Reports

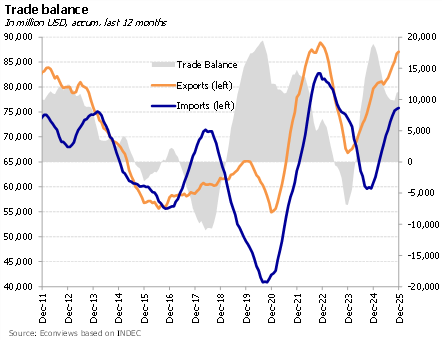

January closed with a highly positive balance for the Argentine economy. After moving past the electoral noise and with a macroeconomy showing signs of stabilization, the Government managed to make significant progress in reserve accumulation, brought country risk down to the 500-point range, and kept the exchange rate under control. However, February has begun with a slightly more complex scenario, as clouds gather on both the external and domestic fronts.

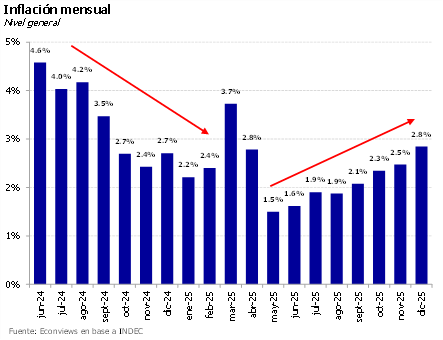

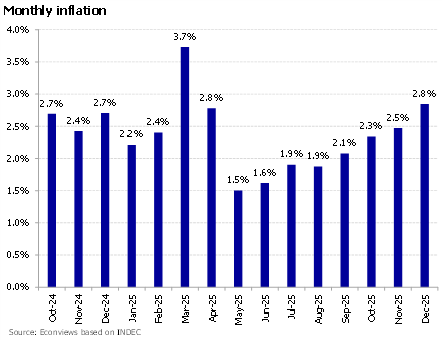

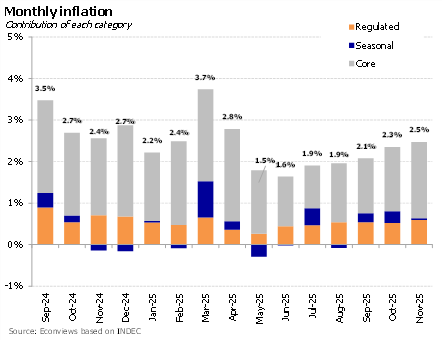

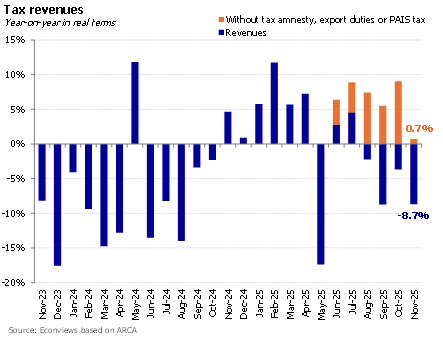

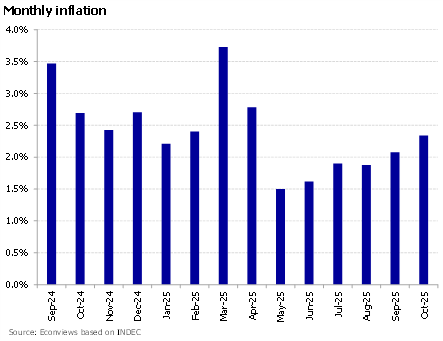

Inflación, INDEC y polémica. Después de un enero tranquilo, el gobierno se autoinfligió ruido innecesario con la decisión de postergar la implementación del nuevo índice de inflación, causando la renuncia del titular del INDEC. No son buenas señales. En un país con una historia de manipulación de estadísticas todavía fresca, la credibilidad cuesta mucho construirla y muy poco dañarla. La decisión también es difícil de entender: si bien en 2024 la diferencia entre ambos índices fue de 16.5 p.p., en 2025 fue de apenas 1 p.p. Con tarifas bastante más alineadas, estimamos que la diferencia tampoco iba a ser significativa en 2026. Yendo al corto plazo, enero pinta para cerrar con una inflación cercana al 2.5%. Nuestro relevamiento de alimentos y bebidas se mantuvo en el 2.8% mensual, y los regulados aumentaron nuevamente cerca de 3.4%. La buena noticia es que registramos una desaceleración importante en alimentos para la última semana del mes.

