Time to look at the opinions polls with an eye on the medium term outlook

The election season is now under full swing. Macri scored victories in the city de of Buenos Aires and in Mendoza, while Scioli is consolidating its leading position within the official Peronist party (FPV) that won in Rio Negro and in Salta. At the moment, it looks that the election is heading towards a two […]

How to get rid of the cepo

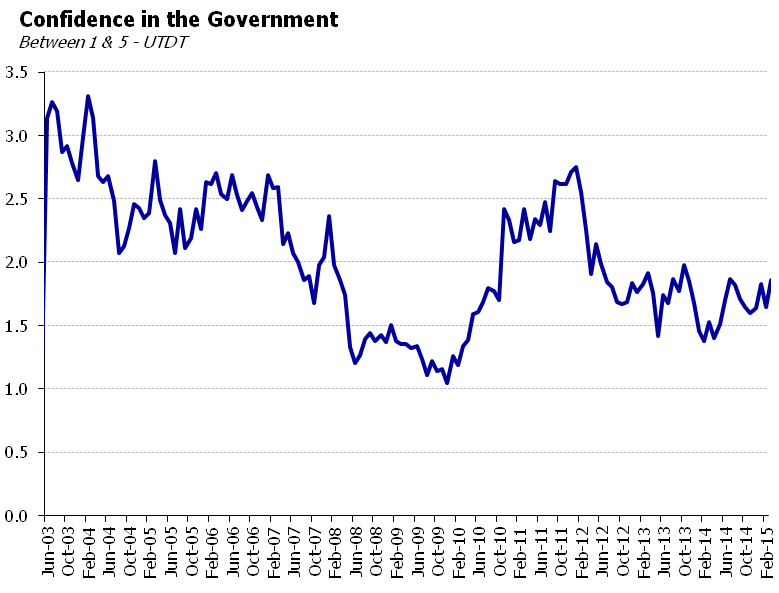

The economy once again provided some positive surprises as the exchange rates remained stable, inflation slowed down, and there was a big rally in the price of Argentine bonds and stocks. All these took place in spite of the lack of economic growth and the difficulties to avoid further drops in international reserves.

Dollars and pesos: how to finance the 2015 fiscal gap

Will in the end be a presidential race between Macri and Scioli? The most recent polls are indicating that this is likely to be the case, as Scioli is strengthening its stance in the official camp, the FPV, while Macri is gaining ground.

Market optimism in spite of the challenges for the transition

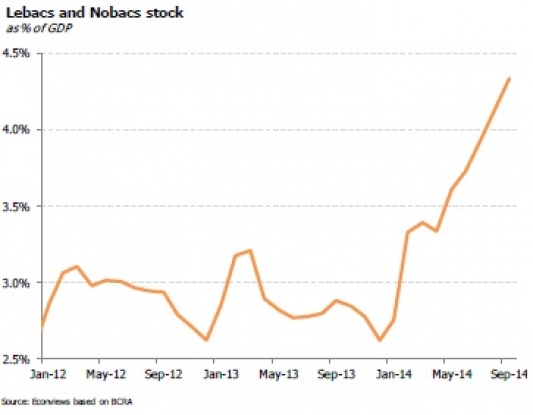

As the Kirchner administration enters into its final year, the economic team appears to have made several strategic decisions that will have key effects on economic developments. These decisions should be seen as part of a broad political agenda in which the Governments main objective is to preserve its image of a progressive administration in […]

