Cristina without Nestor: more questions than answers

Can Cristina win the next Presidential election? Nestors death has drastically changed the political scenario and has raised many questions about the way in which Cristina is likely to manage the economy. On the political side, what stands out is that the opposition is now confused and has lost the initiative. Most of its arguments […]

The economic challenges in the new political environment

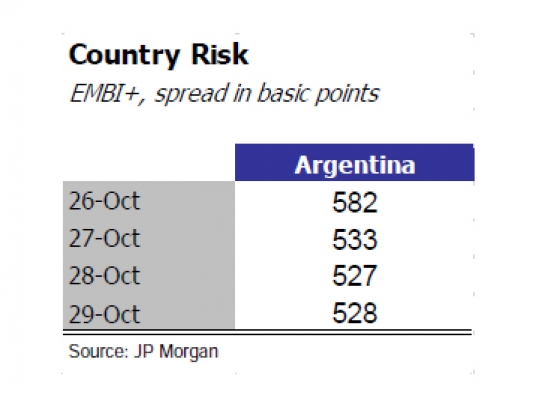

The sudden death of Nestor Kirchner could be seen as black swan (a low probability event with large effects) creates a new scenario for next year presidential elections and opens difficult questions about whether and how Cristinas government will tackle the main economic issues during the next twelve months. The market’s initial reaction was positive, […]

A much better year than expected: What about 2011?

In many ways 2010 has been a much better year than had been predicted. Economic growth has exceeded even the most optimistic expectations; the fiscal accounts have improved relative to 2009 and we now anticipate that the Central Government could show a balance budget for the year as a whole, the country has maintained financial […]

Kristina in Wonderland

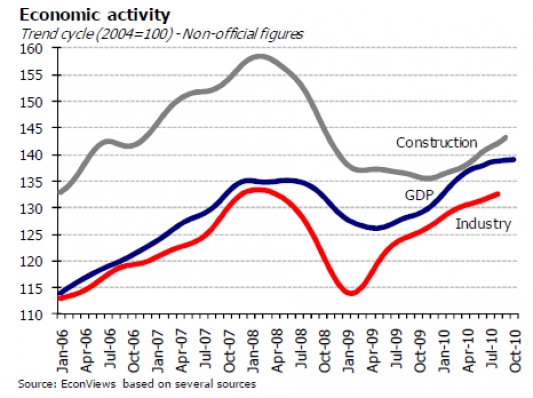

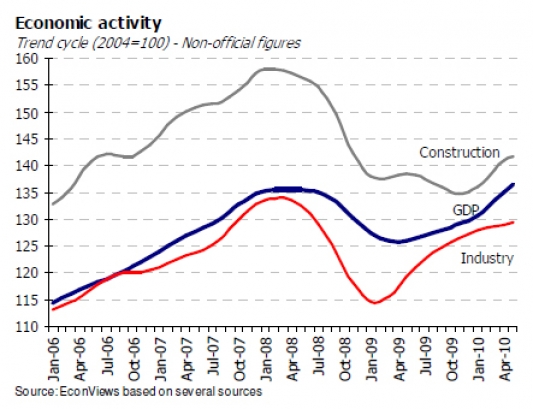

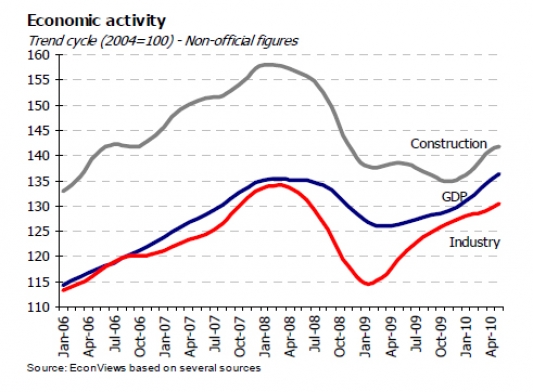

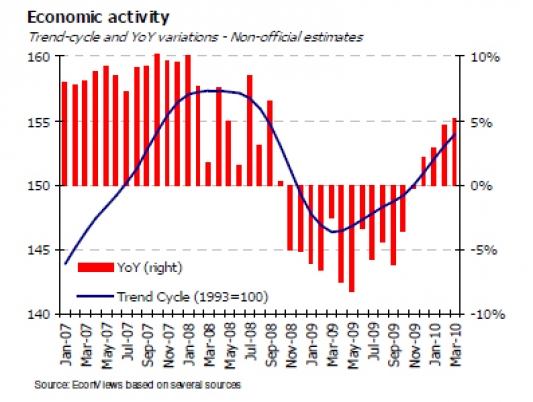

The economy grows at full speed: how much longer can it last? While the economy continues to grow at full speed, the financial variables are moving in slow motion. Growth is now expected to reach 7% this year and around 4.5% in 2011 and for the moment these strong rates of growth have managed to […]

What can change after the Debt Exchange?