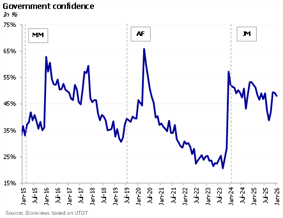

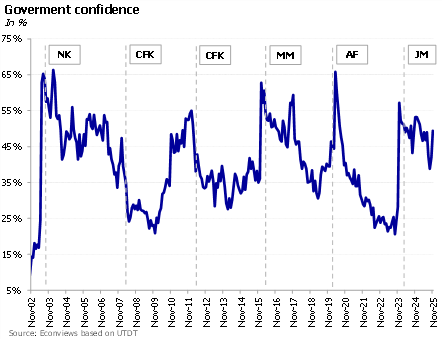

A turning point? After a year characterized by high economic volatility and political uncertainty, the government has strengthened its political position, supported by greater representation in Congress and continued popular backing. Confidence in the administration has recovered to high levels after suffering a significant decline prior to the October elections. This political consolidation has improved governance conditions and enhanced the government’s capacity to advance its policy agenda.

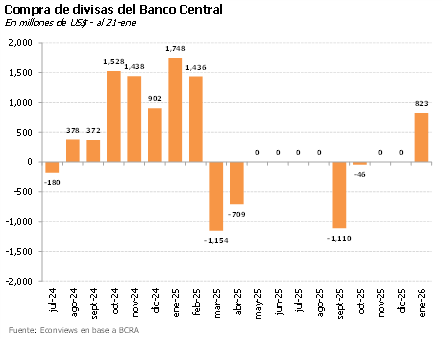

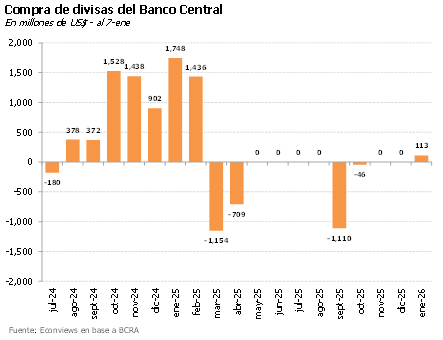

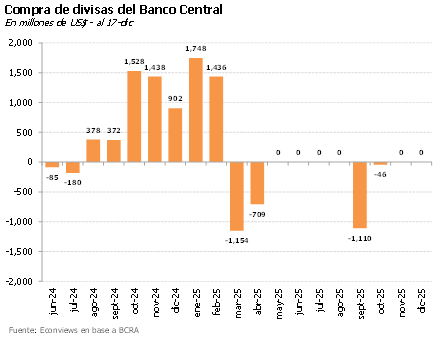

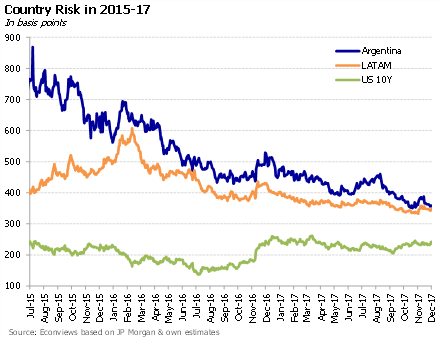

Country risk reached its lowest level since June 2018 last week. The reserve accumulation program was the final push the indicator needed to seek new lows. The market saw results and rewarded them: the Central Bank added USD 1,100 million in January, and the index broke below the 500-basis-point mark.

Suben reservas, baja el riesgo país. El BCRA mantiene la racha compradora con un saldo positivo de US$ 1,083 millones en enero. Esta consolidación del programa de reservas se sumó a un clima internacional favorable: la exitosa colocación de Ecuador (que salió al mercado con 450 puntos de riesgo país) validó el apetito por emergentes y envió una señal positiva para un eventual regreso de Argentina al crédito internacional. El riesgo país perforó los 500 puntos, alcanzando mínimos no vistos desde 2018. Con Ecuador operando en la zona de 413 y la canasta de comparables en 317 puntos, esperamos que el spread argentino siga comprimiendo si el Central sostiene el ritmo de compras.

