The exchange rate and the countdown to primaries

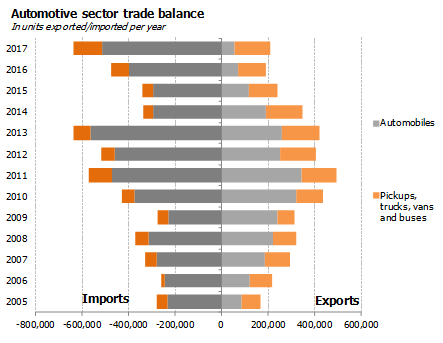

A trade deal between the European Union and Mercosur was finally announced in late June. It should drive the creation of trade, the access to cheaper inputs, the specialization to a higher scale of certain sectors and a greater integration of local firms to global value chains. The agreement promotes a greater regulatory harmonization, integration, […]

Surprise VPs: what does it mean for the economy?

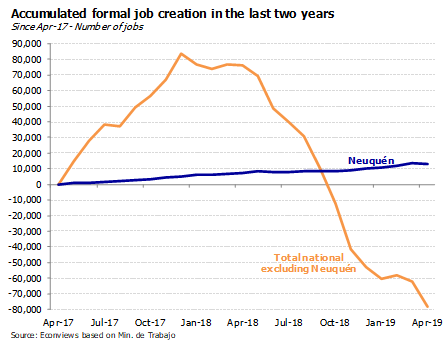

May was a positive month regarding the FX front after the CB announced on April 29th that is allowed to intervene in the FX market discretionally and the Peso reacted positively: it fluctuated around 45.00 ARS/USD since then, even when other emerging-market currencies were depreciating. So far, the monetary entity did not sell international reserves. […]

FX intervention does make a difference

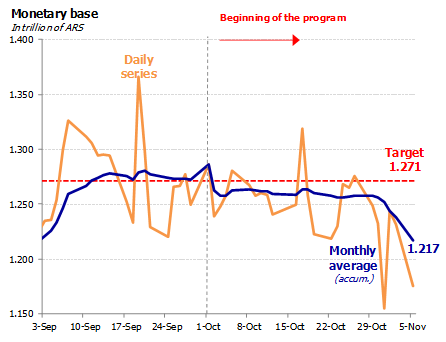

On the monetary front, the contractive bias of the program was first reinforced by freezing the floor and ceiling of the non-intervention zone (NIZ) at the current levels until the end of the year and by preventing the purchase of reserves until June 30th. However, since end-April the Central Bank is allowed intervene in the […]

The political forces preparing to campaign

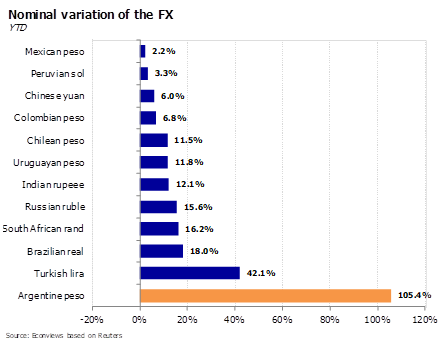

At the beginning of April, FX instability returned and the Peso weakened to almost 44.00. The Central Bank used dollar futures and increased the interest rate to 68.4% in order to contain the depreciation. FX proceeds from the harvest and Treasury’s FX daily auctions for USD 60 million helped to stabilize the currency. As an […]

The key to the elections: FX stability

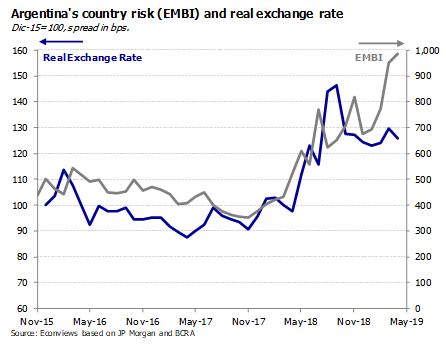

This year began better than expected for the Argentine economy but the release of Januarys inflation figure in mid-February, which was higher than expected (2.9% m/m, while the market was expecting 2.5%), meant a turning point. From that moment, the exchange rate became more volatile and re-entered in the Non-Intervention Zone, country risk rebounded from […]

Summertime for financial markets

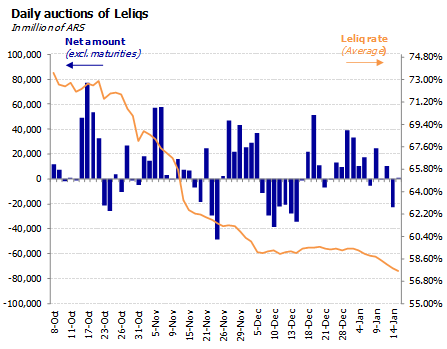

The beginning of the year is being better than expected for the Argentine economy: the exchange rate stands close to the lower bound of the intervention band and volatility remains at low levels, the Central Bank has already bought US$ 978 million and also managed to reduce the LELIQs interest rate by 1,500 bps, while […]

Welcoming an intense 2019

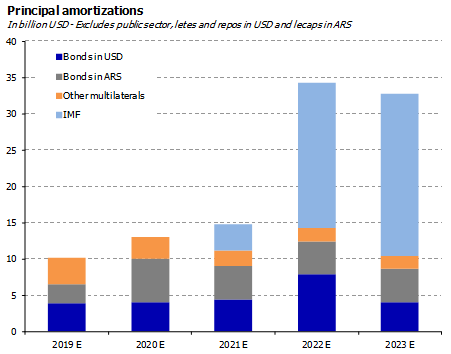

We are starting a year in which the elections will play an important role in the evolution of the economy. If one evaluates Argentina based solely on its economic policies and fundamentals, one would expect that the economy should recover quickly from the recession. However, this is an election year and the choice, as in 2015, […]

Wrapping up a very tough year

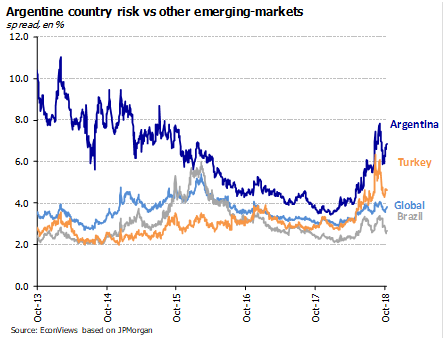

It is by now clear that for the macroeconomic front 2018 has been an extremely difficult year. The figures speak by themselves: inflation 47%, growth -1.8%, poverty 33%, country risk 750 points, the policy interest rate 60%, and the exchange rate depreciated over 100% and has been extremely volatile over the year. On the backdrop […]

And the band played on…

The double zero strategy (zero primary deficit and zero growth of the monetary base) appears to be achieving financial stability, as the Peso has strengthened and interest rates have been falling. How hopeful can we be that it will work? It seems that after a year in which the government has been playing trial and […]

An even tighter monetary policy

There was plenty of news during the last month in both the local and the external fronts. On the one hand, the first election round for president that took place in Brazil last Sunday had a surprisingly overwhelming result: Jair Bolsonaro got 46% of the votes, compared to the 29% Fernando Haddad obtained, who was […]