Perspectives on the Monetary Program and the External Sector

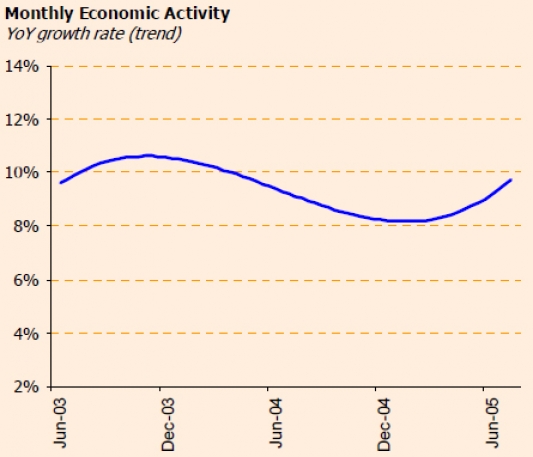

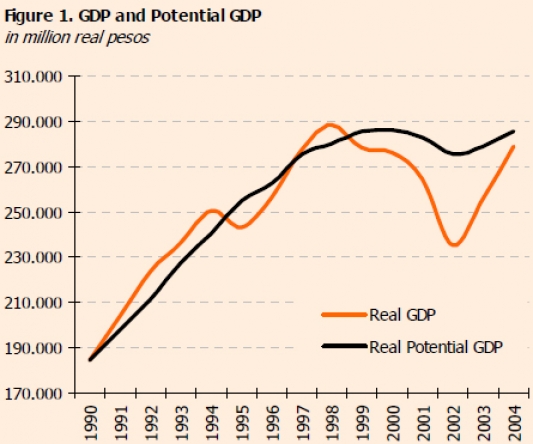

Strong economic indicators still but questions about the future. The recent changes in the Ministry of the Economy take place at a time when the economy is showing a strong growth performance and very robust macroeconomic fundamentals (such as the large budget and current account surpluses). Growth this year is going to end in the […]

Another look at Inflation

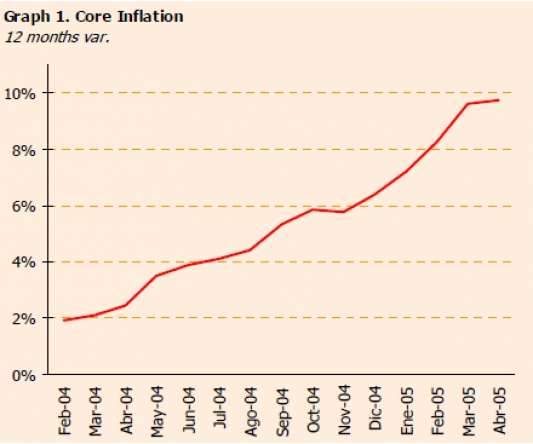

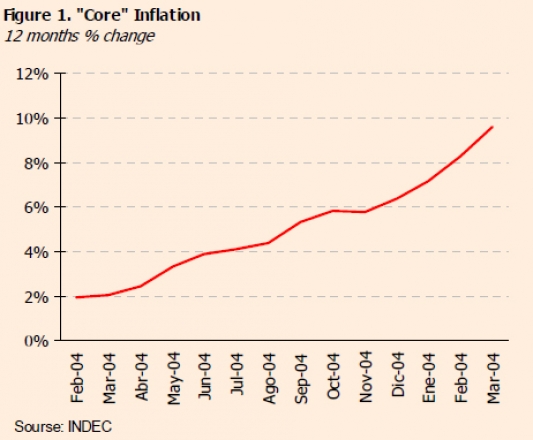

The economy is now reaching a point where high growth could be seen as a mixed blessing. What used to be good news it is now becoming a boomerang as it is increasing the inflationary pressures. And this is happening when inflation is running at 12% per year, without showing any signs of receding and […]

and the Economy Keeps Growing

The Argentine economy regained some growth momentum in the second quarter. GDP growth increased to 10.1% (Q205 to Q204), while investment provided the largest surprise as it increased by 24.1%. This is good news for unemployment, consumer confidence and fiscal revenues just as we are getting close to the elections, but most likely it will […]