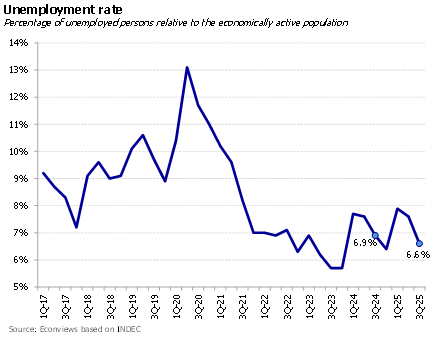

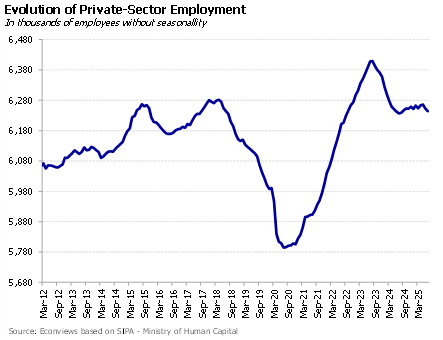

Since the Milei administration took office, a fierce debate has opened up regarding the future of industry and employment. On one side are those arguing that the economic program is causing an “industricide” and higher unemployment, pressing for the economy to remain protected. On the other side are the free-market fundamentalists who lean towards the idea of leveraging comparative advantages.

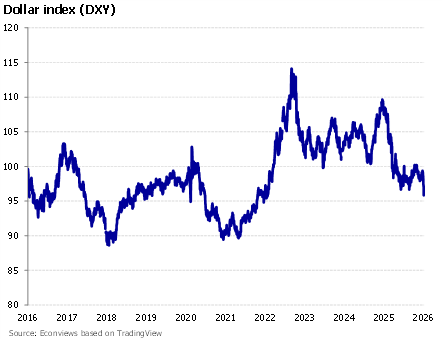

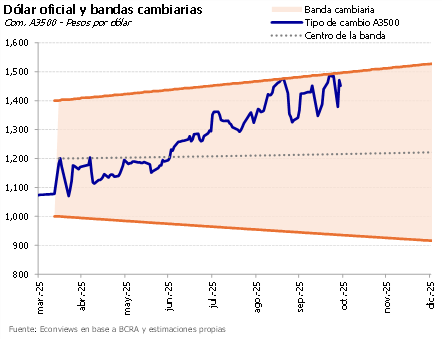

Comprando tranquilo. El Banco Central logra sumar reservas mientras el tipo de cambio se mantiene a raya. En lo que va de enero ya acumuló US$ 822 millones, en un mercado que finalmente aflojó la presión alcista. El bajo volumen operado sugiere que gran parte de las compras se habrían realizado en bloque por fuera del MULC. Juegan a favor las colocaciones de deuda privada, una mejora en la liquidación del agro y una menor demanda de cobertura, disciplinada a fuerza de tasas altas. Por ahora, el riesgo país no logra consolidar la baja, castigado principalmente por el mal humor externo.

Feo dato de inflación. El 2.8% de diciembre estuvo por encima de lo esperado y encendió alguna luz amarilla. Si bien sabemos que el proceso de desinflación no es lineal, y que la inercia juega un papel más fuerte cuando la inflación no es tan alta, la realidad es que los precios se aceleraron por séptimo mes consecutivo. Desde el paso al esquema de bandas, el tipo de cambio dejó de funcionar como ancla nominal, y la política monetaria no ha sido lo suficientemente robusta para coordinar expectativas. Esa falta de un ancla clara es, hoy, lo que más ruido hace de cara al futuro. De todos modos, esperamos mejores números para los próximos meses y una inflación cercana a 25% para todo 2026.

When it was announced in December that the Central Bank would begin accumulating reserves in 2026, many of us were skeptical. The government had consistently missed this explicit target within the IMF program throughout last year and had operated on the edge regarding the external front—to the point of needing a “Trump bailout” to avoid a collapse on the road to the elections.

A new year begins with many challenges but also with hope. Fortunately, it starts with an approved Budget Law and a good chance of moving forward with labor reform. Also, as expected, debt payments were made, providing some peace of mind. However, the challenges remain significant: taming an inflexible inflation rate, ensuring the recovery reaches more sectors and boosts consumption, dropping the country risk by another 100 points to return to the markets at reasonable rates, increasing reserves, and finally lifting capital controls.

