What the mid-term elections, Trump, Brazil and China have in store for Argentina

December was a difficult month for the Macri administration on the political front due to a number of setbacks that it suffered in Congress. At this stage, the overall climate has improved as the summer recess is giving the government some breathing room to regroup and to eventually regain the upper hand that it enjoyed […]

Hello 2017! Outlook, challenges and risks

The government ends its first year with mixed feelings. Though most of the year in the political front it managed to maintain the upper hand and passed over 75 laws in Congress, the last weeks have been tough. The government suffered a setback when the opposition blocked the new electoral law that proposed electronic voting, […]

How to jump start growth and international trade

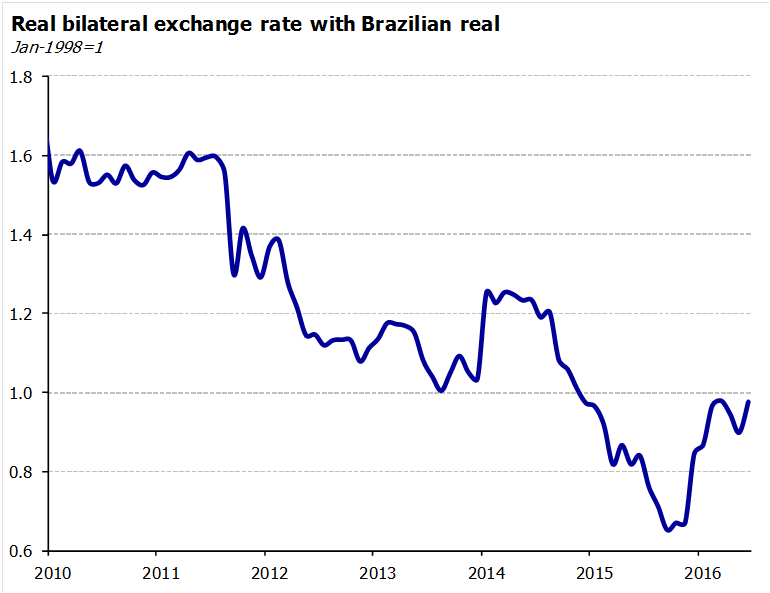

In recent years it is clear that the economy has become more isolated from the world, as there was a clear trend in which the volume of exports and imports continuously fell. Brazil, our main trading partner through Mercosur also underperformed relative to the evolution of world and regional external trade. The recent political changes […]

