Good Vibes in the Last Days of August

In recent days, the vibes in the Argentine market seems to have changed. Let’s hope it stays this way. The Central Bank ended August with net purchases in the exchange market and bonds and stocks rallied. Country risk dropped 74 points against the end of July, but 206 points against its peak in August that […]

Economics vs. Politics

There are several economic issues that now depend directly on political criteria, alliances in Congress, vendettas and more. The most obvious case was the approval in the Senate, by an overwhelming majority, of the change in the pension payment formula. This, if applied, implies a fiscal cost of 0.2% this year and 0.9% of GDP […]

Public Debt Rises: Does Size (In Dollars) Matter?

The July data showed that public debt reached USD 452 billion, almost 10 billion more than in June. So far this year, the debt has grown by USD 82 billion. Several accounting and exchange rate issues justify the increase. For us, there is no significant change in the capacity to service that debt, which is […]

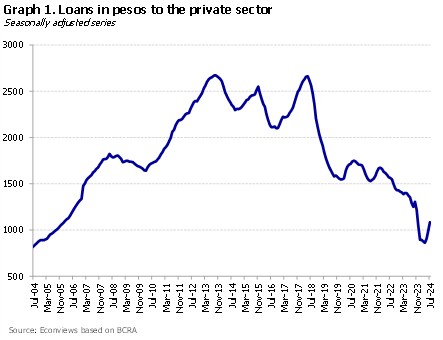

The monetary base is growing, and it is not bad news

Popular wisdom has it that the government has adopted a zero-issuance monetary policy. However, the reality is somewhat different. The monthly monetary report for July, just published by the Central Bank, clearly says that the monetary base grew 10.6% in July against June in real terms and seasonally adjusted. While this is not news to […]

Seeking Balance

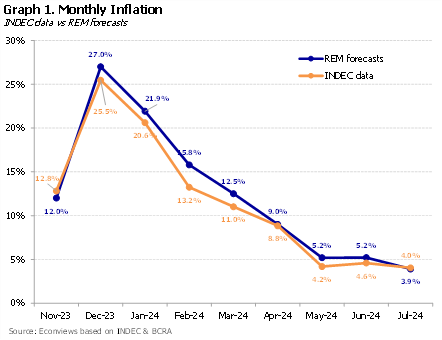

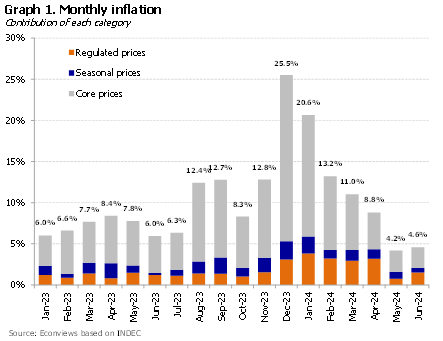

Argentina needs to stabilize. Javier Milei and the economic team made an extraordinary contribution given the inheritance received and some of the results we have seen in these first almost 8 months. Although we do not believe in the 17,000% mentioned by the President, we do believe that there was a risk of hyperinflation when […]

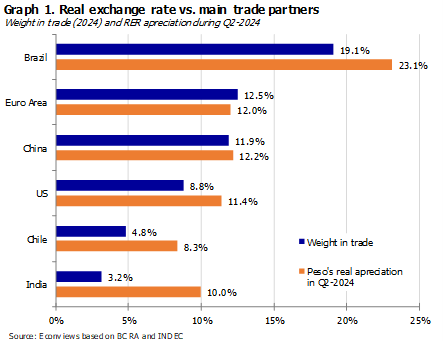

Lifting FX Controls on Good or on Bad Terms

There is a consensus that FX must be lifted, but disagreement remains about how and when to do so. Maintaining the controls has costs, because there are investments that will not take place until they know whether they will be able to withdraw dollars and pay dividends. While FX controls remain in place, there is […]

The Art of Plumbing and Monetary Issuance

The government is focused on turning off the money-issuance faucets. As for that one corresponding to the government financing, there is not any opposition, quite the opposite. The IMF and the entire community of economists and businessmen celebrate that the government has a surplus and that the faucet is not only closed but practically prohibited.

Correct and incorrect assumptions on dollars and pesos

1st assumption. The exchange rate couldn’t depreciate because the Central Bank had dried up pesos from the market (with the Bopreals and by not lending to the Treasury). The truth is that if they had really dried up the market, the price of pesos (the interest rate) would have gone through the roof. But the […]

A New Start for Deregulation and Micro Reforms

Everyone is waiting for the government to give some signal regarding the removal of FX restrictions. Without a doubt, that is the macroeconomic question of the hour. The uncertainty of the market hides the fact that President Javier Milei finally decided to appoint Federico Sturzenegger as Minister of Deregulation and Transformation of the State. This […]

The Limits of FX Controls Are Becoming Evident

On the surface, last week ended very well for Milei’s government. After six tough months, Congress approved “Ley Bases” reform bill and the fiscal package, including the most contentious issues such as the special investment regime, the increase in income tax, the increase in the minimum rate for personal asset taxes and the moratorium and […]