Señales mixtas: el BCRA compra y el Tesoro vende. El 2026 arrancó movido. El BCRA puso en marcha el programa de acumulación de reservas y compró más de US$ 110 millones entre lunes y miércoles, una noticia claramente positiva. Sin embargo, el nuevo esquema de ajuste de la banda cambiaria debutó con cierta presión sobre el tipo de cambio. Al Gobierno se lo vio algo nervioso por el precio del dólar y salió a marcar la cancha con ventas del Tesoro, venta de futuros del BCRA y de bonos dollar-linked. Esta mezcla de señales genera dudas: ¿alcanza este tipo de cambio para cumplir la meta de los US$ 10,000 millones que quiere el Central? Veremos.

Recalibramiento del programa. Punto a favor para los econochantas: el Gobierno puso primera y anunció los tan demandados cambios en el esquema de bandas y en la estrategia de acumulación de reservas. A partir de enero, las bandas se ajustarán por inflación pasada. Esto evitará, al menos, que el techo continúe apreciándose en términos reales mes a mes. Si bien es un avance respecto al esquema previo, en la práctica el “piso” se ha vuelto testimonial. Hubiese sido preferible un diseño de bandas de flotación genuinas en lugar de un esquema de “techo cambiario”. Queda por verse si a este nivel de tipo de cambio el BCRA podrá comprar suficientes dólares. Aun así, lo valoramos como un cambio positivo.

The government has decided to shift the focus of its program. The exchange-rate band, which until now had been adjusting at a monthly pace of 1%, will now move in line with past inflation, closer to 2%. More importantly, it announced an explicit plan to accumulate reserves, with monthly purchases of around USD 800–1,000 million. A pragmatic turn that the market had been loudly calling for.

The October elections marked a turning point .

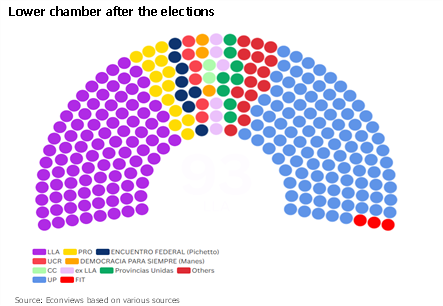

In 2025, the government consolidated its power after achieving a convincing victory in the midterm elections. LLA, President Milei’s party, now holds the largest minority in the lower house, while the Peronists lost their majority in the Senate for the first time since the return of democracy in 1983. This places LLA in a strong position. Although it does not command a majority in either chamber, it can negotiate with provincial parties and the more “reasonable” opposition—including Macri’s PRO—to pass the budget and advance structural reforms. The government does not have a blank check, but it does have enough political leverage to negotiate effectively with Congress.

November’s inflation print came in broadly in line with expectations, but it still raised a yellow flag. It is not alarming for now, although the trend over the past six months has clearly been upward. Core inflation, which better captures underlying dynamics, rose to 2.6%, its highest level since April, and year-on-year inflation accelerated for the first time during the Milei administration.

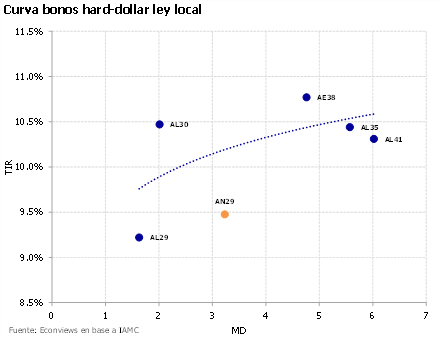

Abriendo mercados. Después de más de 7 años, el Tesoro volvió a emitir deuda en dólares. Se colocaron unos US$ 1,000 millones nominales (US$ 910 millones cash) y la tasa resultó en 9.26%. Se esperaba algo mejor, sobre todo considerando los cambios regulatorios que buscaban incentivar la demanda y lograr un costo más bajo. De todos modos, es un primer paso positivo para reabrir los mercados. Vendrán más.

As we anticipated in our last editorial, the government announced with great fanfare that Argentina will once again place dollar-denominated debt. The January maturities accelerated the timeline, and “Toto” decided to step onto the field to seek financing in the local market.

