A Crucial Test for Milei: The Aerolíneas Conflict and the Legacy of Thatcher and Reagan

The conflict between Milei’s government and Aerolíneas Argentinas, along with Intercargo, is not merely a clash with a unionized sector or part of a budget-cutting plan; it’s a pivotal battle to determine whether a regime change can be achieved—a watershed moment for advancing other structural reforms. While the macroeconomic program is central to bringing down […]

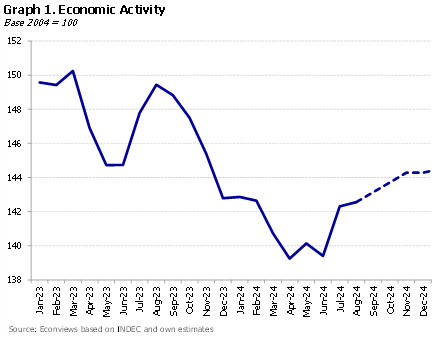

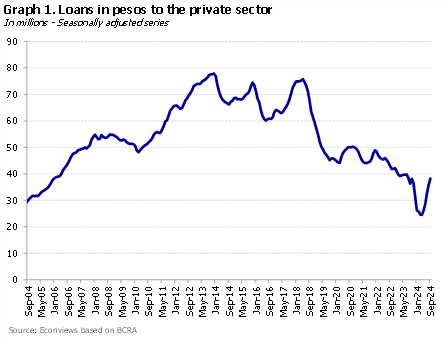

A Unique Interest Rate Policy That Continues to Lower Real Debt

The government is on a winning streak, in terms of country risk, the exchange rate spread and inflation. There is no doubt that the plan has gained credibility over time and that inflation has been falling faster than many of us expected. Given this context, it was to some extent expected that the Central Bank […]

Argentine Bonds Are Rallying, and Country Risk Fell Below 1,000 Points

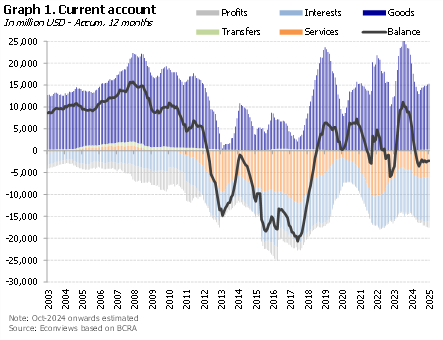

The country risk dropped to 967 basis points last Friday. It is the lowest level since before the 2019 primary elections. At the beginning of the year, we had forecast that it could reach 800 bps in December, and if the trend continues this may happen. Our optimism, at that time and now, is based […]

Surprises and Highlights of Milei’s Speech at the BCRA

BCRA’s Monetary and Banking Conferences were held last week, and after listening to officials, economists and even Milei himself, there was a feeling in the air that there is no hurry to eliminate the FX restrictions, although some regulations may be relaxed to favor imports.

