Good Bye Debt, Hello IMF

Finally, and just when the negotiations appeared to be falling apart, the government announced an agreement with the three main groups of bondholders that should lead to a successful restructuring of the sovereign debt. By the time these groups agreed, roughly 40% of the bondholders had already accepted the offer. The three groups represent another […]

Waiting For An Economic Script

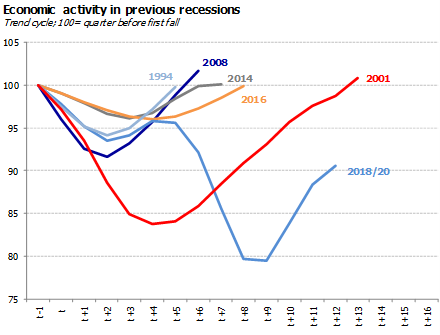

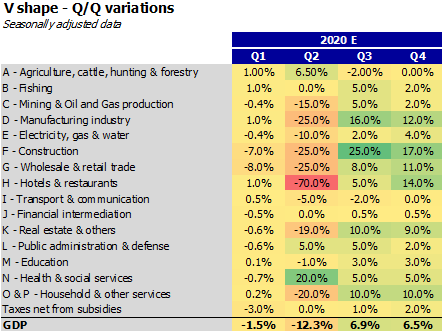

The government finally seems to be approaching an agreement with the main bondholders on the debt and it is also relaxing the lockdown. The big question now is how the economy will perform in the new environment, as the economic challenges are still enormous and the policy tools limited.

Surfing the Covid-19 and the Debt Restructuring

While many Asian and European countries are slowly returning to normal, the focal point of the Covid-19 pandemic has shifted to the Americas. The United States economy has buckled under the sanitary crisis with over 25 million jobs lost in two months and unemployment reaching Great Depression levels, amid ongoing conflict between federal and local […]

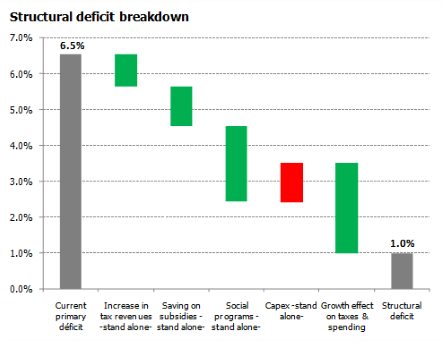

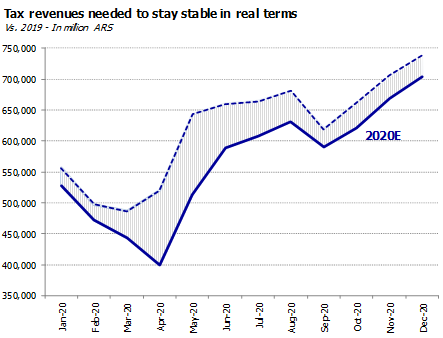

Deficit, Debt & Inflation: A 2020 vision

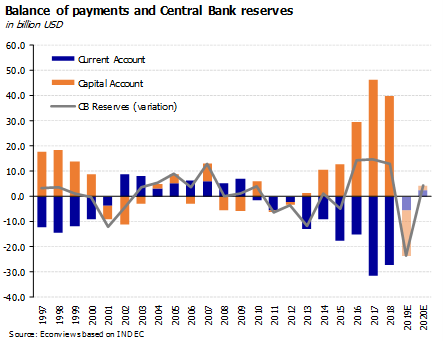

The sanitary emergency caused by the novel Coronavirus has thrown the world into disarray, crashing international markets and putting governments to the test. To face the inevitable recession, most developed countries have announced historical fiscal and monetary stimulus packages. Their Latin American counterparts, especially Argentina, have it a bitharder:most share a tight fiscal situtation, and […]

When It Rains, It Pours: the Economy in Times of Coronavirus

After two weeks of gradually ramping up social distancing measures, on March 19th President Fernández announced a nationwide mandatory quarantine. Although the quarantine ends on March 31st (coincidentially the set deadline for the debt restructuration) the evidence from Asia and Europe suggests it may be necessary to extend the measure. Days before, Minister of Economy […]