El gobierno prepara la cancha para diciembre. Es un mes particular porque la economía necesita más dinero por el pago de aguinaldos y los gastos de las fiestas y vacaciones. Al mismo tiempo, el Tesoro enfrenta vencimientos de deuda en pesos por AR$ 40 billones, de los cuales unos AR$ 13 son con el sector privado. Esto podría llevar a que enfrentemos una escasez de pesos en el mercado. Para prevenir esto, el Gobierno ha tomado algunas medidas que liberaron liquidez a los bancos. El juego es fino, porque a fines de enero típicamente suele caer la demanda de pesos y puede haber presión sobre el tipo de cambio.

As the year-end toast approaches, the market is beginning to eye the January calendar with some concern. And with good reason: Argentina faces capital and interest maturities in foreign currency totaling around USD 4.2 billion, and the Treasury’s dollar coffers are empty. There is no time to buy dollars in the market, nor has the Government signaled any desire to move in that direction. Therefore, the strategy will focus on securing financing—terrain where “Toto’s” team has shown a very deft hand.

To begin with, La Libertad Avanza increased its representation in both chambers of Congress. In the Lower House it is now the largest bloc, with roughly 90 seats—plus additional support from PRO and other parties aligned with the government. In the Senate its representation also grew, and, most importantly, Peronism will not hold a majority in that chamber for the first time since the return of democracy. These numbers pave the way for the approval of the budget and put the government in a stronger negotiating position to advance labor and tax reforms.

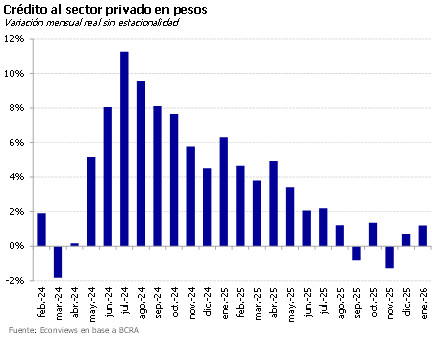

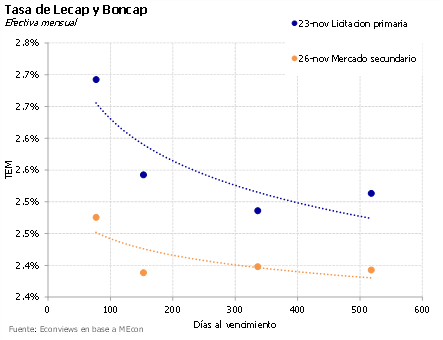

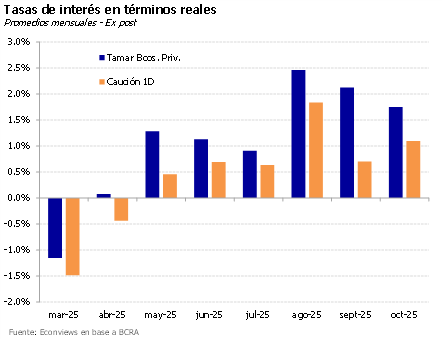

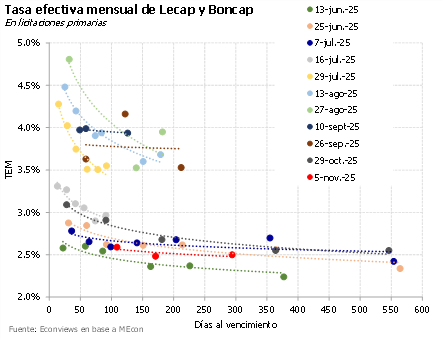

Rates keep falling. Short-term interest rates (repos and caución) have stabilized around 20%, with the Central Bank lowering the floor to 20% in the simultáneas (reverse repo) operations market. This pulled the rest of the curve downward and improves the rate at which the Treasury will be able to roll over its debt in tomorrow’s debt auction. The TAMAR rate is already trading near 33% (down from over 60% before the elections), and overdraft rates have fallen to around 38%. Credit is recovering only modestly in November, but it will likely accelerate in the coming months.