Whats Behind Inflation

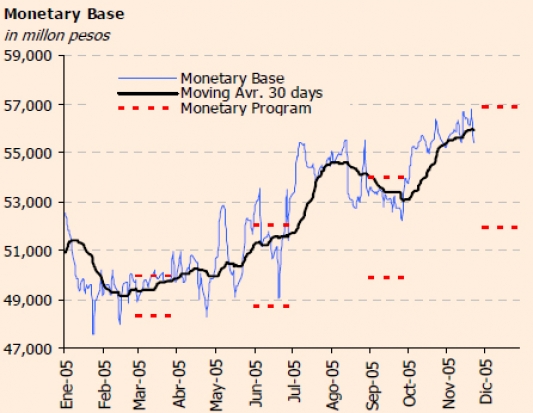

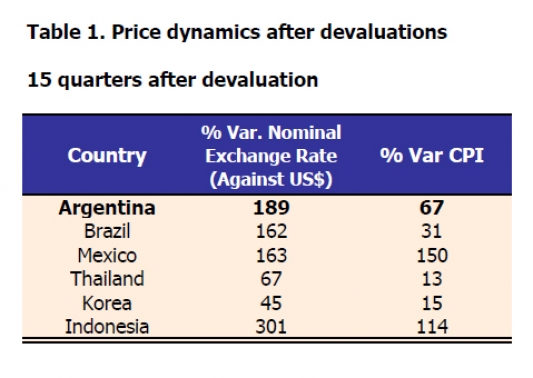

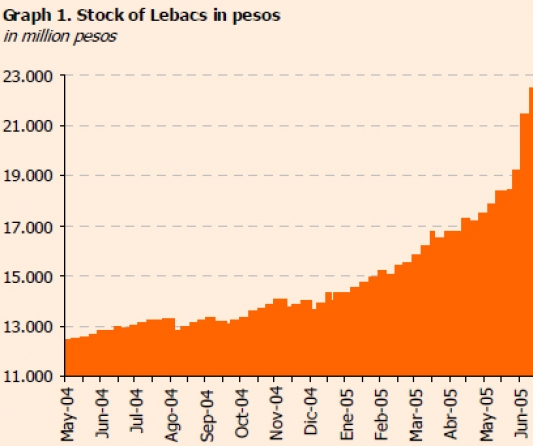

Exchange rate policy and inflation continue to be one of the most difficult policy issues at this time. The government is determined to maintain the exchange rate in the 2.9 to 3.0 pesos range, and to sterilize the increases in money supply by issuing Lebacs in order to avoid an increase in inflation. The main […]

Realidad y Perspectivas del Sistema Bancario Argentino

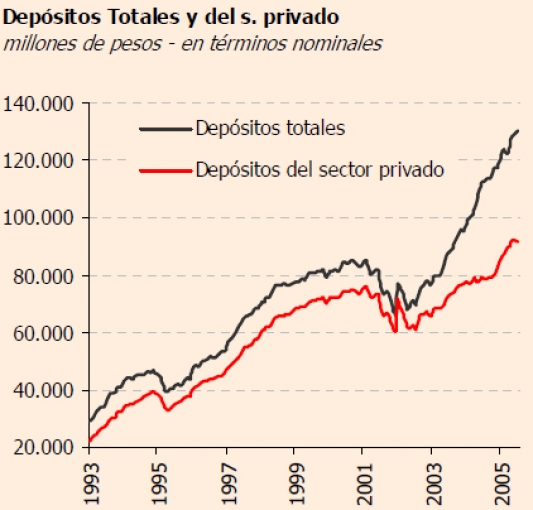

El sistema bancario ha mejorado significativamente, desde el comienzo de la crisis, los indicadores de liquidez, rentabilidad, solvencia, al mismo tiempo que está aumentando el volumen de crédito al sector privado. Los bancos alcanzaron un ROA ajustado de 0,8% en el 2004, es decir, sin considerar las pérdidas por la valuación gradual a mercado de […]

Recent Developments and Employment Prospects

The IMF in center stage again. The IMF board on Monday approved the Article IV consultation with Argentina. In general this is a no event, as countries regularly and with very few exceptions (Venezuela being one of them) have an annual consultation with the Fund to review the economic situation and identify issues for discussion. […]

Inflation, Monetary and Fiscal policies and Growth

The Argentine economy is facing a more complex macroeconomic scenario in the months preceding the October elections. Growth is decelerating, inflation continues to be a threat despite the relief observed in April and the government starts crucial negotiations with the IMF in order to avoid large re-payments in the coming months.

Inflation: The New Headache

The 1.5 percent March rate of inflation has important implications for the macroeconomic outlook. The government will start to face the typical trade-off between growth and inflation. This is not good news for a government that so far has been enjoying a one way street in macroeconomic policy, as it could expand the economy while […]

Good Bye Default Hello Inflation

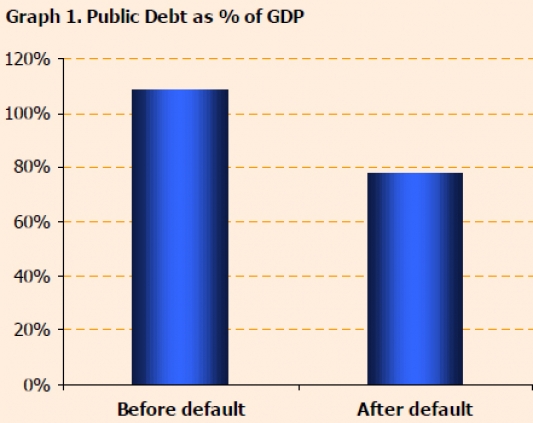

Three years after declaring default and following a long negotiation process the market voted in favor of Argentinas debt restructuring offer. In the end there was 76.1% participation level which falls within what the Fund could consider as broad acceptance, at least at this stage, and will most likely take the debt issue from the […]

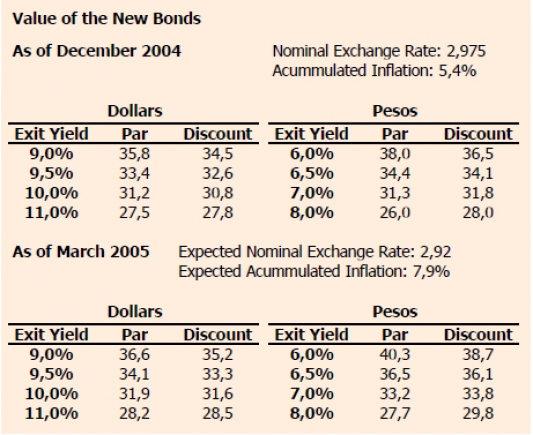

An Update and Reflections on the Debt Exchange

As the offer is entering its final stages everyone is starting to speculate about the final level of participation and about possible opportunities for arbitrage among different bonds. By and large there is optimism about the final outcome. It seems that under current market conditions there is a floor in the 50 to 60% range […]