Services

Reports

We offer reports on the Argentine economic and financial situation, focused on key aspects such as the level of activity, fiscal accounts, inflation, interest rates and exchange rates.

Presentations

We make in-company presentations on the Argentine and international economic situation, adjusting to the client's needs.

Consultations

We are available for specific queries from our clients on current issues via phone or email.

Forecasting

We prepare detailed long-term economic forecasts and alternative scenarios for budgeting and decision making.

Contact Us

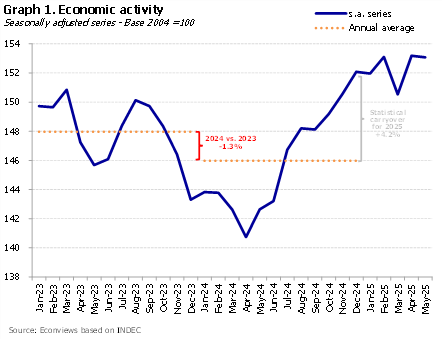

Last Reports

Last week was likely one of the most difficult ones for the government. The exchange rate took the spotlight again with a sharp jump, showing that the idea of the dollar slowly moving to the lower end of the band was just an illusion. The new level isn’t alarming, but the sudden move created concern, especially because it came after a month of more gradual increases — nearly 9% in total. In any case, the situation is not out of control and should stabilize soon around the new level.

The electoral process is starting to affect the overall political and economic climate. Nothing major yet just some mild turbulence, as the opposition begins to take advantage of the situation to negotiate financial resources for the provinces. Congress has been the sounding board for this new dynamic, passing a law to increase pensions and other expenditures, while it is still discussing another law that would boost transfers to the provinces. The total cost of these measures is estimated to be around 1.3% of GDP.

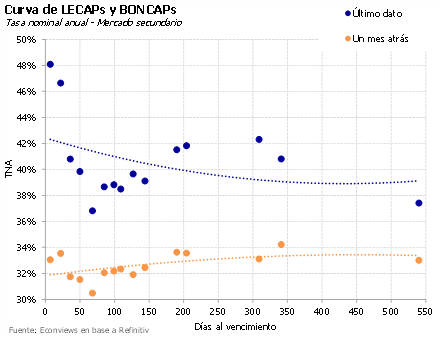

Sigue la presión cambiaria. Pese a las tasas altas y la intervención en futuros, el dólar sigue subiendo. En julio pasó de la zona de $1,200 a $1,300, una suba del 9%. Es sintomática esta suba del dólar porque el gobierno está utilizando tasas de interés de corto plazo elevadas e intervención en el mercado de futuros para contenerlo, pero por ahora no está dando resultados. La buena noticia: desde que el dólar flota, el tipo de cambio real mejoró cerca de un 20%.

In recent days, short-term interest rate volatility has surged. Market rates swung between 18% and 70% in a short period, surprising markets and generating noise in the financial system. This was largely due to changes in monetary policy by the Central Bank, which removed key mechanisms for managing liquidity—tools that most central banks routinely use.

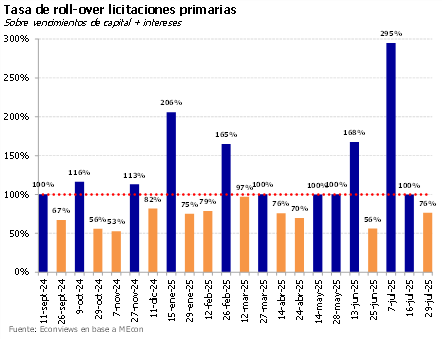

Tasas altas y volátiles. Tras la licitación de la semana pasada, en la que el Tesoro absorbió alrededor de $4.7 billones, las tasas de corto plazo se mantuvieron en niveles muy elevados y con alta volatilidad, arrastrando al resto de la curva. Se notó la falta de una ventanilla overnight, como existe en casi todos los países del mundo, que les permite a los bancos manejar su liquidez diaria. Hasta que este problema se corrija de alguna manera ingeniosa, la volatilidad seguirá. Aunque pensamos que al final prevalecerá el pragmatismo, porque la situación actual genera incertidumbre y atenta contra el crecimiento del crédito.

Articles

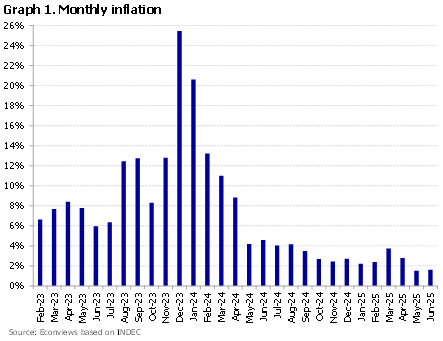

Más rápido de lo que muchos economistas esperaban, el Gobierno va consolidando su objetivo de cerrar el año con déficit fiscal cero, mejora de las cuentas del Banco Central, y camino a la tasa de inflación de un dígito porcentual….

About Us

Graduate in Economics from the University of Buenos Aires and Ph.D. in Economics from Columbia University. Professor and researcher at the Di Tella University and academic advisor at FIEL

With vast experience as an advisor to multilateral organizations such as the IMF, the World Bank and the Inter-American Development Bank, as well as several Latin American countries, he held prominent roles in the financial sector, including the presidency of Banco Hipotecario S.A. and functions in the Ministry of Economy and the Central Bank of the Argentine Republic.

He was an Assistant Professor at the University of Maryland, and taught at institutions such as CEMA, Georgetown University, and Columbia University.

He is a columnist and author of numerous articles in international publications. Author of the book “The Argentine economic crisis, a history of adjustments and imbalances” with Sebastián Kiguel.

Graduate in Economics from the University of Buenos Aires and MSc in Economics from the University of Warwick (UK).

He was an economic consultant at the Inter-American Development Bank (IDB) and at Econviews. He also served as an advisor at the Ministry of Economy and the Ministry of Transport of Argentina.

Alejandro Giacoia

Economist

Bachelor of Economics (UBA).

Pursuing a Master’s Degree in Finance (Di Tella)

Pamela Morales

Economist

Bachelor of Economics (UCEMA).

Associate Professor of Macroeconomics UCEMA

Rafael Aguilar

Economist

Bachelor of Economics (UBA).

He was an assistant in the UBA National Accounts chair

Leila García

Economist

Bachelor of Economics (UBA).

Assistant in the UBA Argentine Economic History