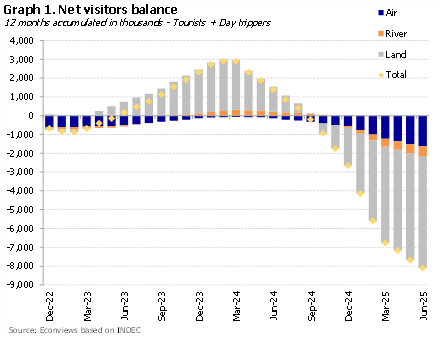

The IMF program has placed the need to accumulate reserves at the center of the economic agenda. Alarm bells rang when INDEC reported that Argentina posted a current account deficit of more than USD 5 billion in the first quarter. This means that imports of goods and services, tourism expenses, interest payments, profit remittances, and […]

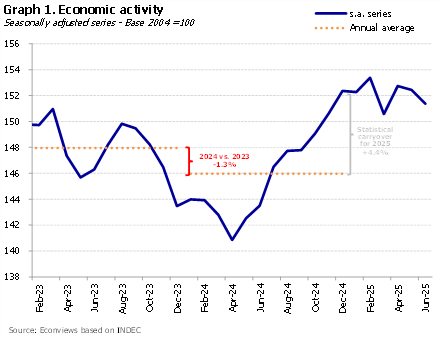

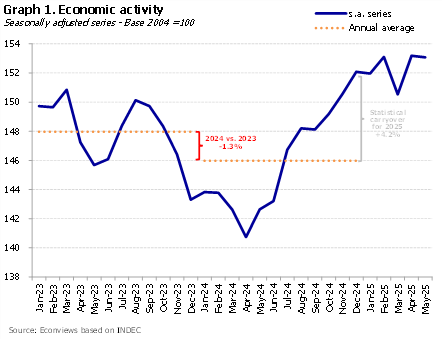

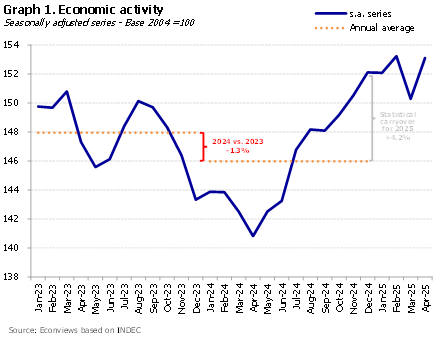

The Dilemma Returns: Inflation or Growth

During the early months of the economic program, the decline in inflation had an expansionary effect on economic activity. The drop in the inflation tax eased the burden on real incomes, negative interest rates encouraged households to spend, credit grew strongly, and a part of consumption, which was repressed, rebounded in a meaningful way. In […]