Growth in the era of low investment

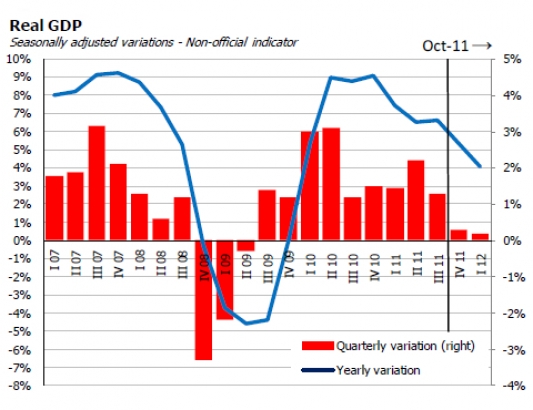

The recent economic indicators tend to confirm that the economy is entering in a period of stagflation. We have revised downward our estimates for this year and we now expect it to grow by around 0.5%, in spite of a statistical “carry over” effect of 1.4 percentage points from last year. On the other hand, […]

Mid-term macro assessment: Goodbye growth, hello stagflation

During the first semester there has been a sharp deterioration in the overall macroeconomic performance. While external factors have played a role, most of the explanation lies on domestic economic conditions and policies. The most recent figures show a drop in industrial production, investment, construction, retail sales and consumer confidence among other indicators. In the […]

Soft landing, hard landing or what?

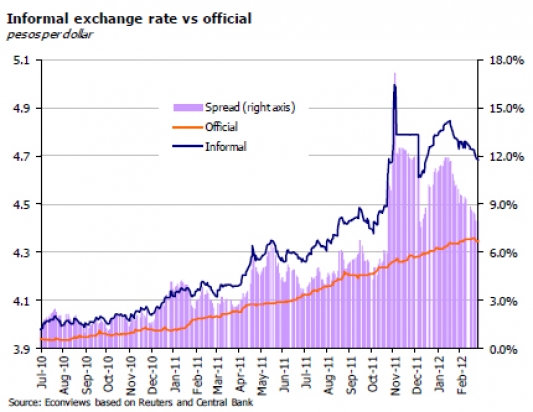

The economy could have entered into recession territory in the second quarter while inflation and wage increases have remained unabated at around 25%, the spread in the parallel exchange rate market reached 30% and there are no indications that it is going to drop any time soon, import controls are preserving reserves but at the […]

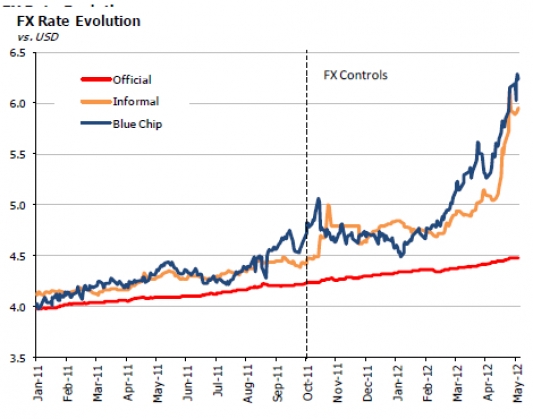

Everything you need to know about the parallel exchange rate

The depreciation of the parallel exchange rate is taking center stage and is raising questions about what does it mean, whether it is sustainable at these levels and about the implications that it has for inflation, interest rates, growth and imports. More importantly, it also raises questions about what policy measures the government can take […]

The economy after the YPF nationalization: the good, the bad and the ugly

Is the expropriation of YPF a surprise or is part of a pattern? A little bit of both. It is in line with other extemporaneous decisions such as the introduction of the variable export taxes, the nationalization of the pension funds, the use of reserves to pay the debt, and the strict introduction of import […]

Argenzuela?

There have been signs in recent months of a marked deterioration in the business environment, as the Government has been broadening the use of foreign exchange and import controls and has open the possibility of intervening or nationalizing YPF. It all started last October in response to pressures on the peso, at a time when […]