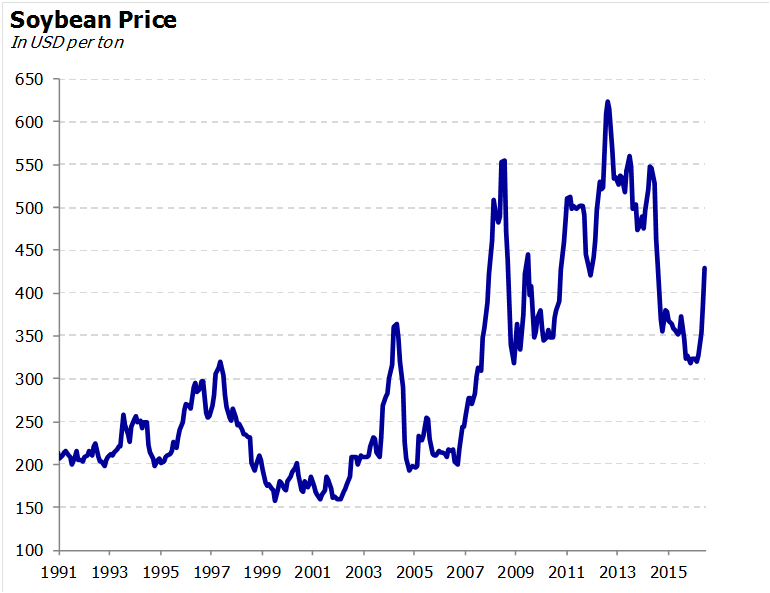

Argentine Farmland: the Promised Land

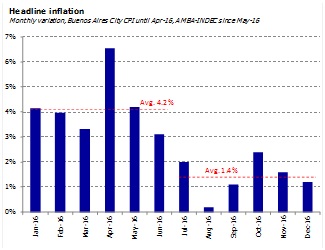

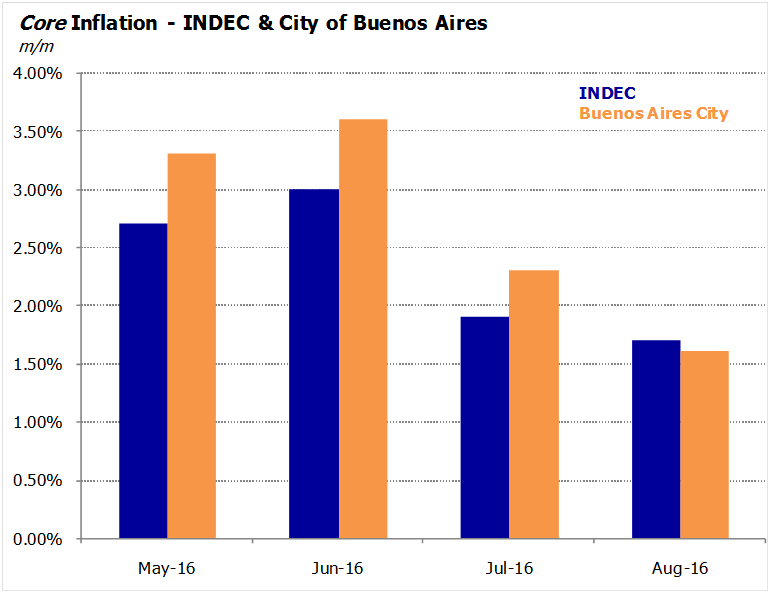

Finally, the government is getting better news in the economic front as all pieces are starting to fall into place; September appears to have been the turning point. Inflation has clearly receded from the high rates that prevailed since December of last year and is now more likely to remain in the 1.5% per month […]

Argentine Banks: Stretching the muscles to grow

Banking penetration in Argentina is low. As of today, deposits account for nearly 20% of GDP and the depth of banking intermediation has been erratic over time in response to macroeconomic cycles. The most important increase in banking penetration took place in the 90’s when the ratio of deposits to GDP rallied from 15% to […]