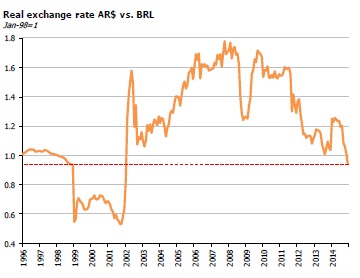

The truth behind the exchange rate

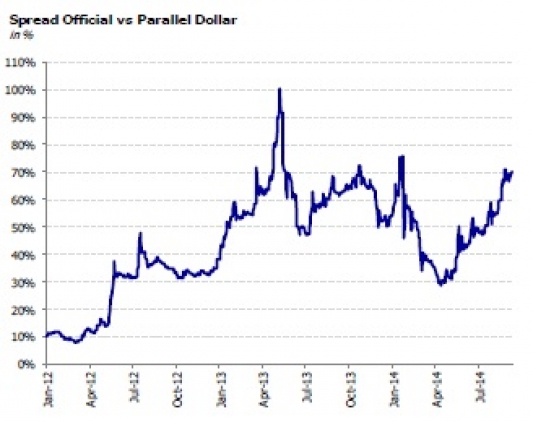

The year ends on a strange note: while the EM world is in turmoil and the currencies are depreciating everywhere, Argentina has managed to stabilize the parallel exchange rate and insists in keeping the official exchange rate quasi-fixed in an effort to control inflation. The question at this stage is whether this stability is for […]

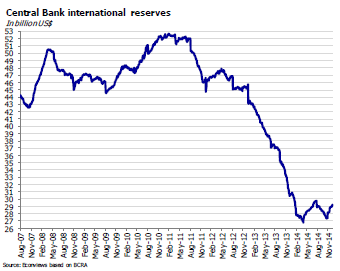

Will there be enough reserves in 2015?

