Services

Reports

We offer reports on the Argentine economic and financial situation, focused on key aspects such as the level of activity, fiscal accounts, inflation, interest rates and exchange rates.

Presentations

We make in-company presentations on the Argentine and international economic situation, adjusting to the client's needs.

Consultations

We are available for specific queries from our clients on current issues via phone or email.

Forecasting

We prepare detailed long-term economic forecasts and alternative scenarios for budgeting and decision making.

Contact Us

Last Reports

Recalibramiento del programa. Punto a favor para los econochantas: el Gobierno puso primera y anunció los tan demandados cambios en el esquema de bandas y en la estrategia de acumulación de reservas. A partir de enero, las bandas se ajustarán por inflación pasada. Esto evitará, al menos, que el techo continúe apreciándose en términos reales mes a mes. Si bien es un avance respecto al esquema previo, en la práctica el “piso” se ha vuelto testimonial. Hubiese sido preferible un diseño de bandas de flotación genuinas en lugar de un esquema de “techo cambiario”. Queda por verse si a este nivel de tipo de cambio el BCRA podrá comprar suficientes dólares. Aun así, lo valoramos como un cambio positivo.

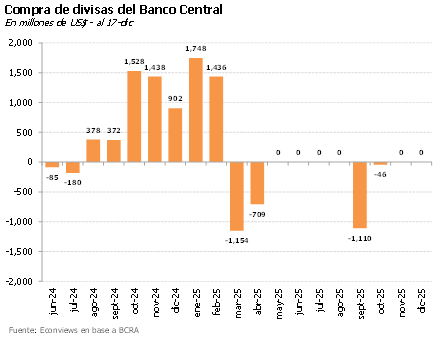

The government has decided to shift the focus of its program. The exchange-rate band, which until now had been adjusting at a monthly pace of 1%, will now move in line with past inflation, closer to 2%. More importantly, it announced an explicit plan to accumulate reserves, with monthly purchases of around USD 800–1,000 million. A pragmatic turn that the market had been loudly calling for.

The October elections marked a turning point .

In 2025, the government consolidated its power after achieving a convincing victory in the midterm elections. LLA, President Milei’s party, now holds the largest minority in the lower house, while the Peronists lost their majority in the Senate for the first time since the return of democracy in 1983. This places LLA in a strong position. Although it does not command a majority in either chamber, it can negotiate with provincial parties and the more “reasonable” opposition—including Macri’s PRO—to pass the budget and advance structural reforms. The government does not have a blank check, but it does have enough political leverage to negotiate effectively with Congress.

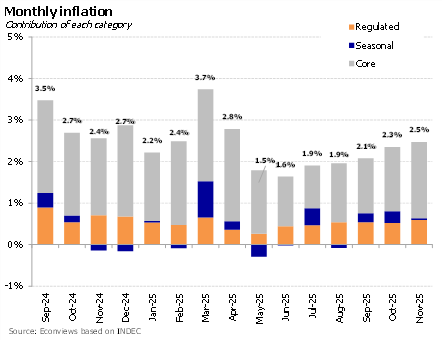

November’s inflation print came in broadly in line with expectations, but it still raised a yellow flag. It is not alarming for now, although the trend over the past six months has clearly been upward. Core inflation, which better captures underlying dynamics, rose to 2.6%, its highest level since April, and year-on-year inflation accelerated for the first time during the Milei administration.

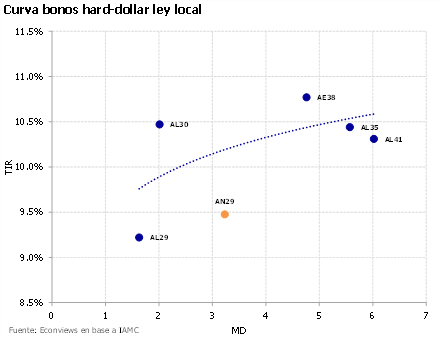

Abriendo mercados. Después de más de 7 años, el Tesoro volvió a emitir deuda en dólares. Se colocaron unos US$ 1,000 millones nominales (US$ 910 millones cash) y la tasa resultó en 9.26%. Se esperaba algo mejor, sobre todo considerando los cambios regulatorios que buscaban incentivar la demanda y lograr un costo más bajo. De todos modos, es un primer paso positivo para reabrir los mercados. Vendrán más.

Articles

Más rápido de lo que muchos economistas esperaban, el Gobierno va consolidando su objetivo de cerrar el año con déficit fiscal cero, mejora de las cuentas del Banco Central, y camino a la tasa de inflación de un dígito porcentual….

About Us

Graduate in Economics from the University of Buenos Aires and Ph.D. in Economics from Columbia University. Professor and researcher at the Di Tella University and academic advisor at FIEL

With vast experience as an advisor to multilateral organizations such as the IMF, the World Bank and the Inter-American Development Bank, as well as several Latin American countries, he held prominent roles in the financial sector, including the presidency of Banco Hipotecario S.A. and functions in the Ministry of Economy and the Central Bank of the Argentine Republic.

He was an Assistant Professor at the University of Maryland, and taught at institutions such as CEMA, Georgetown University, and Columbia University.

He is a columnist and author of numerous articles in international publications. Author of the book “The Argentine economic crisis, a history of adjustments and imbalances” with Sebastián Kiguel.

Graduate in Economics from the University of Buenos Aires and MSc in Economics from the University of Warwick (UK).

He was an economic consultant at the Inter-American Development Bank (IDB) and at Econviews. He also served as an advisor at the Ministry of Economy and the Ministry of Transport of Argentina.

Alejandro Giacoia

Economist

Bachelor of Economics (UBA).

Pursuing a Master’s Degree in Finance (Di Tella)

Pamela Morales

Economist

Bachelor of Economics (UCEMA).

Associate Professor of Macroeconomics UCEMA

Rafael Aguilar

Economist

Bachelor of Economics (UBA).

He was an assistant in the UBA National Accounts chair

Leila García

Economist

Bachelor of Economics (UBA).

Assistant in the UBA Argentine Economic History