Waiting for the IMF and the Article IV

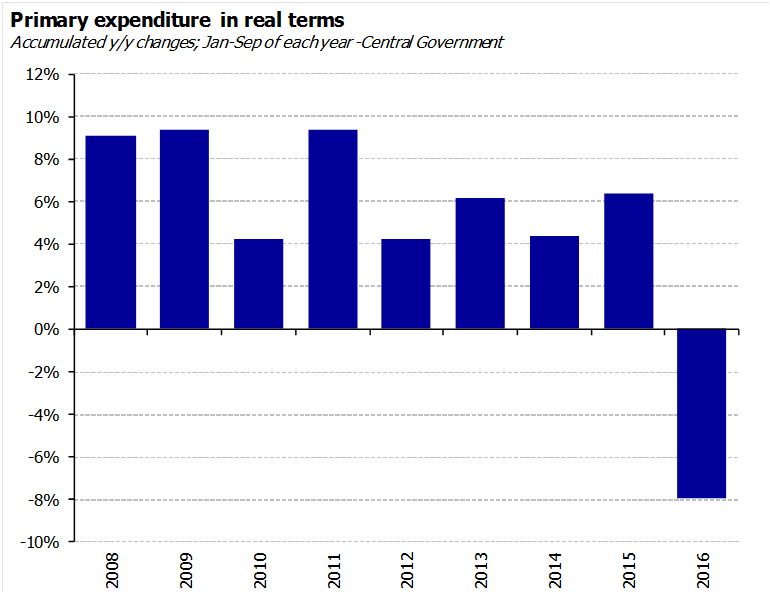

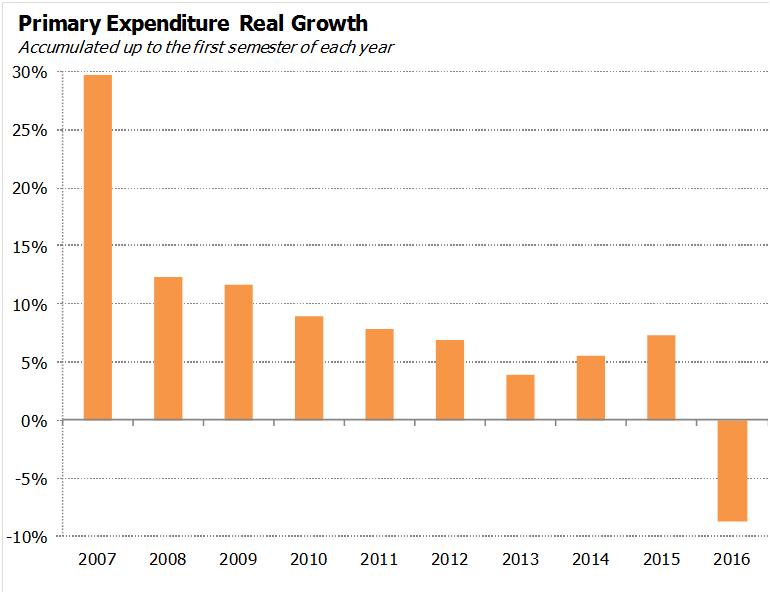

What will the IMF find when it arrives next month to conduct the first article IV review in a decade? Argentina is an economy that is still suffering from the large external and fiscal imbalances inherited from the Kirchner administration, from the large distortions in relative prices that are extremely costly to correct, while it […]

The ups and downs of the Macri-economics scenarios

All eyes are now posed on the evolution of key macroeconomic variables, as inflation is displaying more persistence than had been anticipated, the recession is proving to be deeper, while there are more concerns about the fiscal accounts and the real appreciation of the peso. In what follows we rely on a matrix of scenarios […]

The capital market in Argentina: warming up the engine

The local capital market is relatively small and unsophisticated. This is a legacy of a long history of monetary instability, macroeconomic crises and massive breach of contracts, which undermined the confidence in the local currency and economic institutions. As a direct consequence, most Argentines save abroad the country (which eases financing terms and credit availability […]

