A Soft Transition to the Elections: The Calm That Precedes the Storm?

It seems that the government has enough instruments to maintain key economic variables under control until the elections. The official exchange rate should be manageable and avoid a steep devaluation, the government should be able to rollover the domestic debt, inflation could remain within predictable bounds and economic activity is likely to recover in the […]

In Search of a Program: Hope in Paris, Not So Much in Buenos Aires

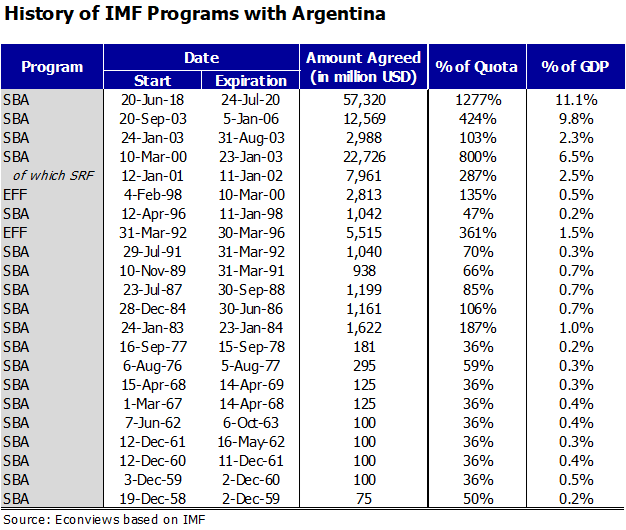

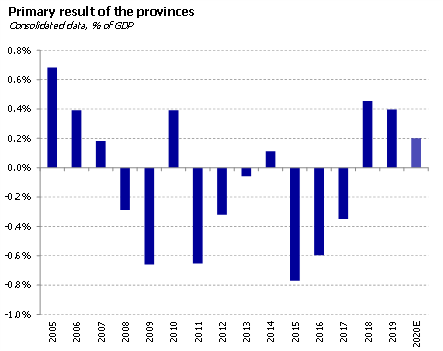

Who is in command? This is a critical question when it comes to economic policies. Minister Guzman is formally the Minister of Economy, but he seems to be primarily in charge of managing debt and the relationship with multilateral organizations. This is a good start, because a potential IMF agreement will set monetary and fiscal […]

Inflation rose in March, but the economy will still muddle through until the elections

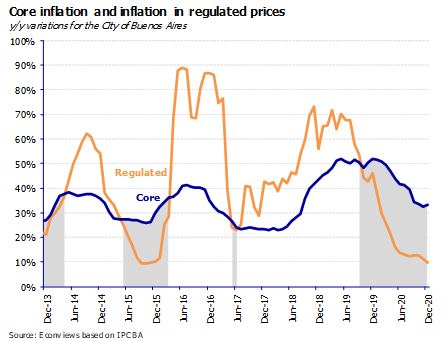

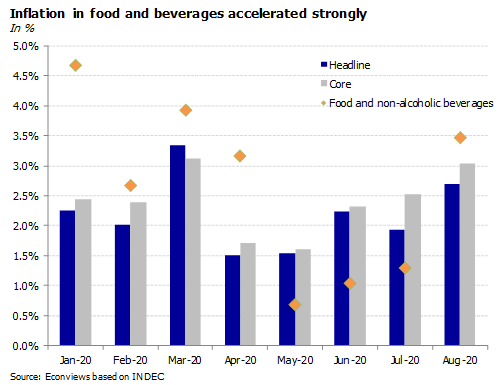

It is increasingly clear that the government is taking every economic decision with an eye on the election and that the 4.8% March inflation rate was a disruptive figure and a potential threat. It was totally unexpected, much higher than anyone was projecting. This jeopardized the strategy of avoiding disruptions on the way to the […]

The efforts to avoid adjustment might work until the elections, and then what?