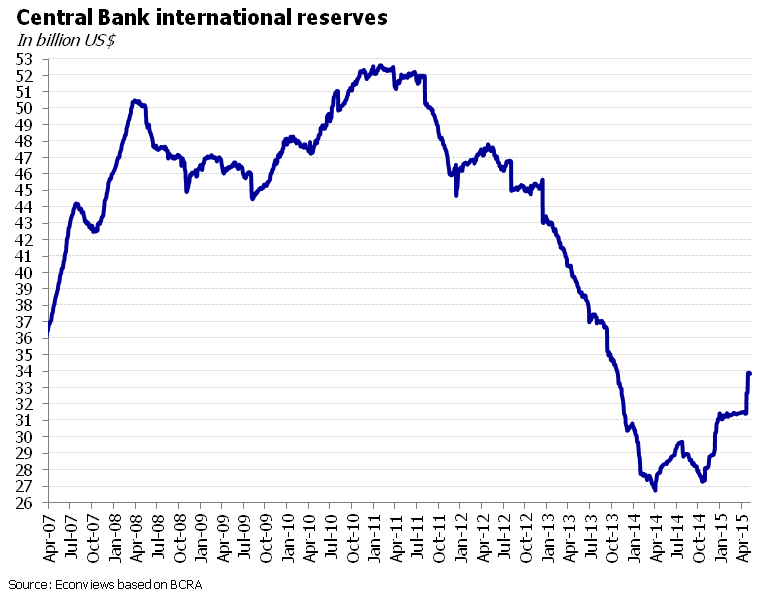

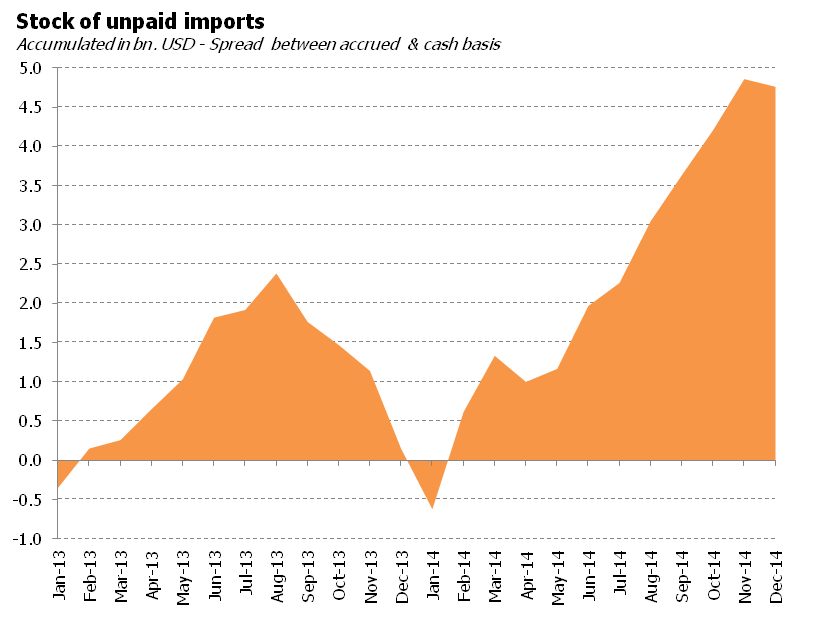

International reserves are now at center stage once more. Creative accounting, short-term borrowing and the postponement of the payment of imports have helped to increase the headline figure to around USD 29 billion. Just without these gimmicks they would only be USD 22 billion. The market players, for reasons that are not totally clear, feel […]

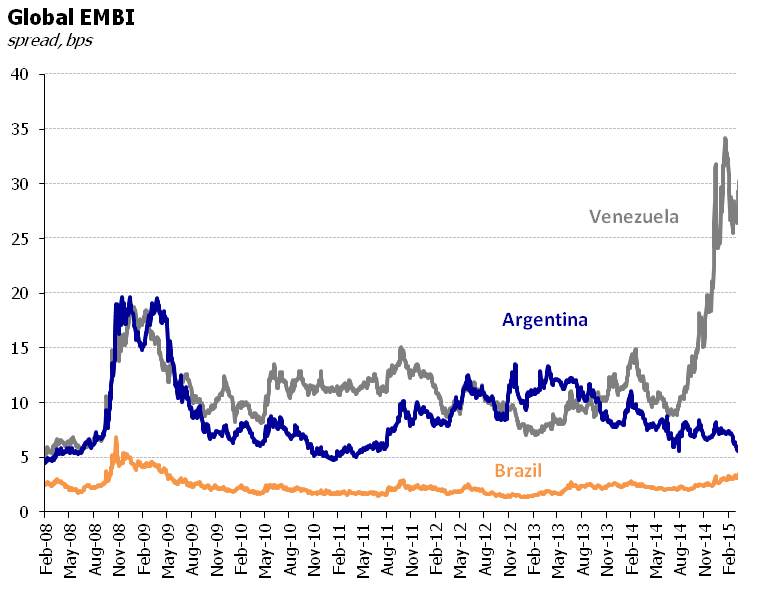

The debt and exchange rate traps: is there a way out?

The changes at the Central Bank are taking place at a critical time: international reserves are once again dropping with a gloomy outlook for the fourth quarter and are likely to end the year at around 25 billion dollars, the currency is getting deeper in overvaluation territory and there is no clue about how the […]

A month after default: bond prices up, the economy down

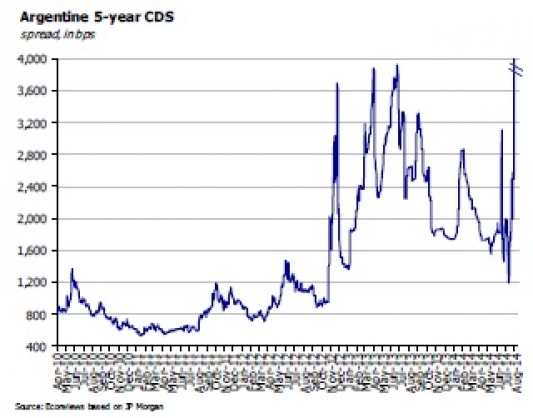

The economy is all of a sudden back in the middle of a storm. There are pressures on the exchange rate that is now overvalued, the spread on the parallel exchange rate has increased to 70%, while international reserves are falling again. Government officials are going around the world (to China, Europe and the US) […]

Toying with default: How long can it last?

In the end there was a default, though not a standard one. Argentina is solvent and it has shown ability and willingness to pay. The Government is even arguing that the country is not in default, as it transferred the funds to service the Discounts bonds to the account that the Bank of New York […]

The final countdown: How to avoid the default

The Supreme Court decided not to take Argentinas case on Monday June 16th, a decision that took the market by surprise and the Government without a contingent plan. This decision left Argentina without any further legal options and it now has to choose between two costly alternatives: either it reaches some type of agreement with […]