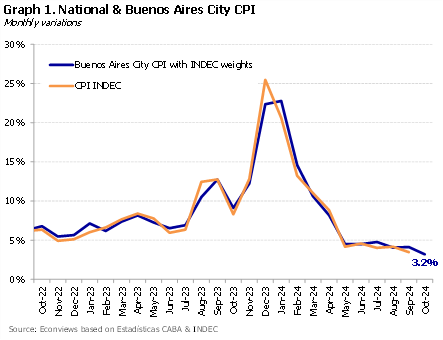

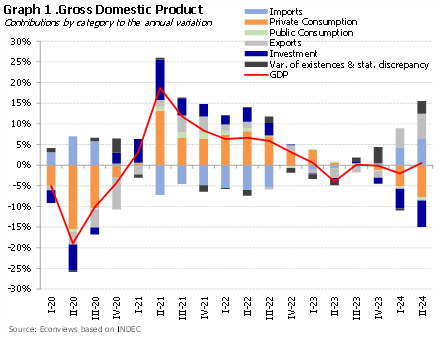

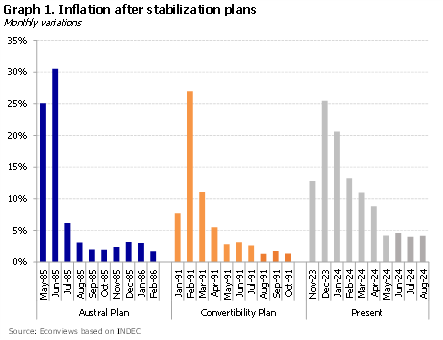

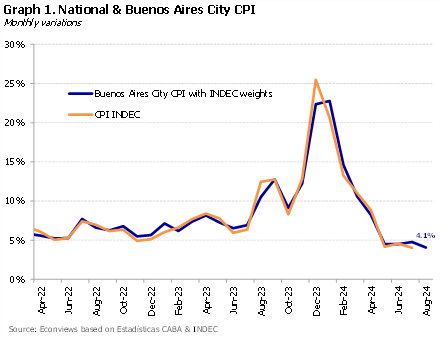

The Government, Leading the Championship Against Inertia

The government scored a good victory against a difficult opponent, inflationary inertia, but the championship is long and the champion is not yet defined. The national CPI showed an increase of 3.47% in September and was in line with our estimates and those of the market. It was the lowest inflation since November 2021. The […]

From Dogmatism to Pragmatism

On Monday, Milei surprised by showing his first signs of understanding realpolitik. In his interview with Susana Giménez, the president changed his speech about China: “I was very pleasantly surprised. It is a very interesting trade partner because they do not demand anything, they only ask not to be disturbed”. He also confirmed that he […]

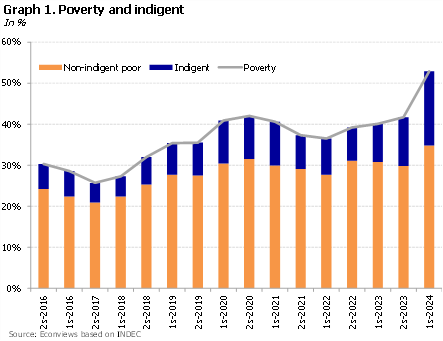

The Social Situation, Another Urgent Stabilization

The poverty and indigence numbers are shameful, but they were not surprising. Months ago it was estimated that poverty in the first semester would be close to 50% and it was 52.9%. Indigence reached 18.1%, indicating that 34% of the poor also have problems to feed themselves, which is what extreme poverty or indigence is […]

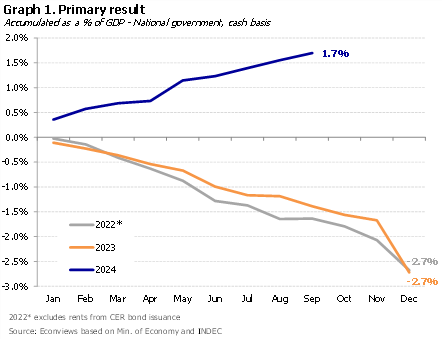

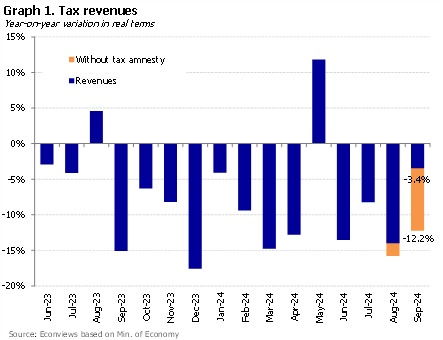

Fiscal Surplus Kills the Concept of “The State Saves You”

With eight consecutive months of primary surplus, in seven of which there was a financial surplus, there are no longer any elements left to doubt Javier Milei’s government’s commitment to fiscal balance. By the end of the year, Milei will have cut around 4 points of GDP. In the first 8 months, the accumulated primary […]

Some Items Are Finding Their Place in the Shelves

President Javier Milei had good and bad news in Congress last week. He got the coalition to sustain the veto on the pension formula but lost on the issue of the intelligence funds decree and the education funds. To some extent, it can be said that the week shed more light than shadows. Having achieved […]

Confidence Improves in a Troubled World

The economic team must be euphoric. The exchange rate spread is at 32% and it reached its lowest value since May, having exceeded 50% at many points last July. It can be interpreted as a symbol of confidence, with bonds and stocks holding up quite well in a bad week for international markets. There may […]