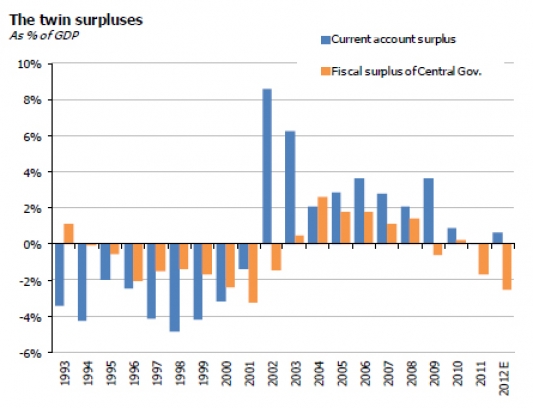

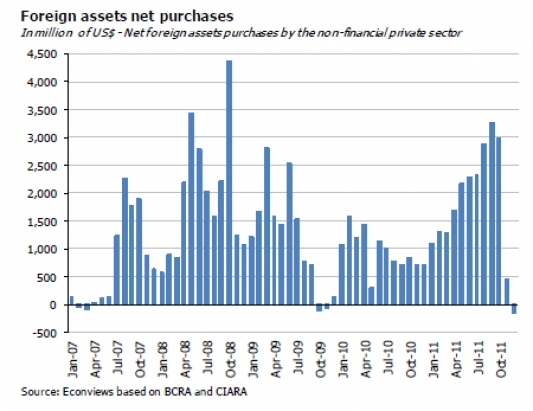

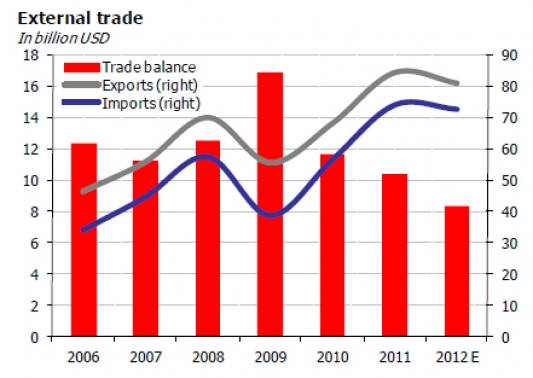

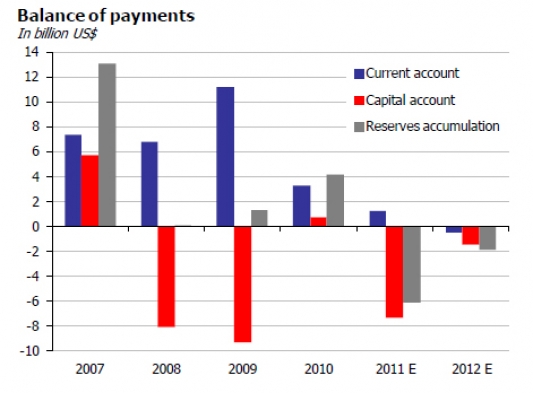

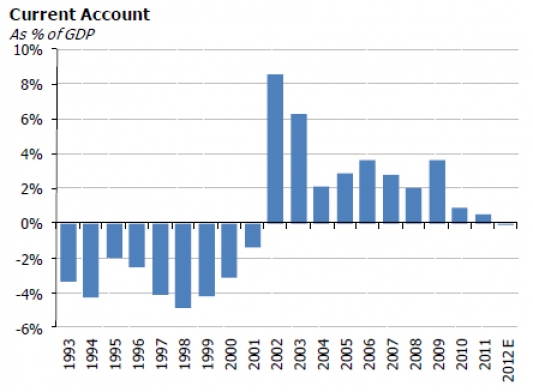

A new look at the deterioration of the external accounts

The external accounts surplus and the resulting accumulation of international reserves have been key pillars of macroeconomic stability in Argentina in recent years. Last year, for the first time in the Kirchner’s era, international reserves fell by around US$ 6 billion, and this reduction took place in spite of roughly US$ 3 billion of external […]

FX Controls: helping reserves but a drag on growth

The government has shown clear signs that it plans to stick to the current policies of widespread controls, as it fully believes that they are effective and that they are working. Eight years of high growth, very strong popular support and a victory by a wide margin in the October elections probably gives the government […]

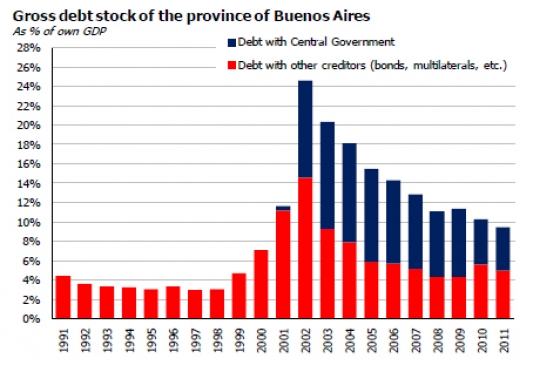

An assessment of fiscal and financial constraints in provinces

It seems clear that the fiscal situation of the provinces has become tighter in recent years, an issue that has raised questions about the ability to service their debt. This report argues that most provinces are only running small deficits following an election year, and while the fiscal situation is tighter than in previous years, […]

Desperately seeking dollars: is the government overreacting?

The draconian foreign exchange restrictions that the government has been implementing in recent months are raising questions about their motivation, their possible economic implications and the likelihood that they could be intensified in the near future (à la Venezuela). The imposition of the controls indicates that the government has too many objectives and is unwilling […]