Services

Reports

We offer reports on the Argentine economic and financial situation, focused on key aspects such as the level of activity, fiscal accounts, inflation, interest rates and exchange rates.

Presentations

We make in-company presentations on the Argentine and international economic situation, adjusting to the client's needs.

Consultations

We are available for specific queries from our clients on current issues via phone or email.

Forecasting

We prepare detailed long-term economic forecasts and alternative scenarios for budgeting and decision making.

Contact Us

Last Reports

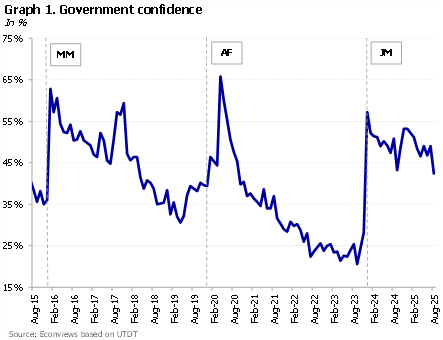

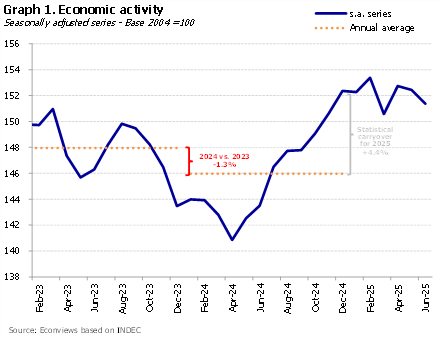

We are now in election mode, and the campaign is heating up. The government is under scrutiny about a corruption scandal that involves close advisors to Karina Milei (namely “Lule” Menem). It is also under pressure in Congress as it lost crucial votes that reversed executive orders while Milei’s veto to stop increases in expenditures for persons with disabilities was turned down. To make things worse, there has been more pressure on the exchange rate despite a drastic increase in interest rates and a deterioration in the country risk that complicates access to external financing.

Inestabilidad política en aumento. Al ruido en el congreso, donde el gobierno acumula una serie de derrotas legislativas en los últimos meses (al contrario de lo que ocurría el año pasado) y donde se lo ve cada vez más aislado, se sumó el escándalo de corrupción que involucraría a funcionarios cercanos a Karina Milei. No creemos que tenga demasiado impacto en términos de votos, pero sí hubo un cambio en el humor del mercado que podría terminar afectando otras variables. En apenas 10 días se celebran las elecciones en la Provincia de Buenos Aires, que el mercado leerá como una suerte de “mini-PASO”. Esperamos una marcada volatilidad.

Another turbulent week has passed in Argentina. There are two months left until the general elections, and just two weeks until the Buenos Aires provincial elections. Until then, noise and volatility will likely remain the main characters. Politics is playing its game, but on the economic front the field has also been muddied.

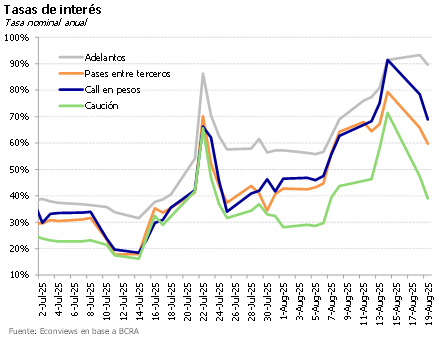

Caos en la política monetaria. A esta altura no quedan dudas de que el esquema posterior al fin de las Lefis no está funcionando. Las idas y vueltas con los encajes, las licitaciones sorpresa y las intervenciones ad hoc en el mercado de pesos no hacen más que erosionar la credibilidad del programa y sumar volatilidad. Seguimos convencidos de que la mejor salida sería implementar un corredor de pases que devuelva estabilidad al mercado, pero el Gobierno insiste en soluciones alternativas que no terminan de resolver el problema. La volatilidad, por ahora, se mantiene.

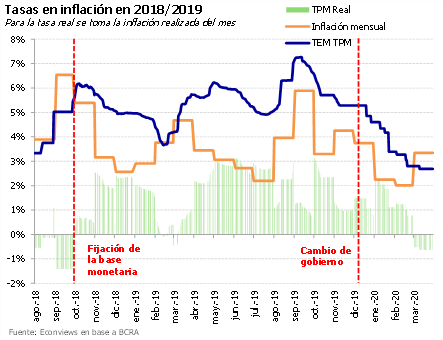

Argentina is managing to bring inflation down, but only through a monetary squeeze whose sustainability is highly uncertain. Last week once again highlighted the erratic and opaque management of monetary policy. In theory, the Central Bank follows a quarterly target for monetary aggregates (transactional private M2). In practice, however, policy has been discretionary, with the sole aim of keeping both the exchange rate and inflation under control.

Articles

Más rápido de lo que muchos economistas esperaban, el Gobierno va consolidando su objetivo de cerrar el año con déficit fiscal cero, mejora de las cuentas del Banco Central, y camino a la tasa de inflación de un dígito porcentual….

About Us

Graduate in Economics from the University of Buenos Aires and Ph.D. in Economics from Columbia University. Professor and researcher at the Di Tella University and academic advisor at FIEL

With vast experience as an advisor to multilateral organizations such as the IMF, the World Bank and the Inter-American Development Bank, as well as several Latin American countries, he held prominent roles in the financial sector, including the presidency of Banco Hipotecario S.A. and functions in the Ministry of Economy and the Central Bank of the Argentine Republic.

He was an Assistant Professor at the University of Maryland, and taught at institutions such as CEMA, Georgetown University, and Columbia University.

He is a columnist and author of numerous articles in international publications. Author of the book “The Argentine economic crisis, a history of adjustments and imbalances” with Sebastián Kiguel.

Graduate in Economics from the University of Buenos Aires and MSc in Economics from the University of Warwick (UK).

He was an economic consultant at the Inter-American Development Bank (IDB) and at Econviews. He also served as an advisor at the Ministry of Economy and the Ministry of Transport of Argentina.

Alejandro Giacoia

Economist

Bachelor of Economics (UBA).

Pursuing a Master’s Degree in Finance (Di Tella)

Pamela Morales

Economist

Bachelor of Economics (UCEMA).

Associate Professor of Macroeconomics UCEMA

Rafael Aguilar

Economist

Bachelor of Economics (UBA).

He was an assistant in the UBA National Accounts chair

Leila García

Economist

Bachelor of Economics (UBA).

Assistant in the UBA Argentine Economic History