The Debt Negotiations Are Heating Up

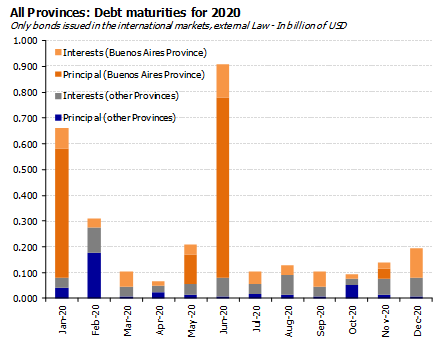

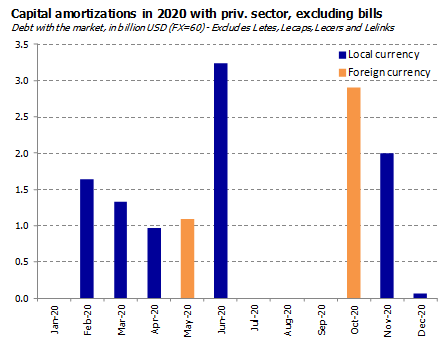

The debt saga started with the Province of Buenos Aires (PBA), which faced the maturity of the BP21 (NY law) for USD 250 million at the end of Jan-20. The province tried to defer the payment from January to May. Despite sweetening the original offer and extending the deadline to accept the deferral several times, […]

Debt: A Time of Critical Decisions

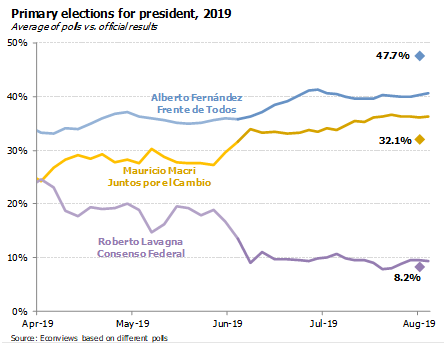

While Alberto Fernández won the Presidential election, as expected, the final results brought some relief to the Macri camp, especially because he lost by a much smaller margin than in the primaries (only eight percentage points compared with 17 points in the primaries). In addition, Juntos por el Cambio (Macris coalition), won the provinces of […]

The countdown for economic decisions has begun

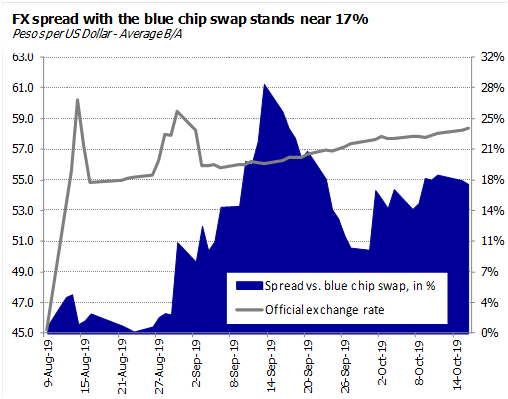

The announcement of debt reprofilement and FX controls last month were effective to moderate the fall in international reserves and contain the depreciation of the official exchange rate, which was only 3.7% since then. The CB added new FX controls on October and the Peso stands nowadays near 58.30. For individuals it limited the arbitrage […]

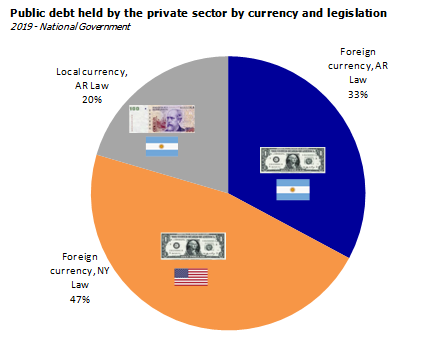

Dollars and Debt: what’s next?

The primaries have clearly marked a turning point for financial stability and economic performance: investors were in shock and confidence all but disappeared, in a matter of hours Argentine credit spreads went through the roof, all financing dried up and the result was that Argentina could not rollover its debt. Confidence was the name of the […]

Surprising election results. What comes next?

The landslide victory of the Fernandez ticket in the primaries has been an unexpected result that shook financial markets and introduced a high level of uncertainty regarding the evolution of economic and financial variables during the transition to December 10th, when the inauguration of the new president takes place, and about the economic policies that […]