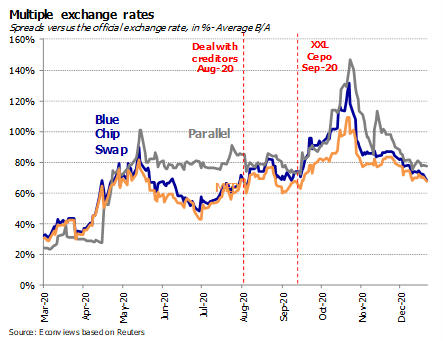

The current economic situation raises two important questions. Firstly, can the government continue to muddle through until the October elections as it did in recent months? In other words, can it keep inflation under control, avoid a new acceleration of the parallel exchange rates and maintain the current growth momentum going? Secondly, and if the […]

Recent Economic Developments: Glass Half Empty or Half Full?

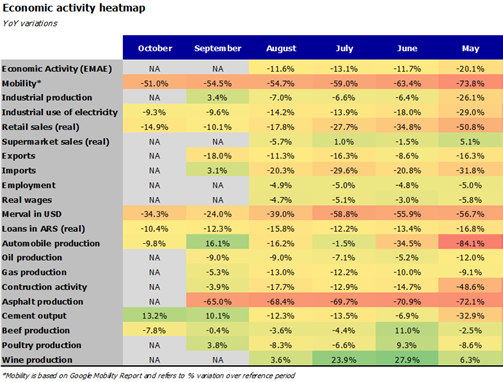

The recent news on the economic front has been overall good. The recovery remains on track in line with the normalization of mobility indicators and a gradual reopening of different business that were affected by Covid-19. The parallel exchange rates remain calm, interest rates have stayed relative stable despite the rise of inflation, fiscal revenues are […]

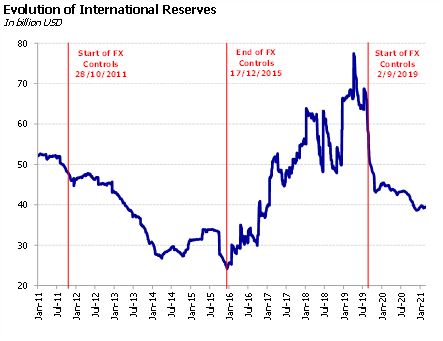

External Tailwind, Intervention, and the IMF: An Impossible Trinity

What a difference a month can make: The game changer has been the rapid and significant increase in the price of soybean, which now stands at around 506 dollars a ton, roughly 50% higher than a year ago. This jump in the price has suddenly soothed the concerns about a continuous drop in reserves and […]

The Spring Brought Some Oxygen, but a Hot Summer is Ahead

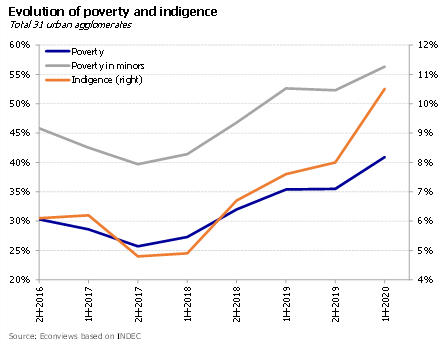

The 2021 midterm elections are starting to affect day to day decisions and can have an impact on the economic develo pments. The starting point is worrisome for the government because the poverty levels exceed 40% and there are no signs that they are receding, the economic recovery is losing steam and there is no […]

High Hopes on an IMF Program, But the Task Aint Easy

The change of guard in the United States is unlikely to change significantly foreign policy towards Argentina. We do not expect softening policies in the IMF as a result. There could be some benefit from a weaker dollar and therefore a rise in the price of commodities. Soybeans have surged in the last months and […]

The Wrong Treatment for the Wrong Diagnosis

As time goes by the economy seems to be getting deeper into a hole: the government continues to be haunted by the record levels of the alternative exchange rates, the persistent drop in international reserves and the increase in the country risk as measured by the EMBI. In the meantime, the sanitary situation is deteriorating […]

Old Recipes for Old Problems

On the back of the debt exchange the government had an opportunity to jumpstart the economy. But Argentina is the country that never misses an opportunity to miss an opportunity. The government was expecting that the deal would be a turning point, which in turn would help to reduce the spread with the blue-chip swap […]