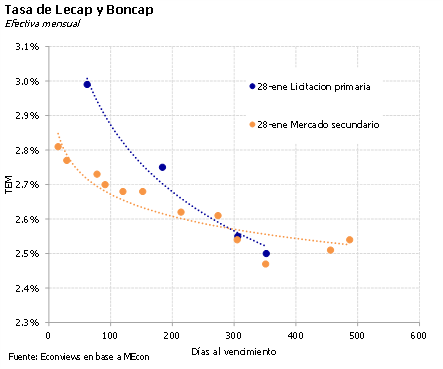

El Tesoro pasó una licitación exigente. Renovó el 96% de los $ 14.6 billones que vencían (contando con sólo $ 5 billones depositados en el BCRA para afrontar pagos). Para apuntalar el resultado, el BCRA había recortado la tasa de simultáneas e incrementado la porción de encajes que pueden integrarse con títulos públicos. Las tasas salieron con un premio lógico respecto del secundario y se logró alargar los plazos, un paso clave para normalizar el mercado de pesos y ordenar el legado post-LEFIS.

The framework agreement on trade and investment with the United States was finally announced. It is not a free trade agreement nor a deep accord endorsed by the Congresses of both countries, but rather a government-to-government understanding aimed at boosting the bilateral relationship and strengthening U.S. influence in Argentina, which Washington views as a strategic geopolitical ally.

Sigue la ayuda del tío Scott. Finalmente, Bessent confirmó que se activó un tramo del swap, tal como anticipábamos la semana pasada al analizar el balance del BCRA. El monto rondaría los US$ 2,700 millones e incluiría tanto los dólares que utilizó el Tesoro de EE.UU. para intervenir en el MULC como los fondos destinados a cubrir el vencimiento con el FMI de la semana pasada. Según los datos disponibles, el BCRA habría recibido DEGs de EE.UU. y se los habría vendido al Tesoro argentino para efectuar el pago al Fondo.

Milei’s economic program seems to have entered a new phase. After the confidence shock triggered by the election victory, signs of a more normalized economy are starting to appear, with interest rates falling to more sustainable levels — both for public debt and for overall economic activity.

The midterm elections reshaped the outlook for both the government and the markets. The result can be seen as a strong rejection of Kirchnerism and, at the same time, as a mandate to govern. In Congress, the administration now has the opportunity to move from defense to offense. The resounding national victory leaves it in a stronger position to advance discussions on labor, tax, and pension reforms.

- Normalizando las tasas. Después del fuerte apretón monetario previo a las elecciones, las tasas de interés comenzaron a acomodarse en niveles más razonables en los últimos días. La semana pasada, el Tesoro liberó unos AR$ 5 billones en la licitación de deuda y aportó liquidez comprando bonos en el mercado secundario, lo que contribuyó a la baja de las tasas. En la misma dirección se movió el BCRA, que redujo la tasa de la rueda repo del 25% al 22%, estableciendo un nuevo piso para las tasas cortas y arrastrando a las tasas pasivas. Las tasas activas también están descendiendo, aunque a un ritmo más lento.

The surprising and impressive victory of LLA in the elections completely reshaped the political and economic landscape. The ruling coalition exceeded its minimum goal (securing one-third of the Lower House) and, together with PRO, also achieved one-third of the Senate—leaving Peronism without a majority in that chamber for the first time since the return of democracy.

The government’s victory in the mid-term election was a game changer. The LLA got 40% of the national vote and achieved its goal of reaching one-third of Congress in both chambers (enough to sustain possible vetoes to opposition populist initiatives). With its alliance with PRO, it now has 104 Congressmen in the lower House, more than the Peronists, thus becoming the largest minority.

El impactante triunfo de LLA en las elecciones del domingo cambió el panorama político. El resultado puede leerse como un fuerte rechazo al kirchnerismo y, al mismo tiempo, como un mandato de gobernabilidad. En el Congreso, el Gobierno tiene ahora la posibilidad de pasar de la defensiva a la ofensiva. Con los vetos garantizados, podrá frenar cualquier embate opositor. Pero además, ambas cámaras quedarán sin mayorías absolutas y relativamente equilibradas. Esto invita al Ejecutivo a impulsar reformas, para lo cual deberá construir consensos con los partidos del centro dialoguista y con los gobernadores. En enero comenzará la discusión por la reforma laboral y tributaria.