There are mixed feelings about the outcomes of the debt exchange. On the one hand, the final figures indicate that with the completion of the second tranche 92% of the debt that was originally in default has been estructured. This could be considered as a great success. On the other hand, though, the transaction lack […]

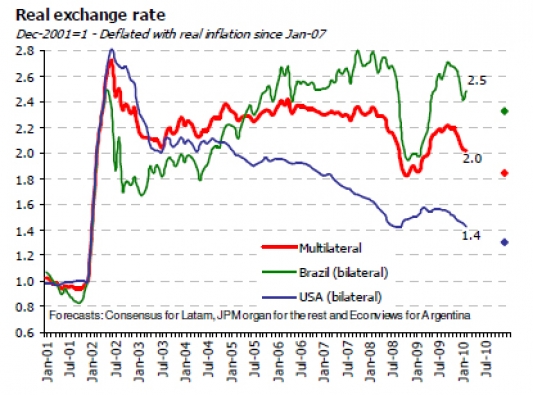

Competitiveness and the real exchange rate: are we back to the 90s?

An update on Argentina The last month has provided mixed news for the Argentine economy. On the one hand, the economy continues to grow on the back of high soybean prices and good weather that are leading a new high soybean record crop that is likely to exceed 54 million tons, of a stable exchange […]

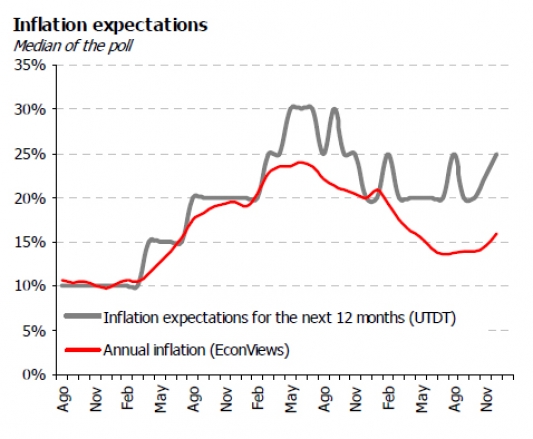

Good bye default, hello inflation: version 2.0

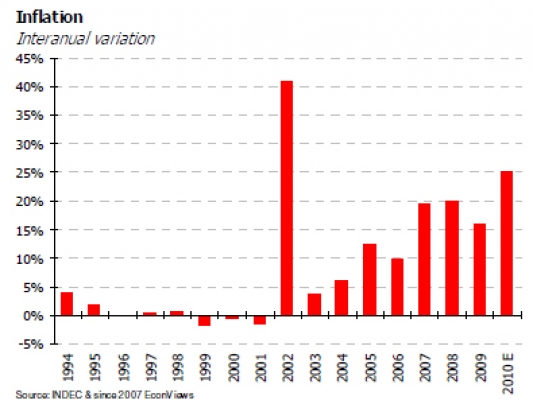

The outlook for the debt swap, and inflation Good bye default, hello inflation! That was the title of our newsletter back in April 2005. The more things change, the more they stay the same. Despite the similarities, there are important differences between then and now, as in 2005 the economy was growing at almost 9% […]

The exchange rate dilemmas and the debt exchange opportunities

Recent economic developments. Economic developments have been recently overshadowed by political events, where there has been a fluid situation as the Government and the opposition have been struggling for power. Most of the action has been in Congress where the official party has managed to block the opposition in its efforts to remove Marcó del […]

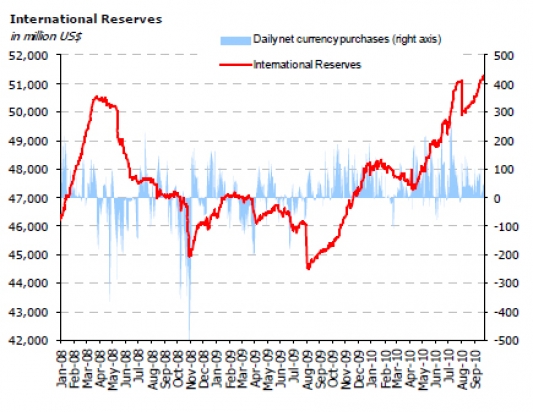

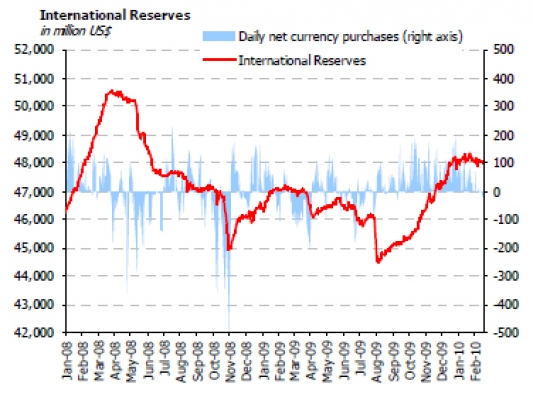

International reserves: Now you see them. Now you don

In few words. There is never a quiet time in Argentina, and the recent months have reminded us that this is a country where surprises are the norm rather than the exception. The new chapter in the Bicentennial Fund, in which the President inaugurated the Congressional sessions announcing a new emergency decree when Congress was […]

The Redrado saga is over, but the inflation and the fiscal sagas just begin

Reflections on the new political scene. It seems that the worst of this institutional crisis is behind us, as Redrado is now out, there is a new president of the Central Bank that will stay in his position till September and there are negotiations with the opposition to set-up a new, smaller and more bounded […]