Services

Reports

We offer reports on the Argentine economic and financial situation, focused on key aspects such as the level of activity, fiscal accounts, inflation, interest rates and exchange rates.

Presentations

We make in-company presentations on the Argentine and international economic situation, adjusting to the client's needs.

Consultations

We are available for specific queries from our clients on current issues via phone or email.

Forecasting

We prepare detailed long-term economic forecasts and alternative scenarios for budgeting and decision making.

Contact Us

Last Reports

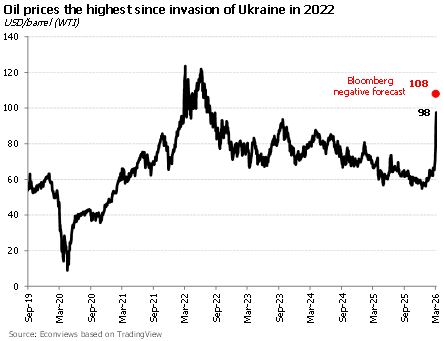

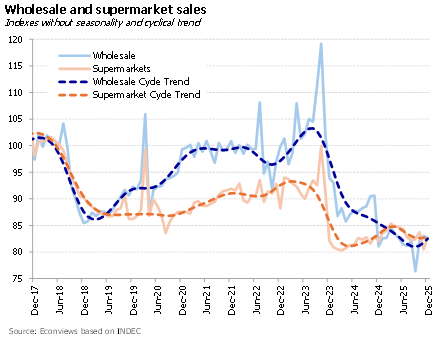

The war in the Middle East has put the brakes on the very favorable international environment that the Argentine economy had been riding. Through February, global markets were showing a strong appetite for risk assets and the dollar was weakening, which was pushing up emerging market currencies and compressing credit spreads to levels not seen in years.

El conflicto en medio oriente domina los mercados. La escalada bélica le puso fin a la racha de dólar débil y baja de riesgo emergente que venía dando viento de cola para argentina en 2026. En este contexto, el peso y el riesgo país operaron bajo presión, en sintonía con sus pares globales, aunque sin movimientos extremos. La clave será el factor tiempo. Si el conflicto se prolonga y recalienta los precios de la energía y los commodities, la inflación en EE. UU. podría forzar a la Fed a un sendero de tasas altas por más tiempo, cerrando la canilla de flujos hacia emergentes. Si se resuelve rápido, el shock habrá sido solo un susto pasajero.

The labor reform shows the determination of the Milei administration to advance structural reforms that can improve the business environment. It also shows that he has achieved a political consolidation in Congress. We expect that this reform will be quickly followed by others, namely the law of glaciers and a tax reform, and by numerous decrees to continue the deregulation of the economy.

Taking advantage of a relatively quiet local macro environment, we turned our focus toward the global front. In just one week: IBM suffered its worst stock market decline in 26 years, a profitable digital payments company laid off 40% of its workforce, and a hypothetical report on mass unemployment went viral on Wall Street. The common thread was neither a financial crisis nor a recession: it was Artificial Intelligence. What until recently was a debate about the future of work is turning into a series of concrete and measurable facts. The question is no longer whether this technological revolution will have a macroeconomic impact, but how deep it will be and how fast it will arrive.

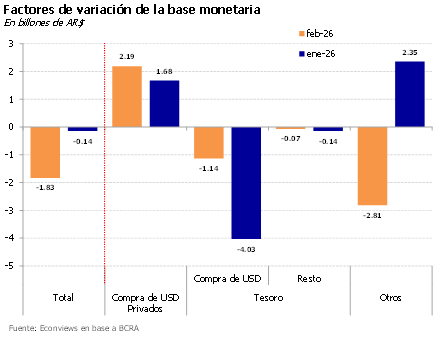

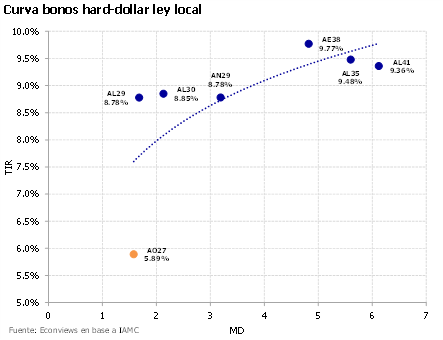

El BCRA sigue comprando y el Tesoro anuncia cómo va a pagar julio. Con compras acumuladas en 2026 que ya superan los US$ 2,600 millones en 36 ruedas consecutivas, la novedad de la semana fue el lanzamiento del Bonar 2027. El Tesoro comenzó a licitar un bono hard-dollar ley local con cupón del 6% e intereses mensuales, buscando captar hasta US$ 2,000 millones en licitaciones quincenales para pre-financiar los vencimientos de julio, que ascienden a cerca de US$ 4,200 millones entre capital e intereses. En la primera subasta de ayer, la demanda fue de casi US$ 900 millones, permitiendo colocar el objetivo de US$ 150 millones a una tasa de 5.89%, confirmando el apetito del mercado. Hay mucha liquidez en dólares en la plaza local y demanda por activos en esa moneda, algo que empresas y provincias vienen aprovechando. Que el Tesoro siga ese camino es una buena estrategia: la operación debería ayudar a comprimir la curva en dólares y dar certidumbre sobre los pagos, contribuyendo a perforar los 500 puntos de riesgo país.

Articles

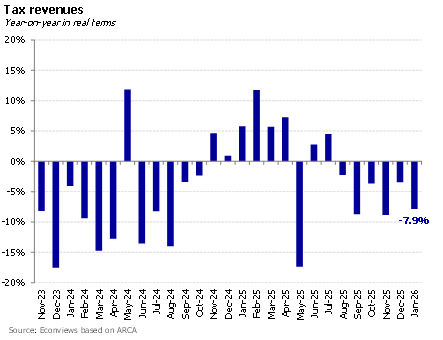

Más rápido de lo que muchos economistas esperaban, el Gobierno va consolidando su objetivo de cerrar el año con déficit fiscal cero, mejora de las cuentas del Banco Central, y camino a la tasa de inflación de un dígito porcentual….

About Us

Graduate in Economics from the University of Buenos Aires and Ph.D. in Economics from Columbia University. Professor and researcher at the Di Tella University and academic advisor at FIEL

With vast experience as an advisor to multilateral organizations such as the IMF, the World Bank and the Inter-American Development Bank, as well as several Latin American countries, he held prominent roles in the financial sector, including the presidency of Banco Hipotecario S.A. and functions in the Ministry of Economy and the Central Bank of the Argentine Republic.

He was an Assistant Professor at the University of Maryland, and taught at institutions such as CEMA, Georgetown University, and Columbia University.

He is a columnist and author of numerous articles in international publications. Author of the book “The Argentine economic crisis, a history of adjustments and imbalances” with Sebastián Kiguel.

Graduate in Economics from the University of Buenos Aires and MSc in Economics from the University of Warwick (UK).

He was an economic consultant at the Inter-American Development Bank (IDB) and at Econviews. He also served as an advisor at the Ministry of Economy and the Ministry of Transport of Argentina.

Alejandro Giacoia

Economist

Bachelor of Economics (UBA).

Pursuing a Master’s Degree in Finance (Di Tella)

Pamela Morales

Economist

Bachelor of Economics (UCEMA).

Associate Professor of Macroeconomics UCEMA

Rafael Aguilar

Economist

Bachelor of Economics (UBA).

He was an assistant in the UBA National Accounts chair

Leila García

Economist

Bachelor of Economics (UBA).

Assistant in the UBA Argentine Economic History