Investment: the key to unlock growth

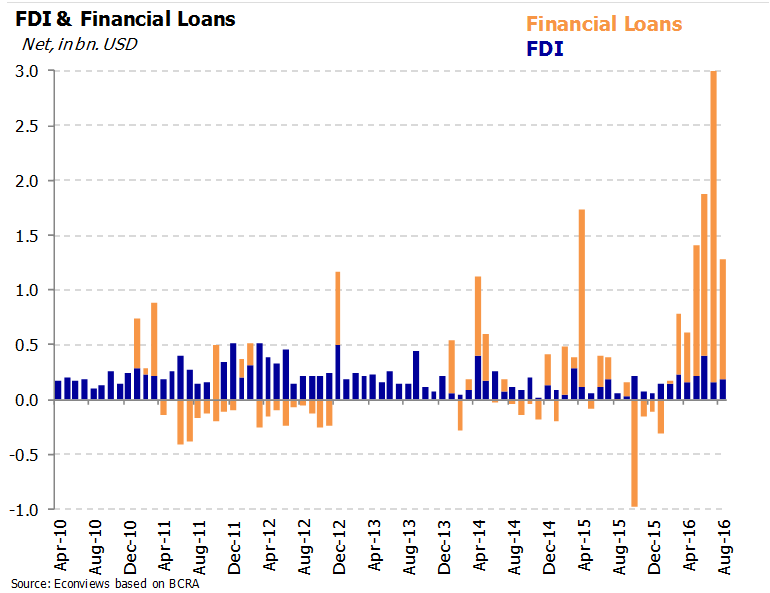

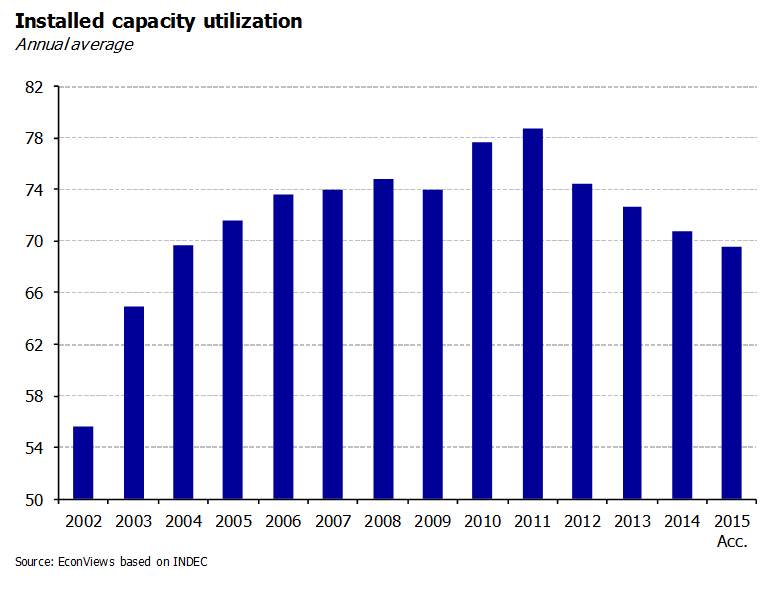

Argentina is entering into a new economic cycle where investment is expected to be the main engine of growth. This represents a change in relation to the way the economy worked in the last years, as consumption had been the tractor, boosted by expansionary fiscal and monetary policies, negative real interest rates and zero-interest installments […]

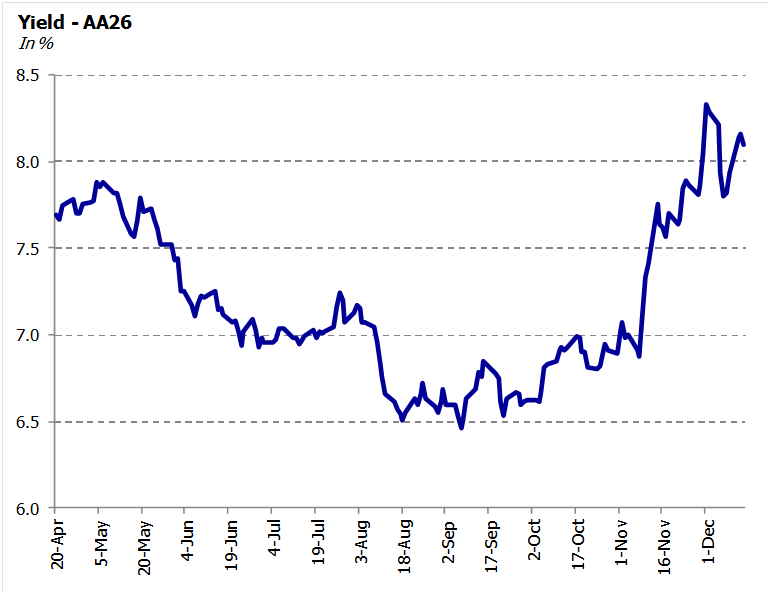

Bye-bye default, hello financing

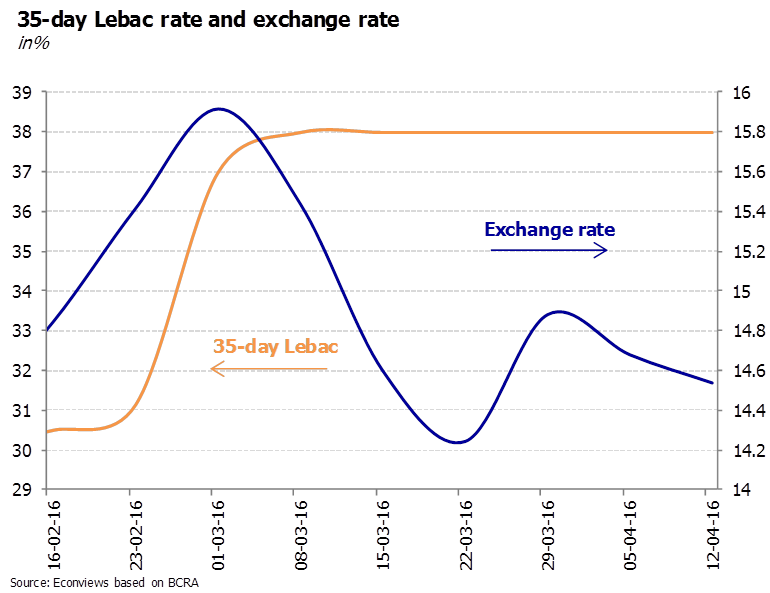

The first four months have been very positive for the Macri administration regarding the achievements on both the political and the economic fronts.