Services

Reports

We offer reports on the Argentine economic and financial situation, focused on key aspects such as the level of activity, fiscal accounts, inflation, interest rates and exchange rates.

Presentations

We make in-company presentations on the Argentine and international economic situation, adjusting to the client's needs.

Consultations

We are available for specific queries from our clients on current issues via phone or email.

Forecasting

We prepare detailed long-term economic forecasts and alternative scenarios for budgeting and decision making.

Contact Us

Last Reports

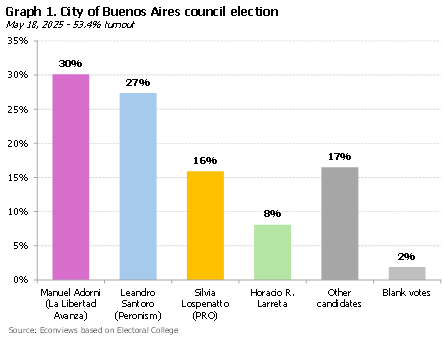

The political and economic climate has markedly improved since Argentina signed the new agreement with the IMF. On the political front, the government scored a key victory in the legislative elections of the City of Buenos Aires, which was a local election with strong implications at the national level. What would normally have been a minor election became a critical test of strength between Milei’s La Libertad Avanza (LLA) and Macri’s PRO. In the end, LLA secured nearly twice as many votes as PRO (30% vs. 16%), marking a major win for Milei and a serious setback for Macri, who lost a district that had been his stronghold in the last two decades.

Finally, the Treasury raised dollars by issuing a peso bond to international investors, who purchased it in dollars. Thus, the Treasury received fresh dollars, although the principal and interest payments will be paid in pesos. The move was a good one: it allowed the government to approach its reserve target with the IMF (which we all know it will not meet) and, at the same time, kept its promise not to purchase reserves within the exchange rate band.

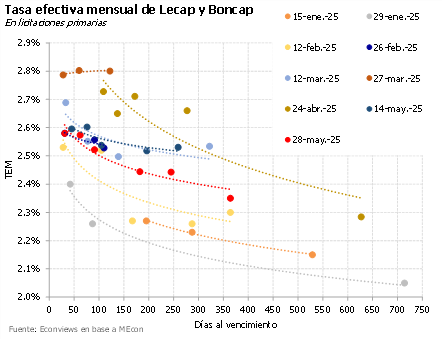

Leve suba del dólar. Después de algunas semanas bastante tranquilas, el tipo de cambio empezó a moverse un poco en los últimos días y ya acumula una suba del 2% desde el viernes pasado. El BCRA sigue sin intervenir dentro de la banda, pero sí metió mano en la curva de futuros, que parece ser la herramienta elegida para contener la presión. De hecho, el interés abierto subió a US$ 4,820 millones y las tasas implícitas siguen bastante por debajo de las Lecaps.

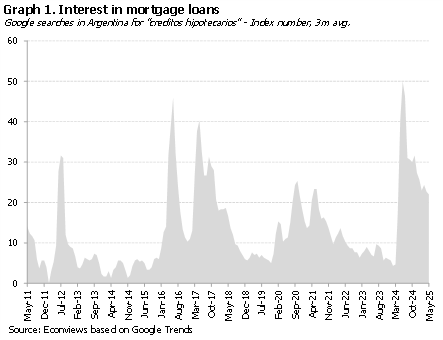

The government’s plan for getting Argentines to use their stashed dollars has finally been revealed, and everything indicates that the measures are less revolutionary than many expected. Even so, they represent an important step forward: by raising the minimum amounts for transactions that must be reported to the tax agency, people’s lives are simplified and the use of funds currently held in the informal economy is facilitated. This could translate into a slight increase in consumption and a greater circulation of dollars. However, if these bills do not enter into the financial system, they are unlikely to translate into more reserves.

Fuerte apoyo en las urnas. El domingo se celebraron elecciones municipales en CABA, donde el oficialismo logró un triunfo importante: desplazó al peronismo al segundo lugar y se impuso sobre el PRO en un distrito que los “amarillos” dominaron durante las últimas dos décadas. El resultado sugiere que el electorado respalda el rumbo del gobierno, valora la baja de la inflación y la estabilidad macroeconómica. Además, deja al oficialismo mejor posicionado para las negociaciones con el PRO en torno a las candidaturas en la provincia de Buenos Aires.

Articles

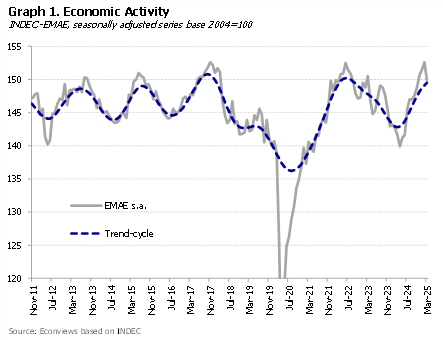

Más rápido de lo que muchos economistas esperaban, el Gobierno va consolidando su objetivo de cerrar el año con déficit fiscal cero, mejora de las cuentas del Banco Central, y camino a la tasa de inflación de un dígito porcentual….

About Us

Graduate in Economics from the University of Buenos Aires and Ph.D. in Economics from Columbia University. Professor and researcher at the Di Tella University and academic advisor at FIEL

With vast experience as an advisor to multilateral organizations such as the IMF, the World Bank and the Inter-American Development Bank, as well as several Latin American countries, he held prominent roles in the financial sector, including the presidency of Banco Hipotecario S.A. and functions in the Ministry of Economy and the Central Bank of the Argentine Republic.

He was an Assistant Professor at the University of Maryland, and taught at institutions such as CEMA, Georgetown University, and Columbia University.

He is a columnist and author of numerous articles in international publications. Author of the book “The Argentine economic crisis, a history of adjustments and imbalances” with Sebastián Kiguel.

Graduate in Economics from the University of Buenos Aires and MSc in Economics from the University of Warwick (UK).

He was an economic consultant at the Inter-American Development Bank (IDB) and at Econviews. He also served as an advisor at the Ministry of Economy and the Ministry of Transport of Argentina.

Alejandro Giacoia

Economist

Bachelor of Economics (UBA).

Pursuing a Master’s Degree in Finance (Di Tella)

Pamela Morales

Economist

Bachelor of Economics (UCEMA).

Associate Professor of Macroeconomics UCEMA

Rafael Aguilar

Economist

Bachelor of Economics (UBA).

He was an assistant in the UBA National Accounts chair

Leila García

Economist

Bachelor of Economics (UBA).

Assistant in the UBA Argentine Economic History